A top Indian economist has rejected former Reserve Bank of India (RBI) deputy governor Viral Acharya's assertion that the pricing power of India's large conglomerates is behind the high and persistent core inflation.

Writing in a report, Soumya Kanti Ghosh, State Bank of India's group chief economic adviser, said it would be "factually incorrect" to say that concentration of power in a few firms and the resultant pricing capacity explain elevated domestic core inflation.

"...the increase in prices during the pandemic was more on account of supply chain and logistical disruptions caused by the pandemic and after the outbreak of the war in Ukraine rather than firms increasing prices because of higher pricing power," Ghosh said in a report on April 24.

"It is thus incorrect to infer that concentration power dictated pricing capacity of firms and thus resulting in unyielding core inflation," he added.

In March, Acharya - now the CV Starr Professor of Economics at New York University's Stern School of Business - had authored a paper that said Indian consumers were not fully benefiting from the fall in input prices due to greater pricing power in increasingly concentrated industrial organisation structures.

"What lends some credibility to this thesis is the observation that in contrast to the rest of the world, India's core inflation is rising more in Goods, where its industrial sectors are increasingly concentrated, than in Services, though there are early signs of pricing power rising in the Services sector too," Acharya wrote. He went on to recommend that India should look to break up its large industrial firms "by regulatory fiat or via competition commission diktat".

Core inflation has been sticky around 6 percent for the better part of two years now, although it eased to 5.8 percent in March. In his paper, Acharya - who was a member of the RBI's Monetary Policy Committee from January 2017 to July 2019 - said the central bank's task of bringing down inflation has been "rendered difficult by the persistence of elevated core inflation".

However, an analysis of seven sectors - telecom, FMCG, two-wheelers, passenger vehicles, retail trade, and steel and basic metals - by SBI's Soumya Kanti Ghosh found that core inflation has been elevated over the last 2-3 years due to supply-side shocks rather than corporate pricing power.

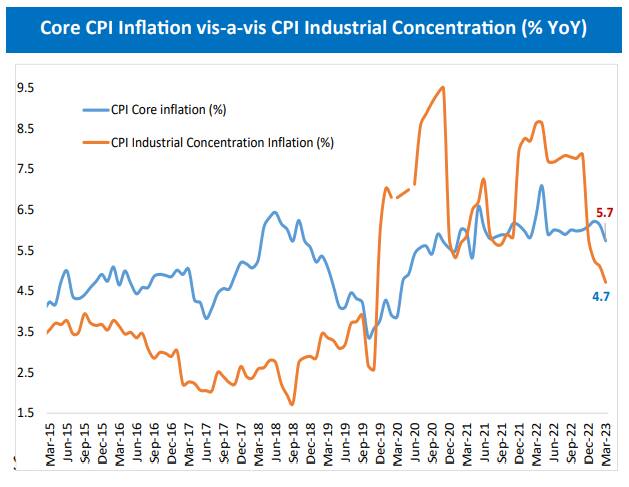

On constructing a measure of inflation he termed 'CPI Industrial Concentration Index', Ghosh said the price rise as per this measure was less than core CPI inflation starting January 2015.

Source: SBI Research

Source: SBI Research"For a brief period beginning January 2020 till November 2020 and also further during the pandemic as supply disruptions weighed heavily, the estimated concentration CPI was higher than the core CPI," Ghosh added.

Ghosh's analysis also found that it is food inflation, not core inflation, which has been driving headline retail inflation.

"On average, 45,600 new firms were registered every year in India, in the period between 1980 and 2018. It vaulted towards 2 lakh (around 1.85 lakh per early estimates) in 2023. In principle, the number of firms formed during 2018-2022 has been much higher in comparison, with a spirit of entrepreneurship sweeping across the nation," Ghosh added.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.