Diwali stock picks 2024: HDFC Bank, SpiceJet, RIL among Teji Mandi's picks for Samvat 2081

Stocks to buy this Diwali: Analysts at Teji Mandi chose stocks like HDFC Bank, Syngene International and SpiceJet among others as their preferred bets for Samvat 2081.

1/7

HDFC Bank: Recently the Q2FY25 earnings were out, growth & quality in terms of asset both has stood out for HDFC Bank when we compare two peers like Kotak Mahindra Bank as well as Axis Bank. For Teji Mandi, it's a clear review that stress in the system is building up for others when the going is good for HDFC Bank. Given the steady performance in the challenging environment, marked by stable margins and improvement in asset quality, analysts at Teji Mandi believe that HDFC Bank is poised to report gradual recovery in loan growth. On that account, the firm assigned a price target of Rs 1,954 to the stock.

2/7

Syngene International: Given its ability to offer end-to-end services to customers right from discovery to commercial manufacturing, Teji Mandi anticipates Syngene to be the largest beneficiary of China+1 strategy. In addition, with a strong Q3FY25 already underway, the management also expects to see a positive change in revenue trajectory and remain on track to deliver within guidance range for FY25 which stands at high single digits to low double digits revenue growth for FY25.Tying that up with the recent investments in the research and CDMO businesses, Teji Mandi believes Syngene is in a good position to leverage opportunities to drive medium to long-term growth. The firm assigned a price target of Rs 1,150 to the stock.

3/7

SpiceJet: Teji Mandi assigned a price target of Rs 82 for SpiceJet. Recently, the company completed its Rs 3,000 crore Qualified Institutional Placement (QIP) attracting investors Goldman Sachs, Morgan Stanley and some of the family offices as well which augurs well. Apart from this, the company will also receive an additional Rs 736 crore from the previous funding round, which will boost its financial stability and growth plans along with settling past dues as well. With this new funding, the company aims to improve its operations, upgrade its fleet, and expand their network to meet the increasing passenger demand. SpiceJet plans to quickly bring back its 36 grounded aircraft, which are currently out of service due to lack of spare parts. With well-defined strategy to turnaround and ramp up by focusing on ungrounding and expansion of fleets, enhancing its presence in highly profitable roots, considering wide body operations in future for Asia Europe connectivity, focusing on Cargo business as it has high potential for growth, margins & returns, Teji Mandi believes that SpiceJet will only fly higher from here onwards.

4/7

Genesys International: Teji Mandi states that the investments Genesys has been making over the past couple of years in its platform and products are expected to yield results starting next year, with additional traction anticipated from H2 FY25. Furthermore, the geospatial sector is experiencing significant growth in the country for the first time, following the recent policy changes that have liberalized the sector. This shift is comparable to the telecom policy transition when the country moved from landlines to mobile phones, which saw a dramatic increase in adoption. Teji Mandi believes that a similar surge in adoption will occur in the geospatial space. Factoring that in, Teji Mandi assigned a price target of Rs 920 for the stock.

5/7

JNK India: JNK India Limited is a leading player in the industrial heating equipment market, specialising in the design, manufacturing, and installation of process-fired heaters, reformers, and cracking furnaces. These products are integral to key sectors such as oil and gas refineries, petrochemical complexes, and the fertiliser industry. Looking ahead, the management remains optimistic about the upcoming quarters. Their order book is strong at Rs 1,246.1 crore, and they well positioned to leverage growth opportunities within the industries JNK India caters to. Teji Mandi assigned a price target of Rs 862 for the stock.

6/7

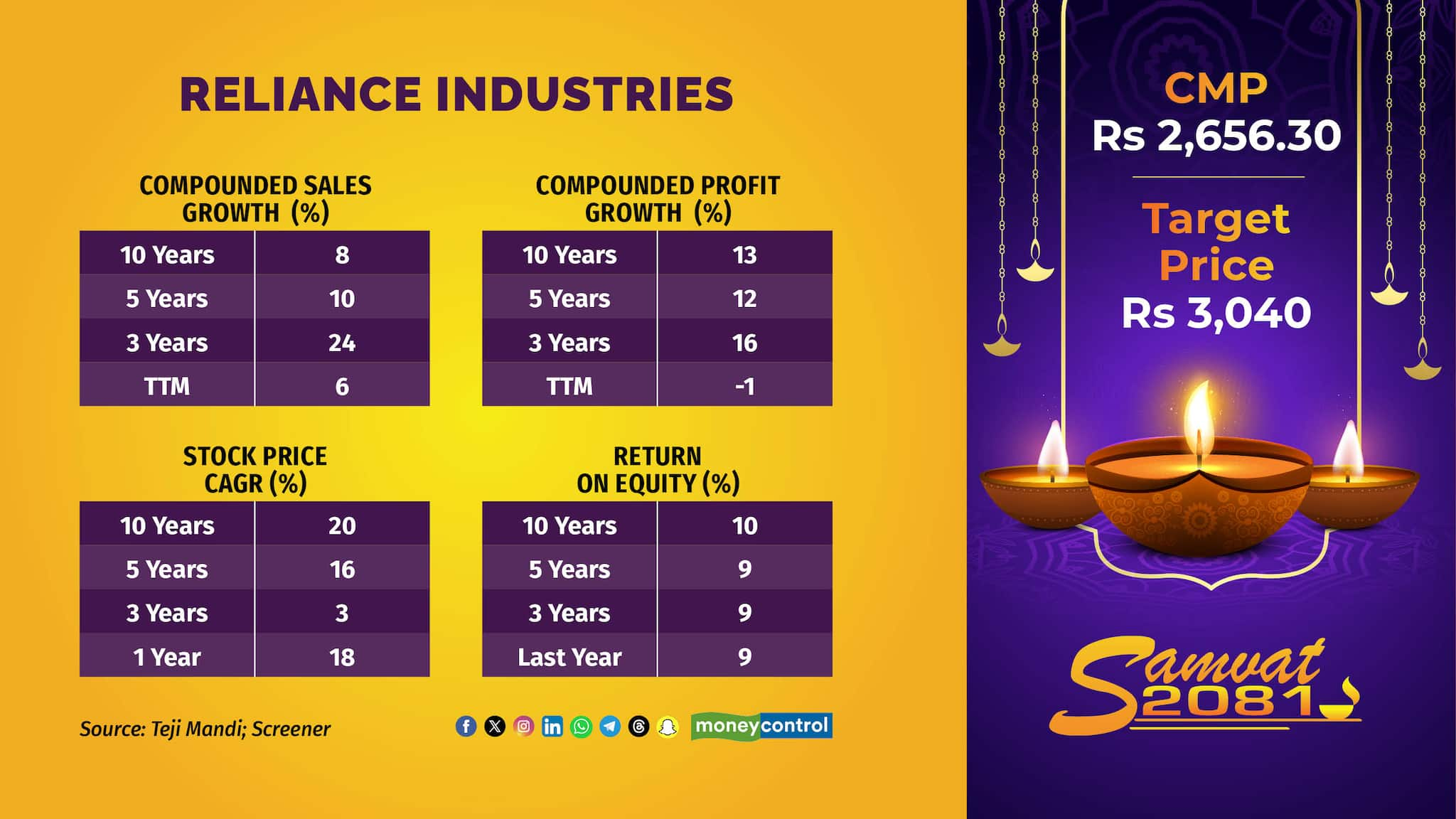

Reliance Industries: The company reported a steady set of earnings in Q2FY25 with consolidated profit more than Rs 16,500 crore, revenue at Rs 2.32 lakh crore and EBITDA margin at nearly 17%. According to Teji Mandi, the longer term outlook for RIL remains constructive as the consumer facing business will be the reason why there will be a recovery and the new energy business, they have given definite timeline that by the end of 2024 one phase will start and that is something which will meaningfully add and will be the key trigger in the coming years. Building on that, the firm assigned a target price of Rs 3,040 for RIL.

7/7

TVS Supply Chain Solutions: Founded by the former TVS Group and now part of TVS Mobility Group, TVS Supply Chain Solutions is an India-based multinational that pioneered the supply chain solutions market in India. In Q1 FY25, the company reported revenue of Rs 2,539.4 crore, a 10.9 percent increase from Rs 2,288.9 crore in Q1 FY24. This growth was driven by sustained momentum in the integrated supply chain solutions (ISCS) segment and an improved macroeconomic environment in the network solutions (NS) segment. Teji Mandi sees significant growth opportunity in India following the recent budget announcement, which has provided a substantial boost to the manufacturing sector. This shift is likely to create more outsourcing opportunities for supply chain players like TVS Supply Chain. With its robust business model, TVS Supply Chain is well-positioned to maintain a competitive edge over its peers. Accordingly, it gave a price target of Rs 218 for the stock.

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!