Swati Dhingra, an external member of the Bank of England's Monetary Policy Committee, is in a unique position as the only major central bank policymaker to publicly call for an interest rate cut in at least two years. If the BOE does decide to ease before either the Federal Reserve or the European Central Bank, it will be in no small part down to her trailblazing. She should stick to her guns until it does.

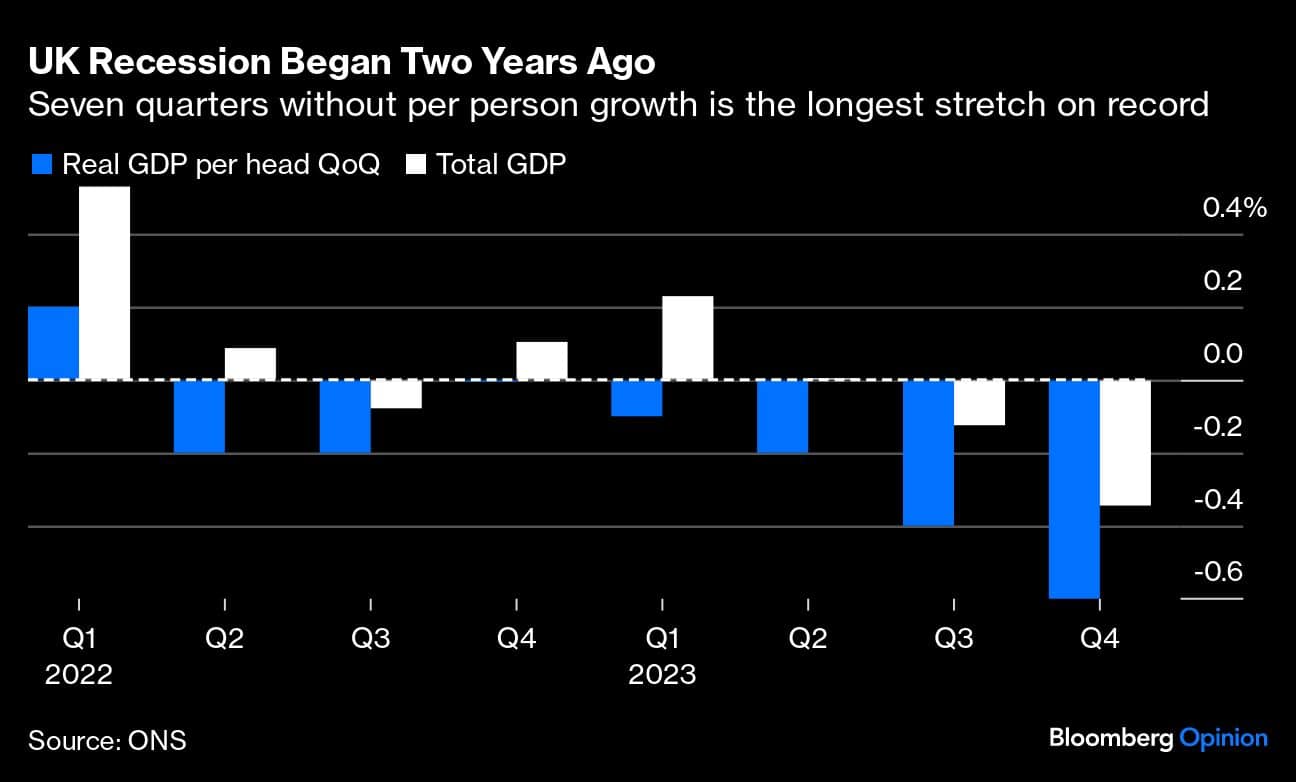

Dhingra has been the lone BOE dove since Silvana Tenreyro stepped down from the MPC in July. Tenreyro and Dhingra had voted against further rate hikes from December 2022; Dhingra’s caution is proving increasingly prescient after the UK economy slipped into recession in the second half of 2023, with per capita gross domestic product failing to grow for the longest period on record.

Former BOE Chief Economist Andy Haldane has echoed Dhingra in the past week, saying that rate cuts are needed to avoid deepening the economic downturn. And in a welcome development, Governor Andrew Bailey was more dovish at Tuesday's Treasury Select Committee hearing, saying that policy could ease before inflation falls to its 2 percent target. Bailey said he sees encouraging signs of improvement in the main areas of concern including sticky wage and services inflation, while repeating the mantra of wanting to see sustained progress.

Dhingra told Tuesday’s hearing that she’s wary of overseeing a "profound hit" to the UK economy, warning of substantial downside risks particularly if the supply-side capacity of the economy suffers long-term damage. She noted that UK job vacancies are rising faster than in the euro zone and the US — a refreshing counterbalance to the watch-and-wait groupthink of her BOE peers, who remain preoccupied with inflationary risks that are fast receding in the rear-view mirror.

She’s emphasized the need to formulate monetary policy with regard to the inevitable time lags, with rates set based on where inflation and the economy are likely to be in 18 months rather than a myopic data-dependent focus on inevitably lagging measures such as labour-force surveys. It helps that her speaking style is easier to follow than the more opaque comments of some of her colleagues.

Dhingra joined the MPC in September 2022. At her first meeting, the official rate was increased by 50 basis points to 2.25 percent, against her preference for a smaller rise. She's warned from the start of her term that keeping monetary policy too tight risks triggering a hard landing, voting just twice to raise rates in 12 meetings and shifting to a preference for no change until voting alone for a cut at the most recent decision earlier this month. With both the other external members still preferring another hike from the current 5.25 percent Bank rate, she’s finally broken definitively away from the pack.

Her full-time role is an associate economics professor at the London School of Economics, where she’s recognized as a leading voice on trade economics. Prior to joining the MPC, she was an outspoken critic of Brexit. However, as she explained in a lengthy Financial Times interview earlier this month, she doesn't come from the monetary policy world. Nonetheless, she's had the courage of her convictions rather than following the consensus. When asked what lessons she'd learnt, her response was "if you want to convince people, you better have really sound evidence to back it up." She’s been as good as her word, highlighting the mounting signs of economic weakness in a commendably frank manner. Hopefully her colleagues will wake up to that evidence before too long.

Marcus Ashworth is a Bloomberg Opinion columnist. Views do not represent the stand of this publication.

Credit: Bloomberg

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!