With the recently-passed Inflation Reduction Act, 2022, the US government has joined forces with its central bank in the fight to lower inflation. US inflation has touched levels last seen 40 years ago, which has made fighting inflation the top priority of policymakers.

The US Federal Reserve has increased policy rates by an unprecedented 225 basis points over the last four monetary policy meetings. US president Joe bidden has called the IRA, "a historic agreement to fight inflation and lower costs for American families."

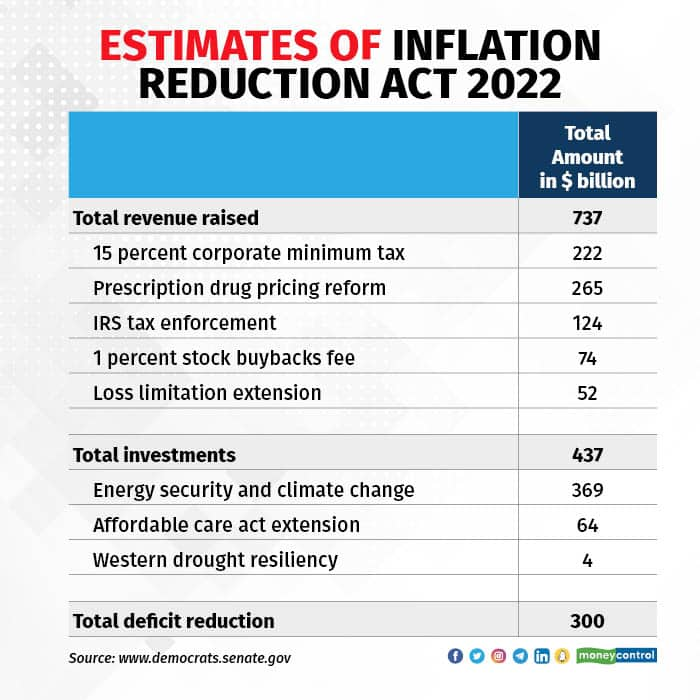

The IRA aims to boost government revenues by around $737 billion, and spend $437 billion over the period 2022-31. This will result in savings of $300 billion, which will translate into lower deficits.

The government plans to grow the revenues by implementing a minimum corporate tax, tax enforcement and fees on stock buybacks. Biden said that, "55 of the Fortune 500 companies paid no federal income tax in 2020," whereas they earned a "collective income of over $40 billion". The government aims to close these tax loopholes used by the wealthy.

The government spending is targeted towards energy security and climate change, which will lower energy bills and reduce carbon emissions by 40 percent by 2030. It will also create additional jobs in the clean manufacturing sector.

The government plans to spend on extension of the Affordable Care Act, which will expand medicare benefits such as free vaccines, affordable insulin, etc. The act will also require drug companies to rebate back price increase that exceed the rate of inflation, and medicare will be expanded to 10 drugs. The government plans to lower healthcare premiums for families covered under the act, leading to average savings of $800 a year per family.

In several ways, the IRA is actually a deficit reduction plan rather than an inflation reduction plan. It is also seen as an extension of the earlier ``Build Back Better’’ initiative announced by Biden on being elected president.

The government hopes that inflation will become lower inflation via two channels. First, lower deficits will lower the supply of money, which will help lower inflation. Second, investments in clean energy and medical services will help lower the cost of living.

While medical costs will be lowered immediately on extension of the act, lower inflation from clean energy will take longer. Some of the steps could lead to higher inflation as corporates will likely pass tax increases on to consumers.

Regardless of the brouhaha over the IRA, its impact on macroeconomic variables is at best expected to be marginal. A report by Moody’s Analytics expects inflation to be lower by just 0.33 percent, and the GDP is expected to rise by 0.2 percent in the next 10 years. Most of these gains, including lower deficit, will come towards latter half of the period, 2025 onwards. Analysis by the Congressional Budget office also conveys similar gains.

Should other nations also pass similar acts? High inflation has become a major concern in most economies. Central banks have increased policy rates to tackle inflation, but monetary policy has a lag of 12-18 months. The government’s fiscal policy can lower inflation quicker.

The IRA experience suggests that calling it the ‘Inflation Reduction Act’ is a smart move in terms of politics, if not economics. By naming it thus, the government conveys to the people that it is trying to protect them from high inflation.

However, looking at the details of the act, we see it is mainly about plugging tax loopholes and spending on medicare and clean energy. The act hardly achieves anything in terms of inflation reduction.

The US has a history of such inflation reduction announcements going awry. On 15 August 1971, former president Richard Nixon, while announcing the breakdown of the Bretton Woods agreement, also proposed policies to reduce inflation and create jobs.

These policies did not work and the US economy suffered from the ignominy of high inflation and high unemployment for the next five years. The lessons from the ‘70s have led today’s central banks to react quickly and aggressively to avoid high inflation. But have governments learnt any lessons?

Amol Agrawal is faculty at Ahmedabad University. Views are personal and do not represent the stand of this publication.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.