Generally, people either struggle to compute their retirement corpus, or are not convinced about it. In this article, let’s look at a simple and precise way of calculating a customised retirement corpus, incorporating an individual’s lifestyle cost, return on investment (ROI percent), inflation rate, and for how many years the corpus has to be set to meet the individual’s cost of living.

Since individual lifestyles, aspirations (reflected through inflation) and ROI profile are different, their respective retirement corpus requirement would also be different. Hence, a traditional methodology/uniform multiplier (e.g. 40x) may not be appropriate, and accurate in achieving the targeted corpus. A much better, and realistic approach would be a multiplier of the expenses, as this incorporates both the lifestyle (inflation) as well as the investment style (ROI).

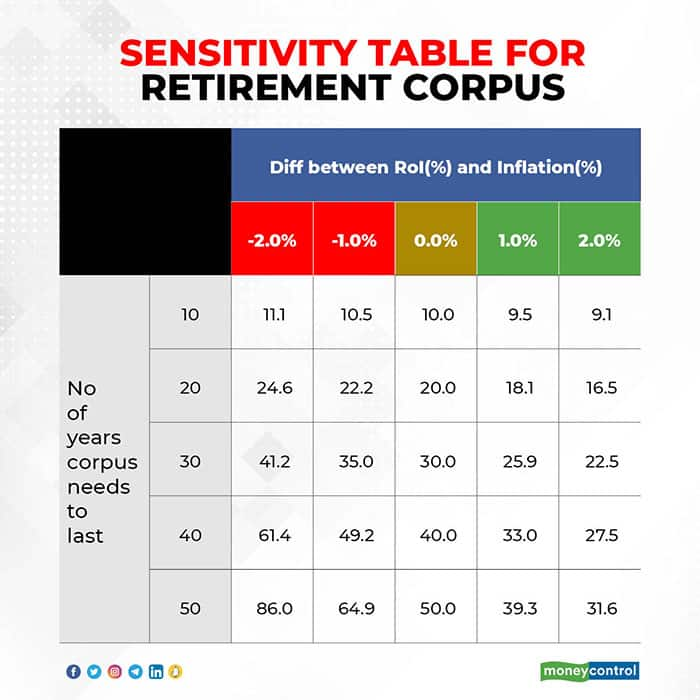

The sensitivity table below depicts this approach:

For example, if a person requires the corpus to last for 40 years, and they earn 1 percent more than inflation on their ROI, then the retirement corpus required should be 33 times the prevailing recurring annual expenses. As the above table, if the same individual’s ROI is not beating inflation and is 2 percent lesser than inflation (ROI is 200 bps less than inflation) then the corpus required would be 61.4 times the expenses.

The multiple will be equal to the number of years, as long as the ROI and the rate of inflation are the same, i.e. if the retirement corpus is for 30 years, and the ROI and rate of inflation are the same, the corpus required should be 30 times annual expenses.

No One-off Costs, OverheadsAs the corpus calculation is based on routine and recurring day-to-day expenses, the corpus thus arrived will not include any expenses which are not part of the annual lifestyle costs. Hence, one-off costs such as child's overseas education, marriage, contribution to exigencies, etc. will not be part of the corpus.

To include such overheads, one should calculate the inflated costs of such one-time expenses separately, and add to the retirement corpus. Similarly, the savings/investments accumulated till date can be subtracted, while outstanding loans can be added to the corpus.

The amount we thus arrive at can also be used as the quantum of term cover required through a life insurance. The individual has the flexibility of reducing the cover once their savings/investments equal the corpus required.

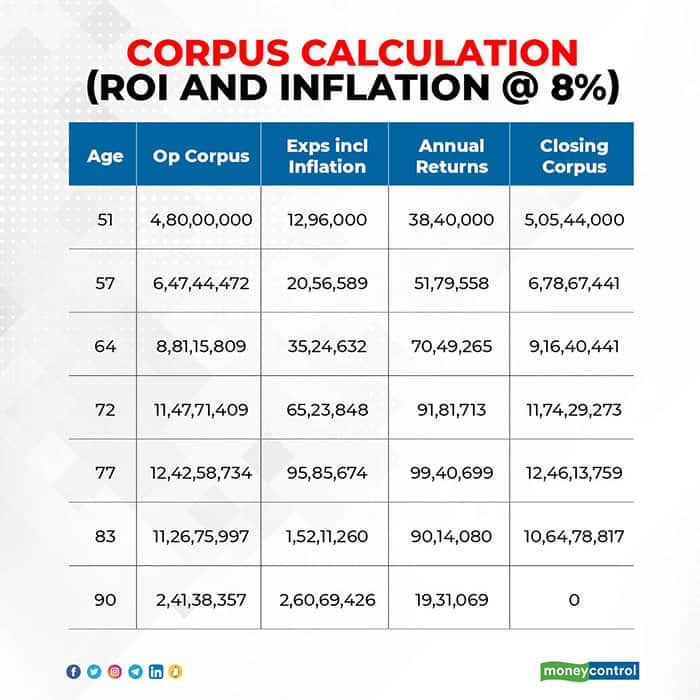

This corpus calculation can also be validated through a cash flow table detailed below:

The above table is a truncated representation of a 40-year cash flow for a 50-year-old individual. Here we assume an annual expense of Rs 12 lakh, with inflation and ROI at 8 percent. It is also assumed that the individual will require this corpus till the age of 90.

The annual expense (Rs 12 lakh) for 40 years would mean that the individual should start with a corpus of Rs 4.8 crore (12 lakh X 40 = 4.8 crore). Add to this an annual return of 8 percent of Rs 4.8 crore, which would be Rs 38.4 lakh, and deduct inflation-adjusted (at 8 percent) expense of Rs 12.96 lakh for the first year. Thus, the retirement corpus at the end of the first year would be Rs 5.05 crore (4.8 crore + 38.4 lakh – 12.96 lakh = 5.05 crore). This is important so that the individual can sustain their current lifestyle, and factor in inflation for the next 40 years.

Compounding EffectIn the sensitivity table shown earlier in this article it is clear that the deviation vis-à-vis ROI and inflation are not linear. The key reason for this is the compounding effect. On the negative side the compounding effect of inflation eats into the corpus at a faster clip, while when the ROI is greater than inflation, compounding ROI helps in achieving the target with a lower multiple.

Some of the other advantages of the sensitivity table are:

It is important that individuals strive to achieve at least 1 percent ROI over inflation so that they can achieve their goals comfortably, either through a lower targeted corpus or sustain the corpus for a longer duration.

For those in the negative zone, their objective should be to relook at their asset allocation strategy and lifestyle costs. It could be possible that inflation on certain items of their livelihood costs are high, which need to be reined in. Failing to do this would necessitate the individual to make tough choices during the golden age of life.

Sooner, one knows the target, easier it is to manage the lifestyle and investment accordingly to live a blissful retired life.

Shankar K has two decades of experience in equity research.Views are personal and do not represent the stand of this publication.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.