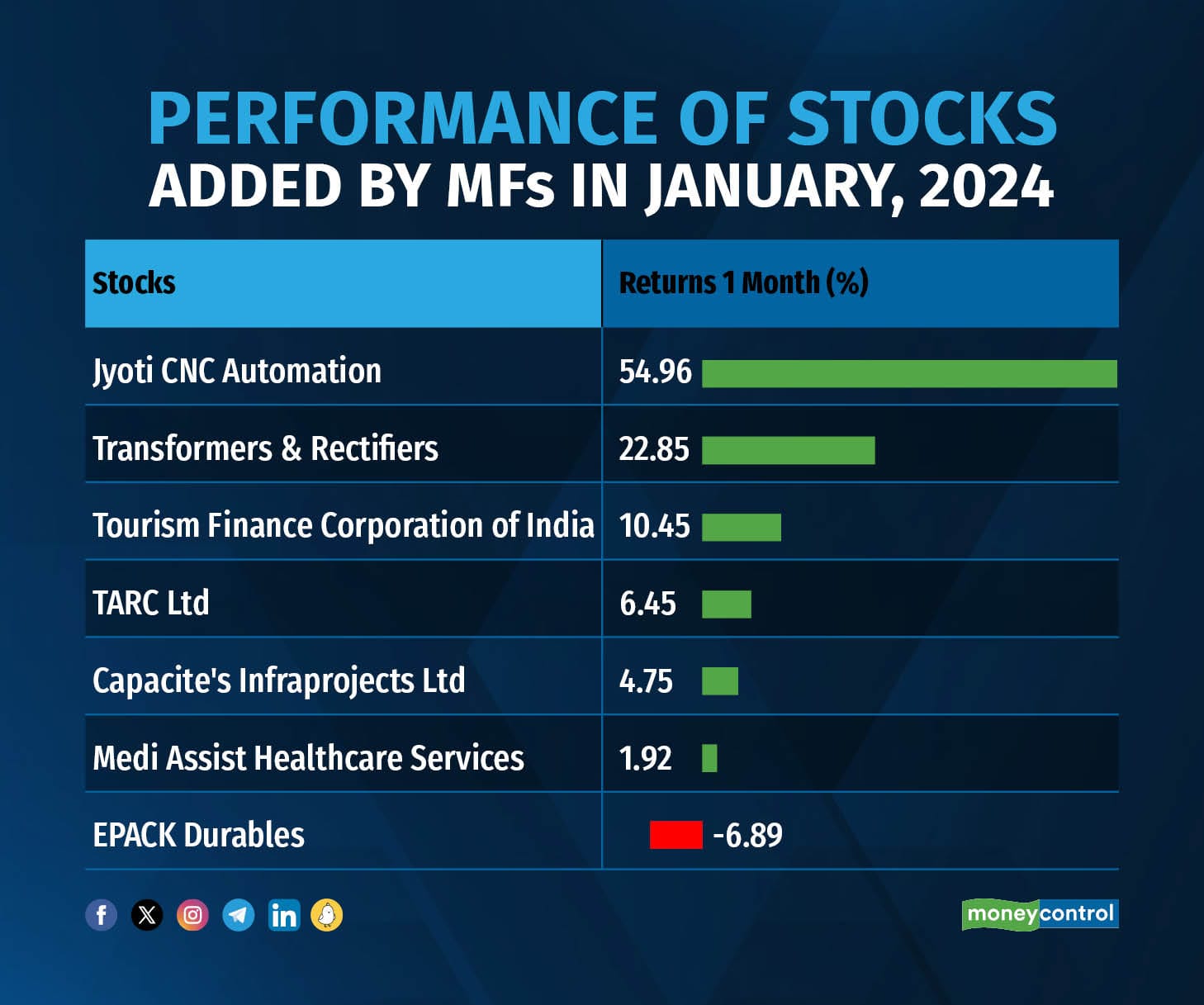

The Mutual Fund Holding Report for January 2024 published by IDBI Capital revealed the top 10 new additions for January month by MFs. Moreover, many of these additions have performed well on a year-to-date (YTD) basis.

The top 10 additions are Jyoti CNC Automation, Medi Assist Healthcare, Capacit'e Infraprojects, Transformers & Rectifiers, EPACK Durable Ltd., Tourism Finance Corporation, TARC Ltd.

The shares of newly listed Jyoti CNC Automation have risen ~50 percent YTD while the shares of Epack Durables have dipped ~7 percent. Shares of both companies were listed in January.

MFs purchases

MFs purchases

Nifty is up 1.75 percent YTD basis while BSE Sensex is up 0.60 percent.

Some of the major exits by MFs Tata Coffee, SH Kelkar And Company, Allcargo Terminals, Tinplate Company Of India and Ambika Cotton Mills. The shares of SH Kelkar and All cargo terminals are up by 47.32 percent and 30.92 percent respectively YTD.

According to the report, some of the sectors where MFs made incremental investments in January month are Paper, Oil &Gas, Realty, Pharma, Shipping & Logistics, Metals& Mining, IT Services, Infrastructure, Capital goods and Auto & Auto Ancillaries.

MFs liquidated their positions in Media & Entertainment, Plastic Products, Chemicals & Fertilisers, FMCG, Diamond & Jewellery, Aviation and Textile.

The Nifty media index is the worst-performing index YTD, down by more than 10 percent while the Nifty Oil & Gas index is the top-performing index with gains of over 24 percent.

Domestic mutual funds were net buyers to the tune of Rs 23,740 crore in January while FIIs were net sellers to the tune of Rs 26,111 crore. FIIs were net buyers in December with purchases of Rs 58,498 crore worth of equities in December 2023.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.