Bulls have taken a breather on November 2 after a run-up in the previous four consecutive sessions as traders may be cautious ahead of the special Monetary Policy Committee meeting called by the Reserve Bank of India on November 3.

The BSE Sensex dropped over 200 points to 60,906, while the Nifty50 fell 63 points to 18,083 and formed a Bearish Belt Hold kind of pattern on the daily charts.

"Though the Nifty declined slightly from the highs, the short-term uptrend status remains intact. Sharp weakness from near the hurdle of 18,100-18,200 is missing," Nagaraj Shetti, Technical Research Analyst at HDFC Securities said.

The positive chart pattern like higher tops and bottoms of smaller degrees is continued as per the daily chart and further consolidation or minor downward correction from here could open a possibility of higher bottom formation at the lows, he feels.

Further sustainable upside could emerge only above 18,200 levels. Next lower supports to be watched are at 17,900 levels, the market expert said.

The broader markets ended flat with a negative bias amid tepid breadth.

Key support and resistance levels on the Nifty

As per the pivot charts, the key support level for the Nifty is placed at 18,054, followed by 18,023 & 17,973. If the index moves up, the key resistance levels to watch out for are 18,153 followed by 18,184 and 18,233.

The Nifty Bank declined 143 points to 41,147, continuing the downtrend for yet another session, and formed a bearish candle on the daily charts on November 2. The important pivot level, which will act as crucial support for the index, is placed at 41,069, followed by 40,971 and 40,813 levels. On the upside, key resistance levels are placed at 41,385 followed by 41,483 & 41,641 levels.

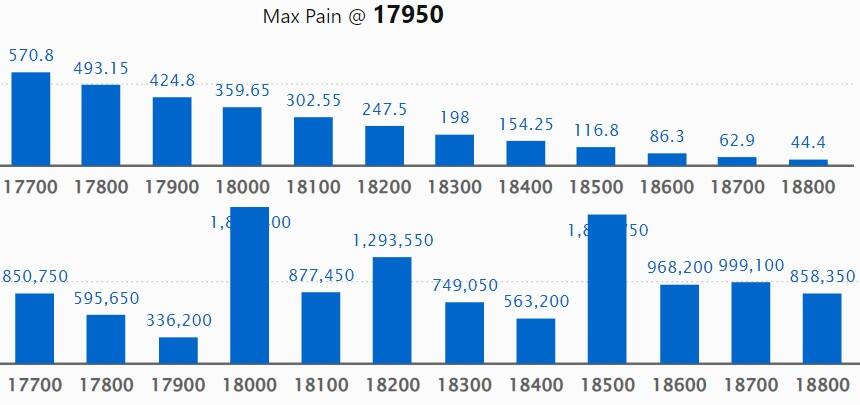

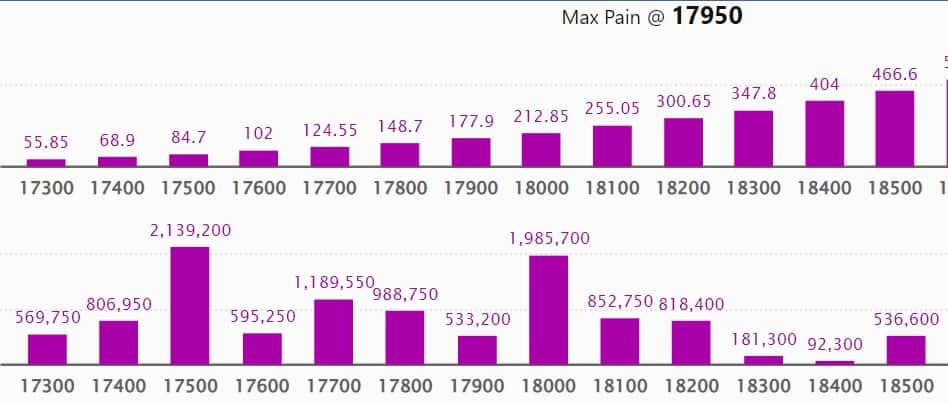

The maximum Call open interest of 19.01 lakh contracts was seen at 19,000 strike, which can act as a crucial resistance level in the November series.

This is followed by 18,000 strike, which holds 18.97 lakh contracts, and 18,500 strike, which has 18.09 lakh contracts.

Call writing was seen at 19,000 strike, which added 1.42 lakh contracts, followed by 18,700 strike which added 1 lakh contracts, and 18,200 strike which added 96,900 contracts.

Call unwinding was seen at 18,000 strike, which shed 2.59 lakh contracts, followed by 18,500 strike which shed 2.52 lakh contracts and 18,100 strike which shed 2.11 lakh contracts.

Maximum Put open interest of 31.09 lakh contracts was seen at 17,000 strike, which can act as a crucial support level in the November series.

This is followed by 17,500 strike, which holds 21.39 lakh contracts, and 18,000 strike, which has accumulated 19.85 lakh contracts.

Put writing was seen at 17,000 strike, which added 1.15 lakh contracts, followed by 17,700 strike, which added 1.11 lakh contracts, and 17,400 strike which added 68,850 contracts.

Put unwinding was seen at 18,100 strike, which shed 1.63 lakh contracts, followed by 17,900 strike which shed 98,250 contracts and 18,500 strike which shed 69,600 contracts.

STOCKS WITH A HIGH DELIVERY PERCENTAGE

A high delivery percentage suggests that investors are showing interest in these stocks. The highest delivery was seen in Biocon, Bosch, HDFC, TCS, and Power Grid Corporation of India, among others.

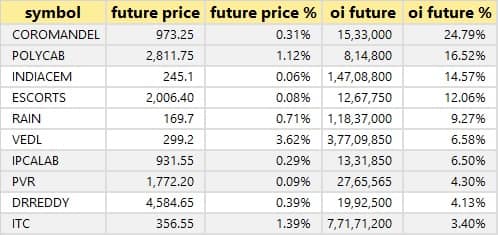

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks including Coromandel International, Polycab India, India Cements, Escorts, and Rain Industries, in which a long build-up was seen.

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks including Whirlpool, Navin Fluorine International, Shree Cement, Nifty, and Apollo Tyres, in which long unwinding was seen.

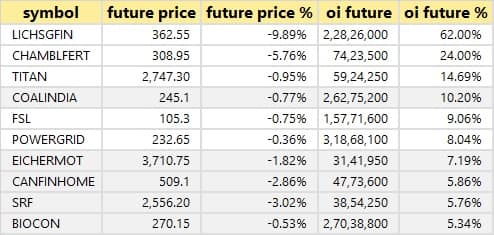

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen, including LIC Housing Finance, Chambal Fertilizers, Titan Company, Coal India, and Firstsource Solutions.

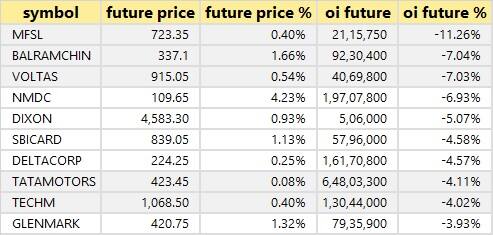

41 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which a short-covering was seen, including Max Financial Services, Balrampur Chini Mills, Voltas, NMDC, and Dixon Technologies.

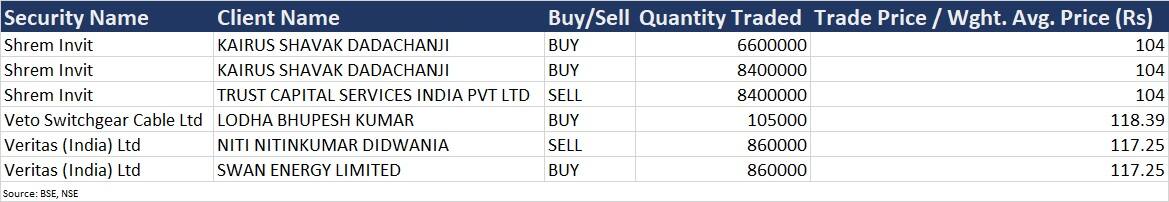

Veritas (India): Promoter Niti Nitinkumar Didwania sold 8.6 lakh shares (or 3.2 percent stake) in the company via open market transaction at an average price of Rs 117.25 per share. However, Swan Energy was the buyer in this transaction, which as of September 2022 already held 6.57 percent shareholding in Veritas.

(For more bulk deals, click here)

HDFC, Hero MotoCorp, Hindustan Petroleum Corporation, Vodafone Idea, Adani Enterprises, Ajanta Pharma, Amara Raja Batteries, Adani Total Gas, Adani Wilmar, Bank of India, Blue Star, Coromandel International, Devyani International, Indian Bank, JK Lakshmi Cement, Raymond, SRF, and Welspun Corp will be in focus ahead of September FY23 quarter earnings on November 3.

Stocks in NewsMTAR Technologies: The defence company has recorded a 30 percent year-on-year increase in consolidated profit at Rs 24.7 crore for the quarter ended September FY23, driven by top line. Revenue jumps 38.2 percent to Rs 126.2 crore compared to the year-ago period.

Nelcast: The company has reported a 262 percent year-on-year increase in consolidated profit at Rs 12.15 crore for the quarter ended September FY23, supported by topline as well as operating performance. Revenue at Rs 328.52 crore for the quarter increased by 37.4 percent compared to the year-ago period.

SIS: The company has reported a 1.4 percent year-on-year decline in consolidated profit at Rs 67.4 crore for the quarter ended September FY23, impacted by weak operating performance and margin compression. Revenue for the quarter increased by 14 percent YoY to Rs 2,768 crore, while EBITDA at Rs 109.8 crore fell by 10.8 percent for the quarter YoY.

JK Paper: The paper manufacturer recorded its highest-ever quarterly consolidated turnover of Rs 1,722.63 crore, a 72 percent growth compared to September FY22 quarter. EBITDA for the quarter at Rs 587.13 crore increased 130 percent and profit at Rs 324.23 crore rose 174 percent after providing Rs 33.64 crore as an exceptional item for the quarter ended September FY23 compared to corresponding quarter of previous financial year.

Jindal Stainless: The company has reported a significant 63 percent YoY decline in consolidated profit at Rs 151.84 crore for the quarter ended September FY23, impacted by higher inventory, power & fuel cost, and other expenses. Revenue grew by 11.5 percent YoY to Rs 5,604 crore for the quarter.

Rail Vikas Nigam: Life Insurance Corporation of India has offloaded a 2.02 percent equity stake in the company via open market transactions. With this, LIC's shareholding in the company reduced to 6.7 percent, down from 8.72 percent earlier.

Dalmia Bharat: The company registered a 74 percent YoY decline in consolidated profit at Rs 56 crore for the quarter ended September FY23 impacted by higher power & fuel cost, and freight charges. Revenue for the quarter grew by 15.1 percent YoY to Rs 2,971 crore, while EBITDA fell 39 percent YoY to Rs 379 crore during the quarter. Volume increased by 13.7 percent to 5.8 million tonnes for the quarter compared to the corresponding period last fiscal.

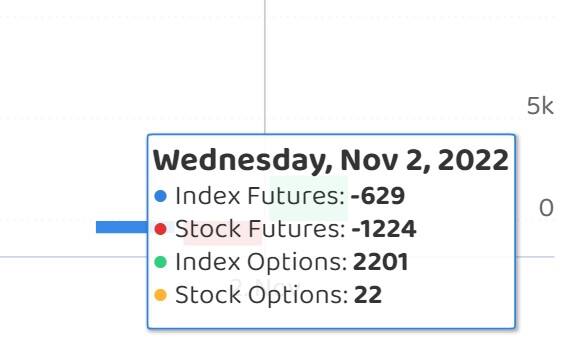

Fund Flow

Foreign institutional investors (FIIs) have net-bought shares worth Rs 1,436.30 crore, whereas domestic institutional investors (DIIs) net-sold shares worth Rs 1,378.12 crore on November 2, as per provisional data available on the NSE.

Stocks under F&O ban on NSEThe NSE has added LIC Housing Finance and retained Punjab National Bank under its F&O ban list for November 3. Securities thus banned under the F&O segment include companies where derivative contracts have crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.