10 sectors where small-cap mutual fund managers went on a treasure hunt

Small-cap fund managers look for sectors with healthy growth potential and consistent profitability. But an occasional large-cap stock may make it to their portfolios

1/11

Fund managers of small-cap mutual funds mostly follow a bottom-up approach while choosing stocks. But they are also conscious about the sectors those stocks belong to as sectoral behaviour and dynamism may influence the prices of the stocks. So fund managers look for sectors having healthy growth potential and consistent profitability. Over the past two and a half years, COVID-19 impacted businesses across the world and reshaped the way they operate. Many sectors have become 'flavours of the season' while many fell out of favour. Here are the sectors most preferred by small-cap fund managers. Data as on April 30, 2022.

2/11

Chemical stocks have put up a strong show over the last year. Experts believe Indian chemical companies are likely to gain market share on favourable factors like supportive policies, lowest tax rates in the world for manufacturing, and tougher environmental norms in China. HSBC Small Cap Equity, IDBI Small Cap and Union Small Cap Fund were a few smallcap schemes that had significant exposure to the sector.

3/11

IT – Software has been the preferred sector among investors after the pandemic outbreak as businesses get increasingly digitised. Software companies capitalised on the trend. Schemes that had larger exposure to the sector include HSBC Small Cap Equity, Axis Small Cap and Invesco India Smallcap Fund.

4/11

After tepid years, India’s textile sector is now back on the growth track, helped by improving export demand. Top three schemes that had notable exposure to the sector are L&T Emerging Businesses, DSP Small Cap, and PGIM India Small Cap Fund.

5/11

After prolonged underperformance, the pharma sector recovered in 2020 thanks to improved sentiment due to the onset of the pandemic. But it has put up a lacklustre show lately as the sentiment faded. Recent correction has given room for fund managers to pile up select pharma stocks. Top three schemes that had notable exposure to the sector are Quant Small Cap, Sundaram Small Cap, and HSBC Small Cap Equity Fund.

6/11

Despite non-residential segment construction spending growth remaining weak for much of 2021, select stocks showed better prospects. Quant Small Cap, Invesco India Smallcap, and IDBI Small Cap Fund held significant exposure to the sector.

7/11

Higher raw material prices have weighed down the sector over the past two years. Kotak Small Cap, IDBI Small Cap, and Axis Small Cap Fund were a few schemes that held significant exposure to the sector.

8/11

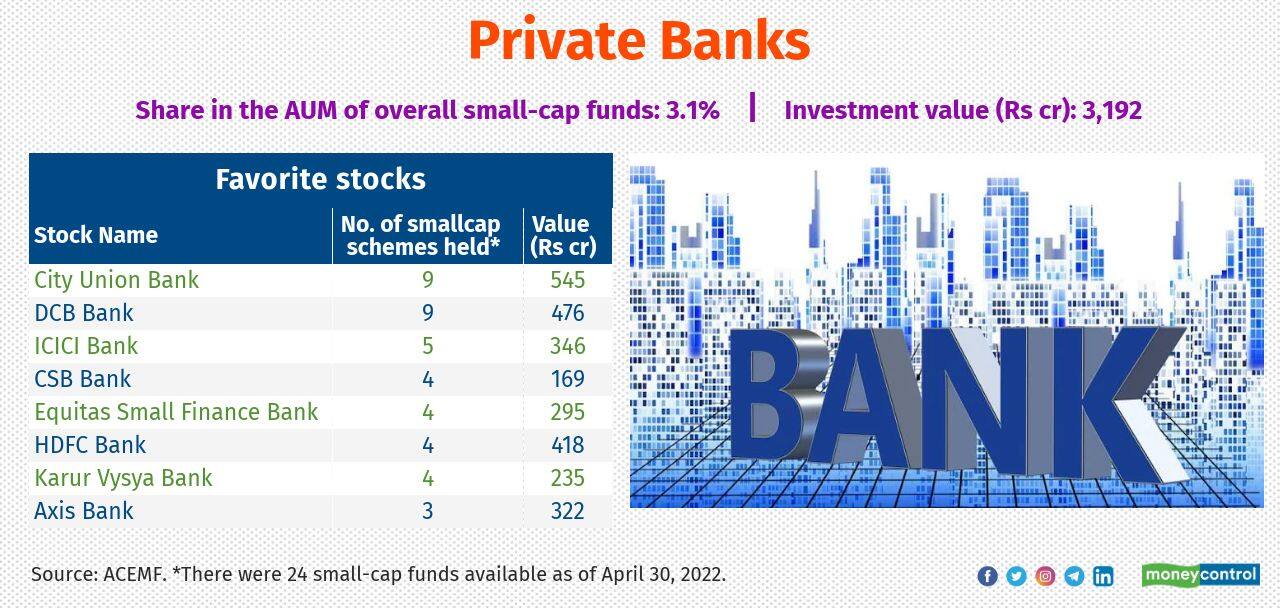

Stocks of private sector banks have been under pressure for the last 15-18 months. Persisting concerns over asset quality, lack of credit growth and growing bond yields forced foreign investors to exit them. However, smallcap funds were attracted towards select private sector banks like City Union Bank, DCB Bank, ICICI Bank and CSB Bank. Schemes like Franklin India Smaller Cos, BOI AXA Small Cap and ITI Small Cap Fund had a notable positions in the sector.

9/11

Stocks of real estate players made a strong comeback in recent months, thanks to robust residential sales in the December quarter and a strong launch pipeline in the March quarter. Experts believe the low interest-rate regime, rock-bottom home loan rates, stable residential prices, and continuing work-from-home trend are key triggers driving residential affordability. Franklin India Smaller Cos, L&T Emerging Businesses and Axis Small Cap Fund held significant exposure in the sector.

10/11

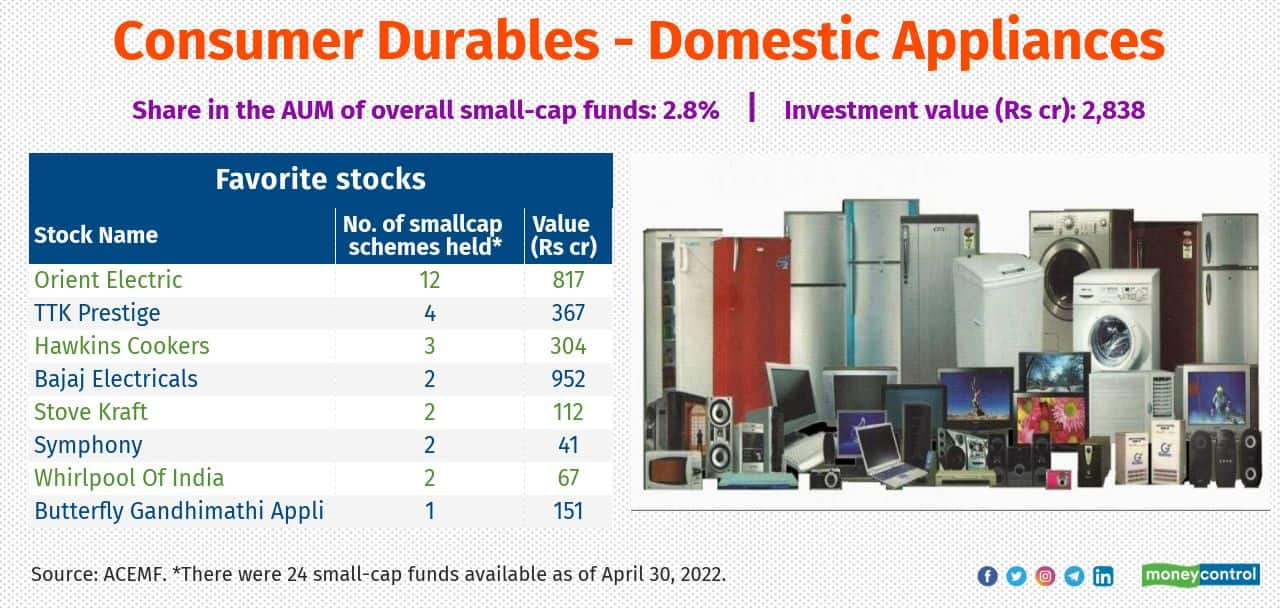

Despite higher revenues posted by many players, the sector’s margins moderated in FY21 due to a rise in prices of key commodities such as copper, aluminium and polypropylene. Top three smallcap schemes that held notable exposure to the sector are HDFC Small Cap, Kotak Small Cap, and PGIM India Small Cap Fund.

11/11

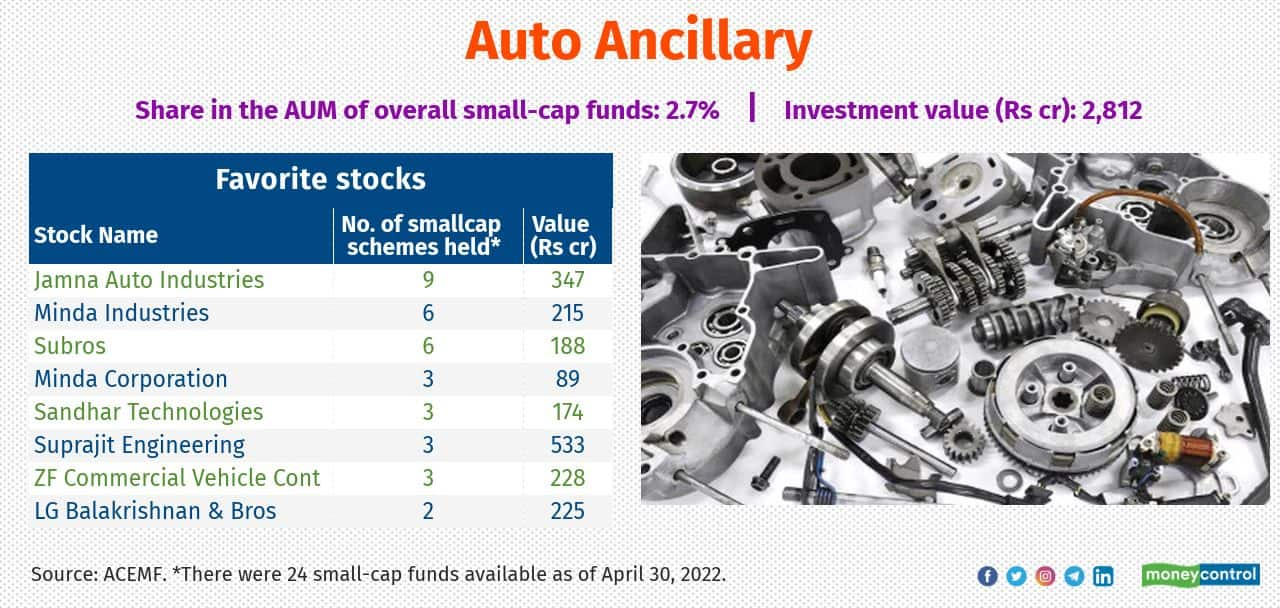

Acquisitions of electric vehicle tech companies and ramping up of component business with an eye on the global market have improved growth prospects of auto ancillary companies. Schemes such as IDFC Emerging Businesses, DSP Small and HDFC Small Cap Fund held significant allocation to the sector.

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!