V-Mart Retail is a medium-sized hypermarket value retailer that caters primarily to aspirational customers. It sells apparel, general merchandise and groceries through its 179 outlets (total retail area of 15 lakh square feet) across Tier I/II/III cities of northern, north-western and eastern India.

In Q1 FY19, revenue grew on the back of eight store additions and 1 percent same-store sales growth (on a high base). Fashion/kirana products comprised 94/6 percent of quarterly turnover, respectively.

A higher share of private label sales and better negotiating power aided gross margin expansion. At the operating and bottom-line levels, margin remained flattish year-on-year (YoY) due to an increase in costs (overheads, depreciation) and a higher tax rate.

Most of the 35 new stores to be added in FY19 will be based out of Tier IV markets such as north-eastern India. Since price sensitivity in such regions is high, sales growth will be predominantly driven by volumes.

Widening the merchandise base from 3,986 stock keeping units (SKUs) in FY17 to 4,591 SKUs in FY18 will strengthen the product portfolio.

The process of setting up an omnichannel is being considered during the course of the ongoing fiscal. Brand campaigns will be promoted through social and digital media.

How can margin improve?Contribution of margin accretive private label brands to total revenue is expected to increase from 50 percent at present to 75-80 percent over the next 2-3 years.

Network augmentation will be undertaken in a cluster format, wherein new outlets within a state, despite being located in different cities, will be in a radius of 100-150 km from each other.

Technological system upgradation and focus on efficient supply chain management should translate in reduced data/inventory redundancy and higher cost savings, respectively.

Consolidation in the number of vendors (third-party apparel manufacturers) will lead to better negotiation of trade terms, thus reducing procurement costs.

Which risk factors should one take into account?Rainfall in Uttar Pradesh and Bihar (among key revenue contributors for V-Mart) has been pretty subdued of late. This has impacted consumption. Same-store sales growth has been tepid in the company’s Tier IV outlets too as evident from the demand dip in Odisha and Jharkhand.

Rental costs, that have been on an uptrend in V-Mart’s existing and target geographies, can dent operational profitability. Full-price sales can be hard to achieve given the stiff competition from unorganised entities and extended end of season sale periods.

Is V-Mart investment-worthy?Backed by healthy fundamentals, a strong margin profile and an aggressive expansion strategy in the fast-growing under-tapped/untapped territories, the management has succeeded in positioning V-Mart as one of India’s best performing retailers. The stock has all that it takes to re-rate in the long-run.

While sustained same-store sales growth (in excess of 4 percent) and an uptick in inventory turns will be pivotal in terms of operating leverage, the opportunity landscape on the sales front is equally huge because there are numerous cities/towns that V-Mart is yet to explore.

E-commerce isn’t much of a threat either since a major chunk of the population in the company’s markets are not tech-savvy. As the fiscal progresses, rural India will be a beneficiary of numerous sops ahead of general and state elections, which can be a demand trigger.

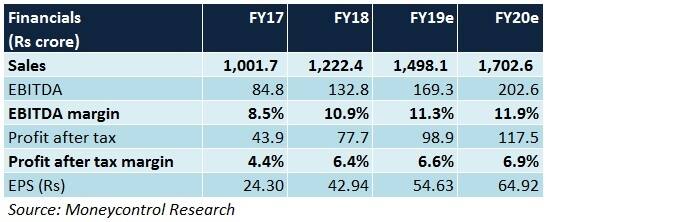

Though we remain positive on the stock for the long haul, at 37.2 times FY20 projected earnings, all moats seem to be priced in. Therefore, we advise investors to go long on corrections.

Follow @krishnakarwa152For more research articles, visit our Moneycontrol Research pageDiscover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!