F&O Manual: Recovery may continue tomorrow, analysts suggest buy on dips

Recovery in the market was driven by gains across financial names and heavyweights like Reliance Industries and Bajaj Finance.

1/5

The market managed to stage a swift recovery on March 21 driven by positive global cues on the back of easing concerns over the health of the global banking system and hopes of a pause or smaller rate hikes by the US Federal Reserve. On account of the gains in today's sessions, most analysts predict a change in the underlying tone in the market which makes them hopeful of the sustenance of this uptrend. The Nifty erased its losses from the previous day and ended the session 119.10 points or 0.70 percent higher at 17,107.50. (Blue bars show volume and golden bars open interest (OI)).

2/5

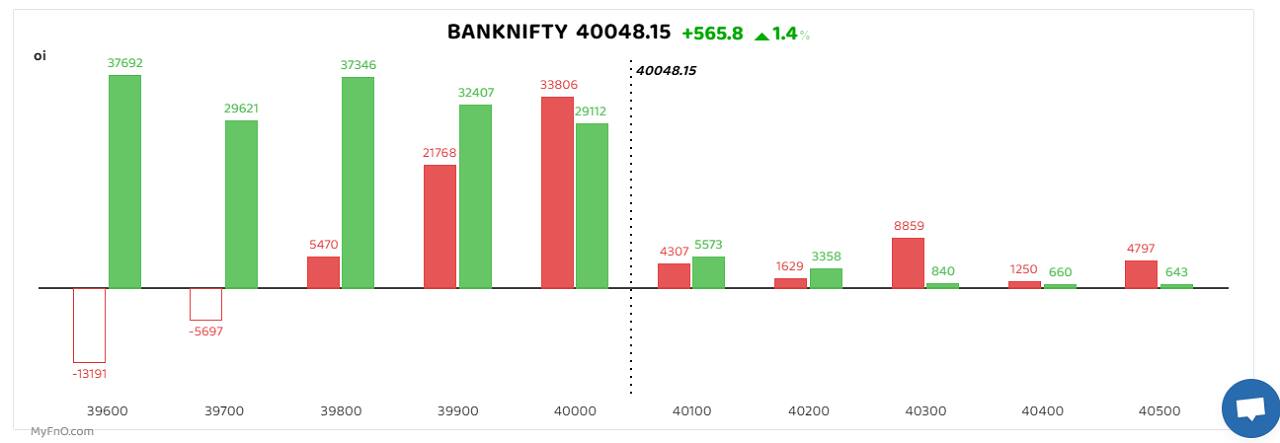

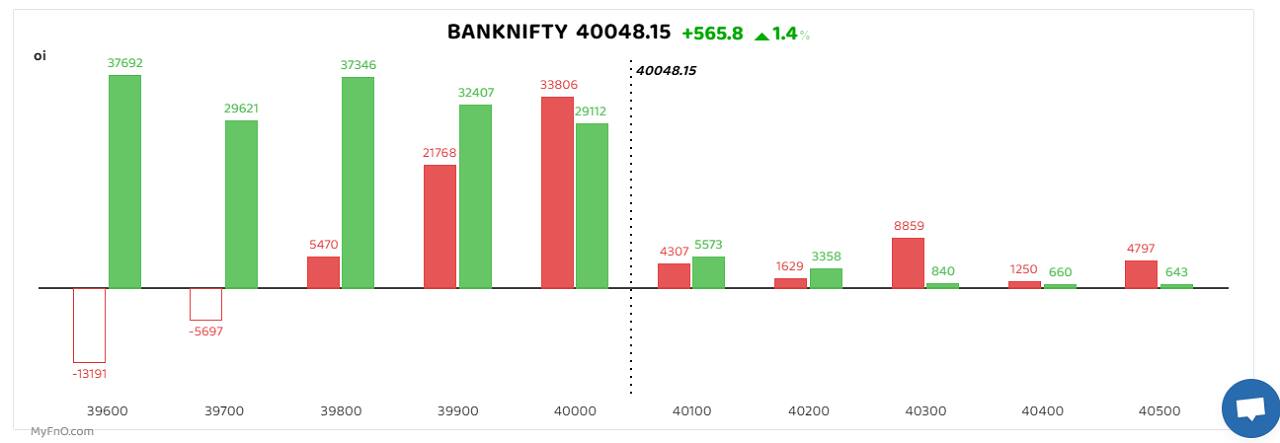

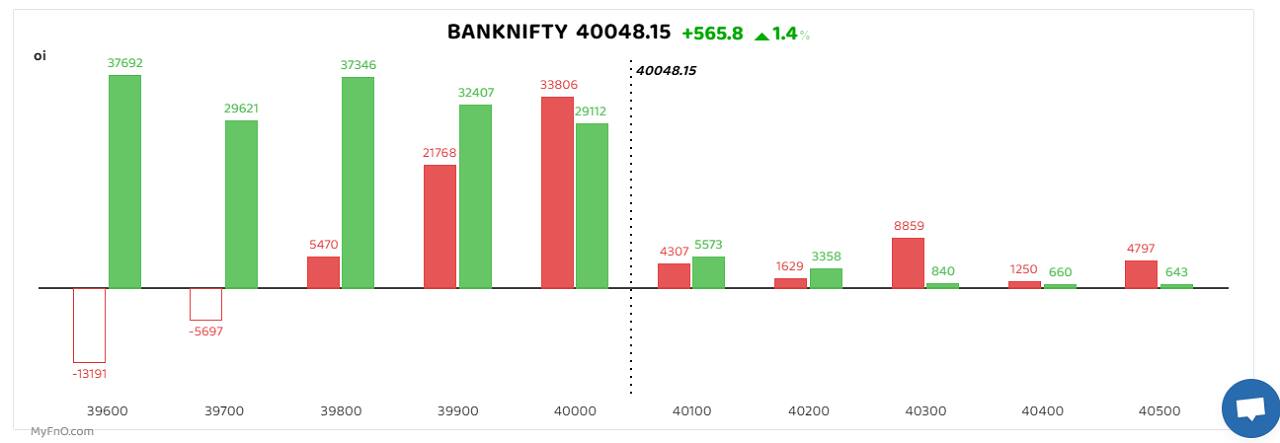

On the options front, put writers moved to higher strike prices, with the maximum accumulation seen at 17,000. This indicates that the level will act as crucial support for the index in the next trading session. Call options writers also shifted higher as bulls gave a fight for recovery. Maximum call writing was seen at 17,400 followed by 17,100. Sahaj Agarwal, Head of Research, Derivatives at Kotak Securities expects the upward momentum to continue and suggests investors buy on dips while trading with a positive bias. Anuj Dixit, Executive VP- Equity Research, Sovereign Global forecasts a sharp short-covering rally towards the 17,450-17,520 zone if 17,230 is decisively surpassed. (Bars reflect change in OI during the day. Red bars show call option OI and green put option OI.)

3/5

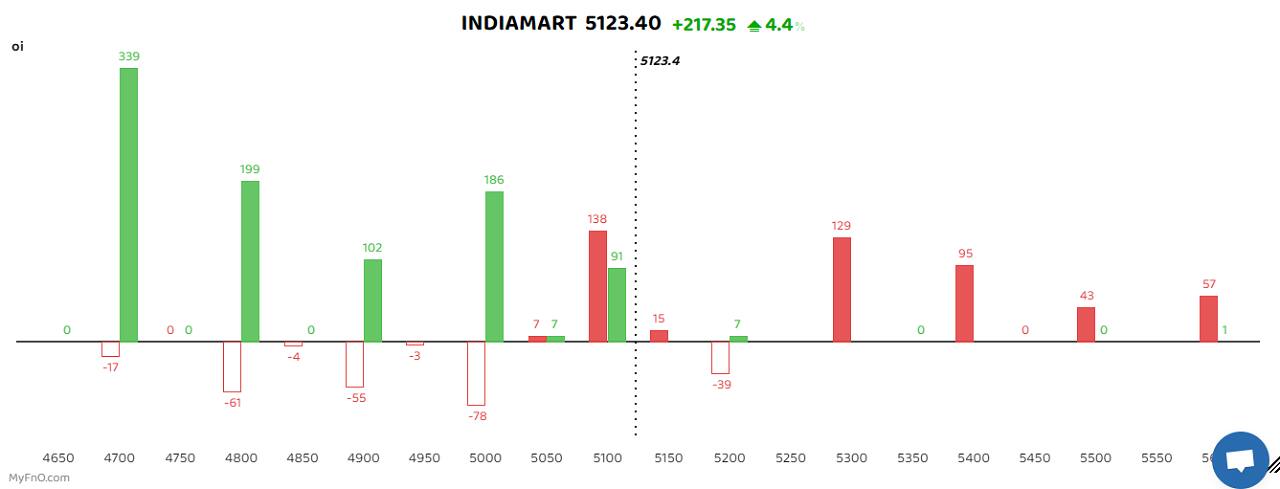

IndiaMart InterMESH witnessed the maximum addition of long positions as open interest in the counter shot up over 26 percent, the highest in a year. Apart from that, several financial names including Axis Bank, ICICI Prudential, Shriram Finance, IDFC, Bank of Baroda, and SBI Life Insurance Co among others also saw long buildups. A long build-up is a bullish sign that happens when open interest and volume increase with the rise in share price. (Bars reflect a change in OI during the day. Red bars show call option OI and green put option OI.)

4/5

GAIL saw strong short buildup as the stock slipped below its 20-day simple and exponential moving averages today. Short additions were also seen in Hindustan Unilever, Britannia, Tech Mahindra, Voltas and Metropolis India. The short build-up is a bearish sign that takes place when the price of a stock falls, along with high open interest and volume. (Bars reflect a change in OI during the day. Red bars show call option OI and green put option OI.) Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

5/5

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!