10 midcap stocks that rewarded MF investors in 2023

Within the midcap space, PSU stocks in power finance, capital goods, oil marketing, defence, and also power and realty stocks attracted healthy buying interest

1/11

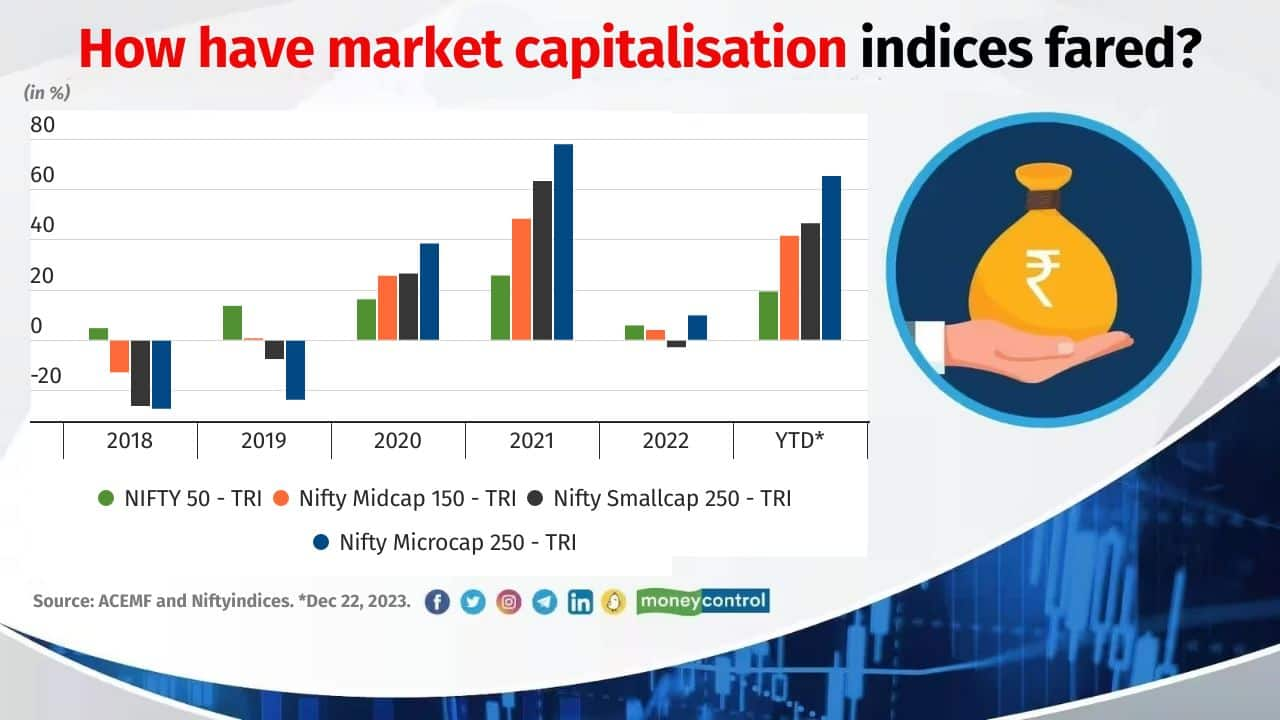

Midcap stocks demonstrated an impressive performance in 2023, with the Nifty Midcap 150 TRI delivering an absolute return of 38 percent year-to-date (YTD). Many midcap stocks rallied and traded near their lifetime highs.

Deepak Jasani, Head of Retail Research at HDFC Securities, says, “Investors focused on midcaps where the float and institutional ownership were limited while searching for Alpha. While the largecap segment became expensive, some midcaps looked cheap on a relative basis, given that their earnings could grow faster than the largecaps. Large MF inflows in small- and midcap schemes also meant that more money needed to be deployed in these categories. Within the midcap space, PSU stocks in power finance, capital goods, oil marketing, Defence, and also power and realty stocks attracted more buying interest.”

Here are the top midcap stocks that delivered multi-bagger returns, rewarding the equity mutual fund schemes that held those stocks. Portfolio data as of November 2023. Source: ACEMF.

Deepak Jasani, Head of Retail Research at HDFC Securities, says, “Investors focused on midcaps where the float and institutional ownership were limited while searching for Alpha. While the largecap segment became expensive, some midcaps looked cheap on a relative basis, given that their earnings could grow faster than the largecaps. Large MF inflows in small- and midcap schemes also meant that more money needed to be deployed in these categories. Within the midcap space, PSU stocks in power finance, capital goods, oil marketing, Defence, and also power and realty stocks attracted more buying interest.”

Here are the top midcap stocks that delivered multi-bagger returns, rewarding the equity mutual fund schemes that held those stocks. Portfolio data as of November 2023. Source: ACEMF.

2/11

REC

Schemes that held notable allocation to the stock: JM Value, 360 ONE Quant and Mahindra Manulife Mid Cap Fund

Also see: Mutual fund industry assets top Rs 50 trillion landmark: what helped achieve this number?

Schemes that held notable allocation to the stock: JM Value, 360 ONE Quant and Mahindra Manulife Mid Cap Fund

Also see: Mutual fund industry assets top Rs 50 trillion landmark: what helped achieve this number?

3/11

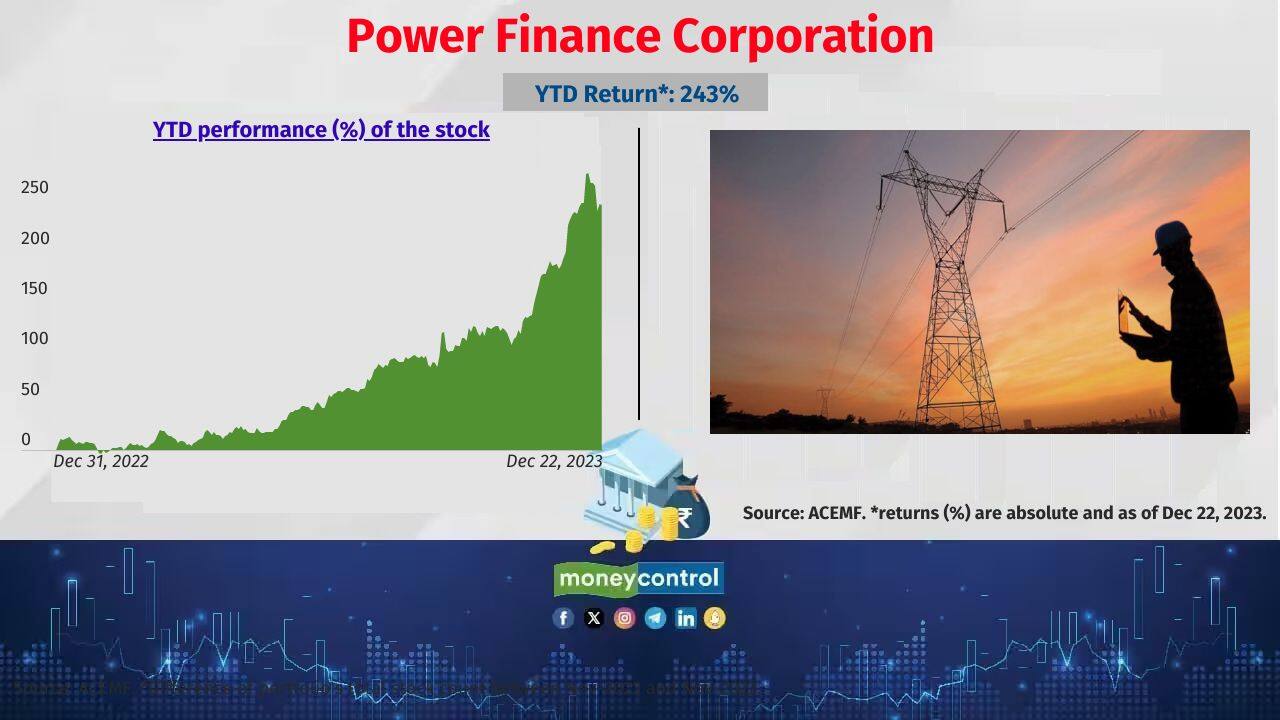

Power Finance Corporation

Schemes that held notable allocation to the stock: Nippon India Growth, Kotak Multicap and Mirae Asset Midcap Fund

Schemes that held notable allocation to the stock: Nippon India Growth, Kotak Multicap and Mirae Asset Midcap Fund

4/11

Indian Railway Finance Corporation

Schemes that held notable allocation to the stock: HDFC Balanced Advantage Fund, Parag Parikh Conservative Hybrid and HDFC Dividend Yield Fund

Also see: Tax-Saving FDs: These largest banks offer up to 7% interest rate

Schemes that held notable allocation to the stock: HDFC Balanced Advantage Fund, Parag Parikh Conservative Hybrid and HDFC Dividend Yield Fund

Also see: Tax-Saving FDs: These largest banks offer up to 7% interest rate

5/11

Rail Vikas Nigam

Schemes that held notable allocation to the stock: Bank of India Mfg & Infra and Bank of India Flexi Cap

Schemes that held notable allocation to the stock: Bank of India Mfg & Infra and Bank of India Flexi Cap

6/11

Jindal Stainless

Schemes that held notable allocation to the stock: ICICI Pru Commodities, Tata Resources & Energy and Bank of India Mid & Small Cap Equity & Debt Fund-Reg(G)

Also see: Most sold mid-cap stocks by active fund managers in November

Schemes that held notable allocation to the stock: ICICI Pru Commodities, Tata Resources & Energy and Bank of India Mid & Small Cap Equity & Debt Fund-Reg(G)

Also see: Most sold mid-cap stocks by active fund managers in November

7/11

Prestige Estates Projects

Schemes that held notable allocation to the stock: HDFC Housing Opp, Tata Housing Opportunities and Franklin India Prima Fund

Schemes that held notable allocation to the stock: HDFC Housing Opp, Tata Housing Opportunities and Franklin India Prima Fund

8/11

Aurobindo Pharma

Schemes that held notable allocation to the stock: Bandhan Equity Savings, UTI Large & Mid Cap and HSBC Balanced Advantage Fund

Also see: “Strong buy” smallcap stocks by PMS in November

Schemes that held notable allocation to the stock: Bandhan Equity Savings, UTI Large & Mid Cap and HSBC Balanced Advantage Fund

Also see: “Strong buy” smallcap stocks by PMS in November

9/11

Bharat Heavy Electricals

Schemes that held notable allocation to the stock: Taurus Discovery (Midcap), Tata Business Cycle and Nippon India Focused Equity Fund

Schemes that held notable allocation to the stock: Taurus Discovery (Midcap), Tata Business Cycle and Nippon India Focused Equity Fund

10/11

KPIT Technologies

Schemes that held notable allocation to the stock: HSBC ELSS Tax saver, Sundaram Small Cap and Franklin India Smaller Cos Fund

Schemes that held notable allocation to the stock: HSBC ELSS Tax saver, Sundaram Small Cap and Franklin India Smaller Cos Fund

11/11

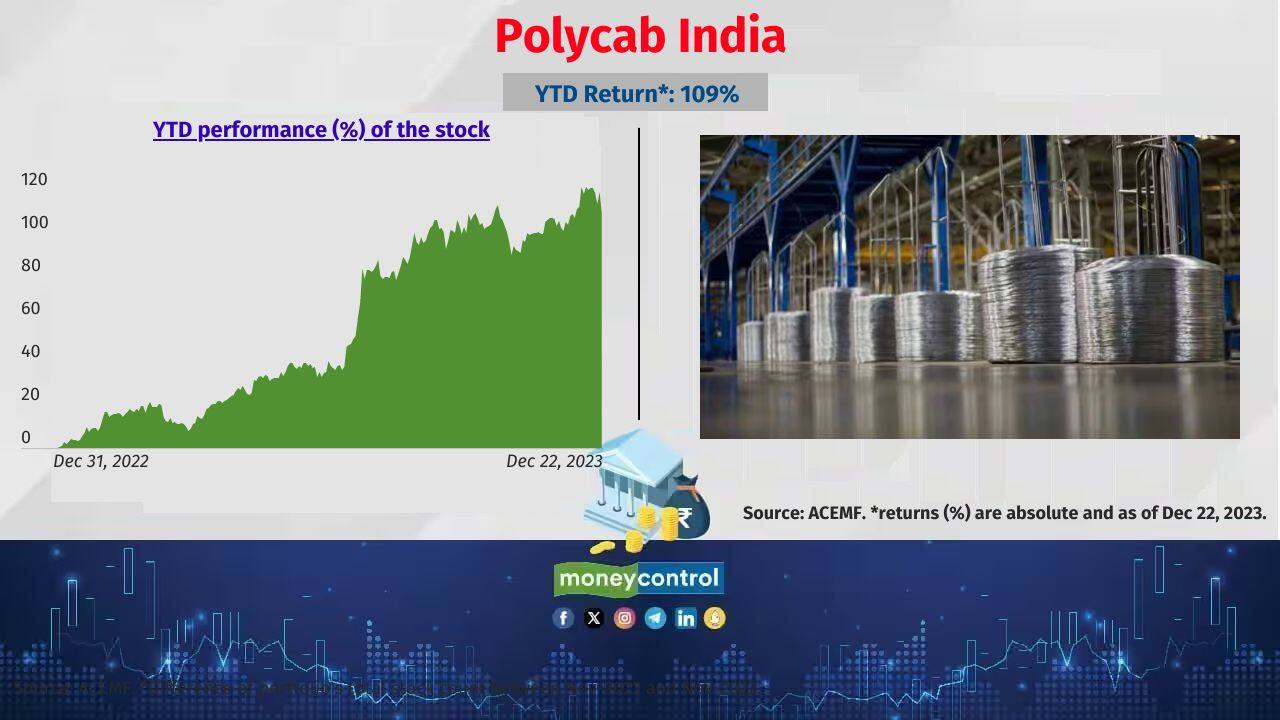

Polycab India

Schemes that held notable allocation to the stock: Tata Housing Opportunities, Canara Rob Mid Cap and DSP Midcap Fund

Also see: Sensex @ 71,000; How larger asset equity MF schemes tweaked their portfolio

Schemes that held notable allocation to the stock: Tata Housing Opportunities, Canara Rob Mid Cap and DSP Midcap Fund

Also see: Sensex @ 71,000; How larger asset equity MF schemes tweaked their portfolio

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!