Wind energy is meant to thrive in turbulent conditions. In 2023, the companies that seek to harness it are battening down the hatches.

Siemens Energy AG confirmed Thursday it was seeking German government support for loan guarantees to help it win contracts, sending the shares plummeting 35 percent. The total decline has been 68 percent since late June, when the maker of wind and gas turbines forecast a €4.5 billion ($4.8 billion) annual loss stemming in part from faulty products at its renewable unit Gamesa.

It’s not the only one caught in squalls. Xinjiang Goldwind Science & Technology Co, the biggest turbine manufacturer, reported the following day that third-quarter profits fell 98 percent. On Wednesday, General Electric Co said losses from its wind unit in 2023 and 2024 would total about $2 billion.

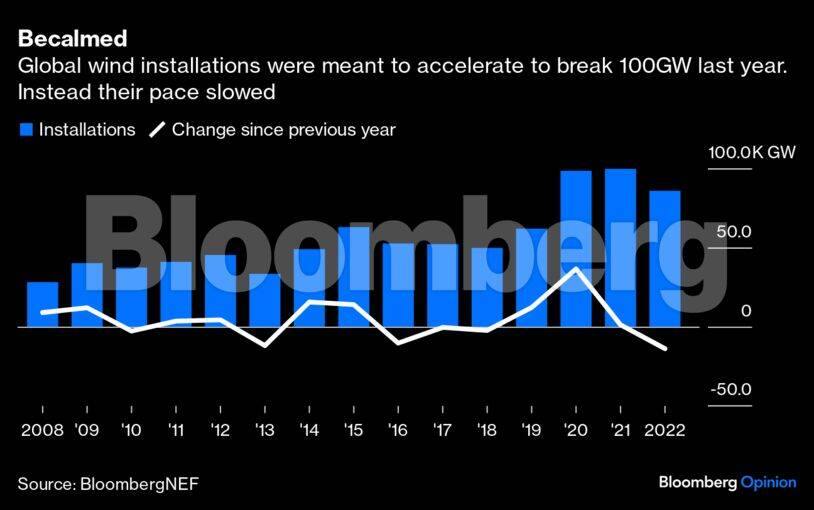

Problems have been building for the best part of two years. The pace of wind installation growth fell last year for the first time since 2018. No offshore bids were submitted in the UK’s latest wind auction in September. New York regulators this month blocked developers’ request to alter contracts for 4 gigawatts of projects off the coast of Long Island to accommodate higher costs. BloombergNEF now expects US offshore wind capacity to be just 16.4 gigawatts by the end of the decade, not much more than half of the Biden administration’s 30GW target.

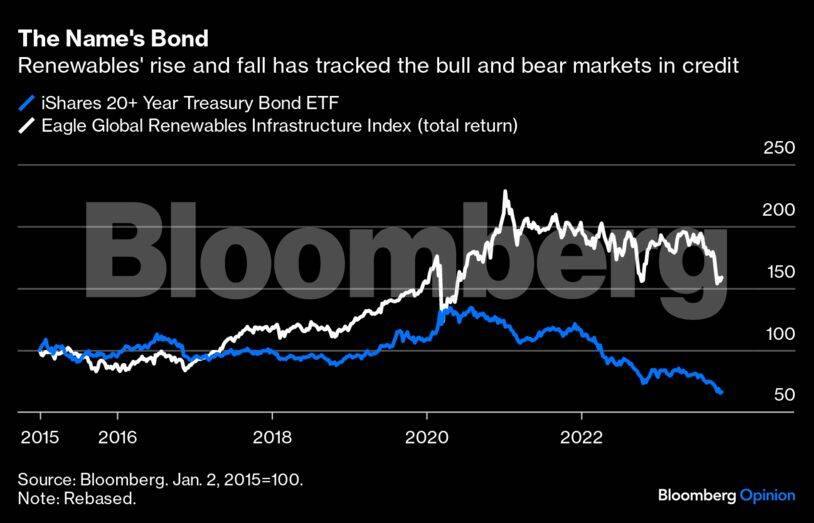

The wrenching recovery from COVID-19 has been a perfect storm for wind. Expenditure for renewables is almost all upfront, meaning the sector is unusually sensitive to borrowing costs. That meant it thrived in the long bull market for bonds, when the popularity of debt pushed down interest rates — but it’s been hit as credit markets sagged since 2020. A 3.2 percentage-point rise in the cost of capital can lift the price of German offshore wind by 26 percent.

Years of supply chain disruptions mean materials are more expensive, too. At the peak last year, the steel plate from which turbine towers are made cost almost triple the €600 a metric ton level at which it traded in recent years, and even now it’s running at €795/ton. Copper is also about a third above levels in the long metals bear market from 2013 to 2020.

The governments whose auctions underpin renewables development have been slow to accept how things have changed. The slumping price of wind and solar over the past decade has often seen them bracketed together — including by their supporters — as industries where ever-declining costs are not just a norm, but a rule.

That’s clearly not the case. Unlike solar, where grids are being transformed by the power of consumer rooftops alone, wind depends on large-scale engineering that doesn’t inevitably get cheaper the way that manufactured goods do. If anything, the premium on construction and engineering expertise is rising now: The state of the art has been moving from relatively small windmills generating about 2 MW each, to behemoths of 14MW or more, standing nearly as tall as the Eiffel Tower from blade tip to the ground.

Action plans put out by the European Union and New York state in recent weeks have been welcomed by the industry and caused shares to rally, but they’re unlikely to be enough to turn the page.

A proposal in Europe’s plan to make permitting simpler instead promises additional rules on cybersecurity and preventing bids simply going to the best-value tender. Deferred payment terms and lower prices being offered by Chinese entrants are painted as a problem that needs to be excluded, rather than a competitive edge that must be matched.

That’s not going to solve the problem. The best way to help Europe’s turbine manufacturers is to give them a vibrant pipeline of projects to sell into by simplifying processes for developers — a point where Brussels’s plan offers many promises but few certainties. That will encourage investment in the entire supply chain, further enhancing efficiency and restarting the virtuous circle where wind gets cheaper because it’s growing faster, and grows faster because it’s getting cheaper.

There are still reasons to hope the industry will turn the corner. Amid all the bad news, last week also featured signs that the bond bear market may be reaching its end. GE set a date for the long-planned spinoff of its energy unit, a sign that equity investors’ appetite for wind power stocks isn’t completely sated.

The rising cost of gas, coal and carbon means that wind still looks competitive in economic terms — if anything, more so than ever. Wind power is often most available when solar generation is weak, at night and in winter. Combined with its predictable long-term costs and higher utilisation, that means that even pricier tenders are likely to cut customer bills by pushing expensive fossil generation out of the fuel mix.

The sector’s woes aren’t going to be fixed without concerted action, though. The danger of the current situation is that an entire industry is about to die of neglect. What wind needs is a sign governments are going to match their clean-power pledges at whatever price the market needs, and slash whatever red tape is getting in the way of that goal.

David Fickling is a Bloomberg Opinion columnist. Views do not represent the stand of this publication.

Credit: Bloomberg

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.