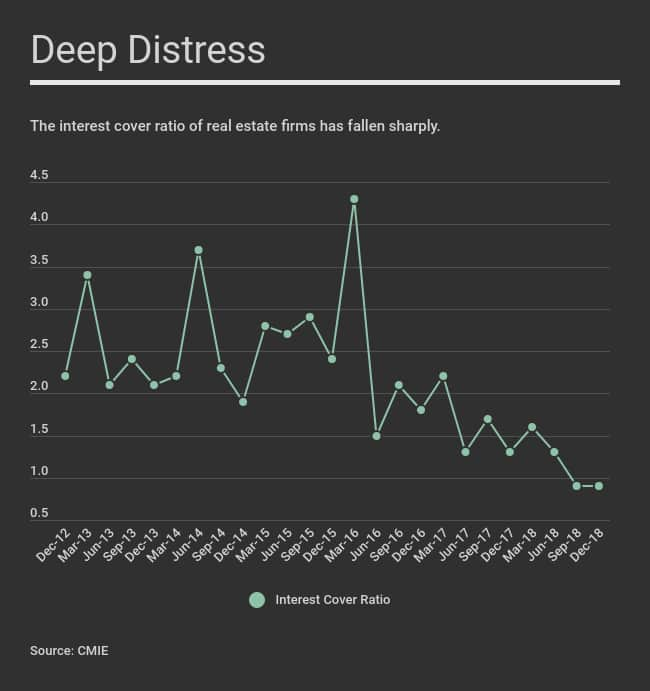

The asset quality risk from the real estate developer sector is very real for banks and non-banking financial companies, but especially the latter. The chart below shows clearly why.

The ability of developers to repay interest has fallen. A slowdown in demand, unsold inventory and high leverage has reduced the ability of these firms to cover interest payments. The interest coverage ratio of 26 firms sampled by the Centre for Monitoring the Indian Economy (CMIE) has fallen to 0.9 times. This is borne out by other analyses too. Investment bank Jefferies estimates that the percentage of developer debt where the debt service coverage ratio is less than 0.5 times has increased from 53 percent in FY15 to 69 percent now.

The upshot: Around 15-20 percent of developer debt, amounting to at least $10 billion (Rs 70,000 crore) is at the risk of turning sour, according to separate analyses by CLSA and Jefferies. While banks have been reluctant to increase realty exposure, NBFC lending has grown at 30-35 percent annually in the last 5 years. Clearly, it is time for Reserve Bank of India to do an asset quality review for NBFCs.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.