By Yashraj Erande, Vipin V and Kevin Sanghvi

Every institution eventually reaches a point where incremental changes no longer move the needle – only reinvention does. For banking, that moment isn’t approaching – it’s already here.

A new generation, shaped by the internet, is entering its financial prime. It is fluent in swipe-first interactions and deeply suspicious of bureaucracy. These are the digitally native segments of Gen Z (born 1997–2012) and Gen Alpha (2013 onwards), together making up nearly half of India’s population. Gen Z alone is over 377 million strong and already influencing 46% of consumer spending. They aren’t just young — they’re fundamentally different. They expect money to move with the same ease as scrolling through Instagram Reels: fast, intuitive, and frictionless.

A New Generation, A New Set of Expectations

Gen Z has grown up with platforms like Netflix and Instagram that anticipate their needs. They expect the same from their bank. For Gen Z, money is not a destination — it’s a fluid layer beneath every experience. They don’t want upgraded versions of old-school banking, but fast, personalised, mobile-first experiences that fit their lifestyle. They might want an instant credit line for a last-minute weekend trip or toss ₹1,000 into a portfolio called “Year-end Goa Trip.”

The implication is clear: what worked for previous generations — brand equity, mass advertising, and branch networks — may no longer be relevant for the next.

The Rise of Global Challenger Banks

Globally, challenger banks are leading this reset. In Brazil, Nubank has scaled to over 100 million users, with more than 50% under the age of 35. Nubank’s success stems from youth focus, radical transparency, mobile-first products, personalised customer service, full-stack digital DNA, and culturally viral marketing — driving trust and growth at very low cost.

In the UK, Revolut began by solving a narrow pain point — foreign exchange fees — before expanding into a multi-product lifestyle platform. South Korea’s KakaoBank embedded finance into daily life through integration with the country’s leading messaging app.

Importantly, these digital banks are becoming profitable over the last 1–2 years as they reach maturity — signalling that scale and sustainability are now converging.

Having supported multiple digital bank builds globally, we’ve seen that success depends not just on technology, but on sharp positioning, product–market fit, and agility. The playbook is clear:

* Pick one sharp, underserved need.

* Build a frictionless, mobile-first solution.

* Create a brand that feels human, relatable, and shareable.

* Expand offerings after earning trust.

Can Legacy Banks Make the Leap: From Product Utility to Cultural Identity?

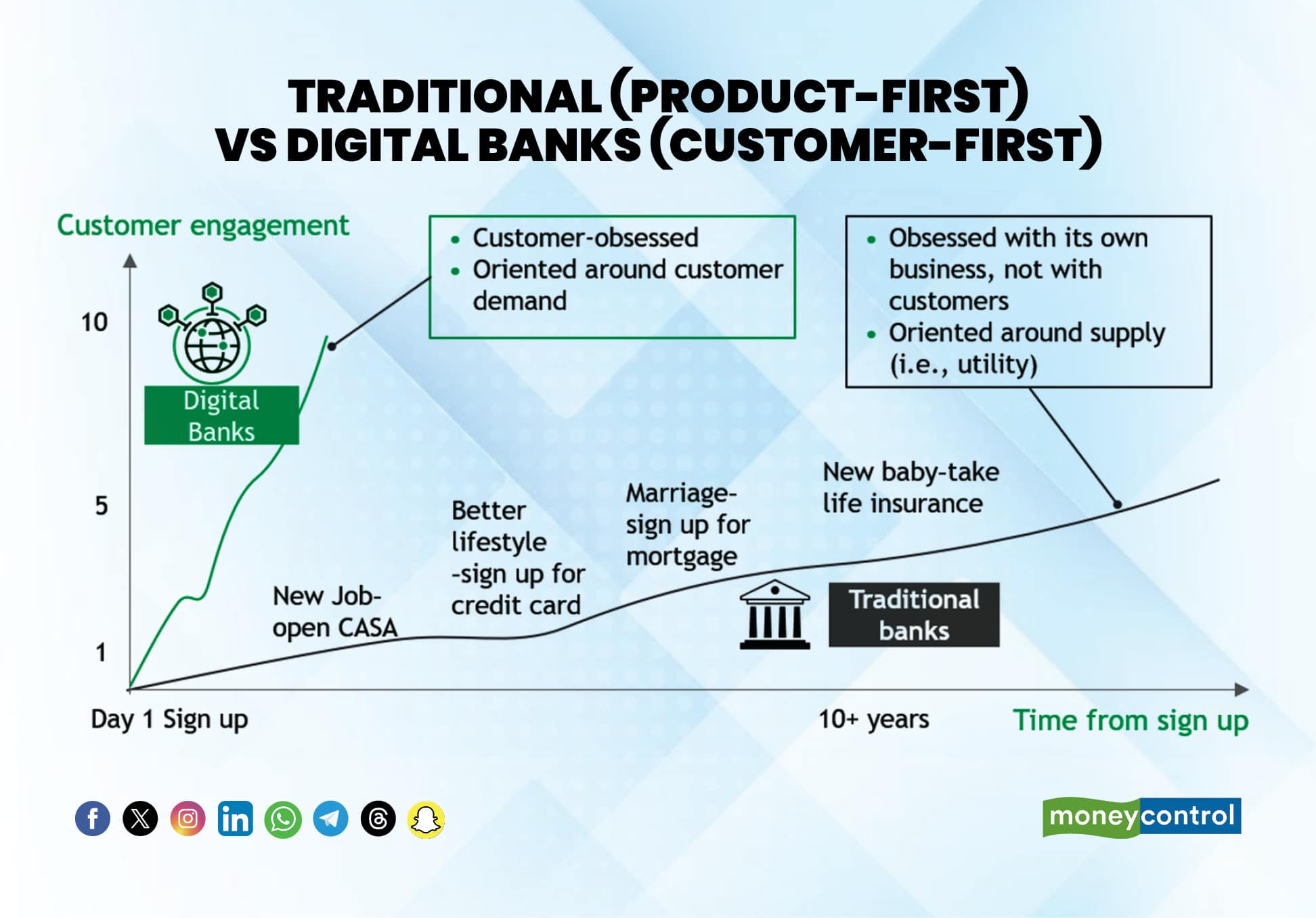

Traditional banks now face a critical question: Can we evolve fast enough to stay relevant? Not just in technology, but in tone, thinking, and trust.

That means asking:

# Can we become the bank Gen Z “vibes” with?

# Can we remove friction so effectively that the app becomes indispensable and simply “slays”?

# Can we design for virality, not just usability?

# Can we build experiences that reflect Gen Z’s aspirations and anxieties — not just more products?

Imagine “My First Job” — a smart, goal-based journey helping a 22-year-old get her first brag-worthy digital credit card, salary account, and SIP — while tracking rent, splitting bills, and unlocking local deals, all in one seamless experience.

Legacy assumptions like branch-led expansion and national media buys must be rethought. Product features such as well-timed nudges, gamified rewards, and referral streaks drive more organic growth.

Trust is no longer built through branches or ad spends — but through day-to-day utility. If a bank doesn’t feel relevant to Gen Z, they will switch — or worse, never sign up at all.

Reimagining Banking is Tough — Not Impossible

Reimagining banking for Gen Z isn’t just a design refresh. It’s a structural transformation across operations, technology, strategy, and culture. For legacy banks, this means launching a challenger bank with a different tech stack, product DNA, and a dedicated team — unencumbered by legacy processes.

However, this reinvention doesn’t come without hurdles. Legacy mindsets, regulatory ambiguity, and integration with traditional infrastructure often slow progress. These challenges can be effectively mitigated by ring-fencing the digital bank, engaging early with regulators, and leveraging API-first, modular architecture.

Seize the Moment: Unlocking the Gen Z Opportunity

It is critical for banks to think like start-ups — empowered teams, sprint-based product development, and fintech/BaaS partnerships. Fast experimentation, real-time feedback loops, and sharp focus on a few killer use cases can deliver speed without sacrificing impact.

India has the talent pool and ecosystem to create the world’s first truly AI-native digital bank. But it requires bold commitment and regulatory support.

Globally, digital banks operate with cost-to-income ratios up to 10 percentage points lower than traditional banks. Applied to India’s banking sector, this could unlock $5 billion in industry value — a compelling case for both incumbents and new-age founders.

Banks that act with sharp focus and truly understand Gen Z’s identity, ambition, and hustle will win lasting loyalty and brand equity. In meeting that demand, the future of banking will not just be secured — it will be redefined.

(The authors - Yashraj Erande, Global Leader - FinTech, India Leader, Financial Services, BCG; Vipin V, Managing Director & Partner, BCG; Kevin Sanghvi, Principal, BCG.)

Views are personal, and do not represent the stance of this publication.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.