Sectors such as consumer discretionary, healthcare, and energy may lead the next big bull market replacing financial and consumer staples that have lead the charge in the past, Morgan Stanley said in a strategy note. “In our view, financials and consumer staples, which led the previous bull market, may give way to consumer discretionary and healthcare,” the note said. For the past seven years, financials have been investors' favorite sector, representing almost 30 percent of the Nifty market cap at the peak. Meanwhile, the re-rating of consumer staples has taken the sector's metrics to well over 2-SD above their 20-year average. “But, if history is a guide, the leadership of the next bull market could shift to consumer discretionary and healthcare. These sectors are unloved, under-owned, and undervalued based on the metrics we have used,” highlighted the note. The rational which the global investment bank gave behind the analysis is that both sectors are underweighted in institutional portfolios, have lost share in the Nifty's market cap, are reporting profitability well below history, and are trading below historical average relative to valuations. Fundamentally, the outlook for both shall improve in the coming months. “The third sector that deserves mention is energy. It also fits the description of being unloved, under-owned, and undervalued,” said the note.

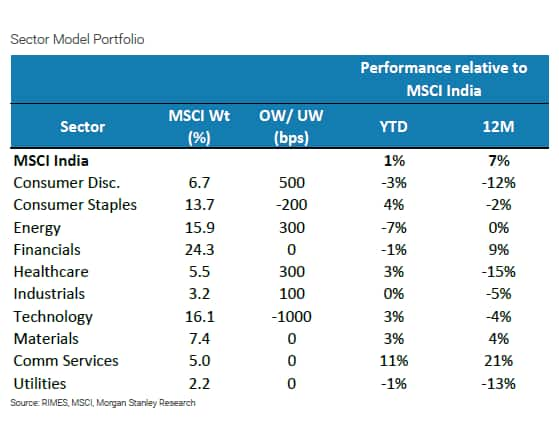

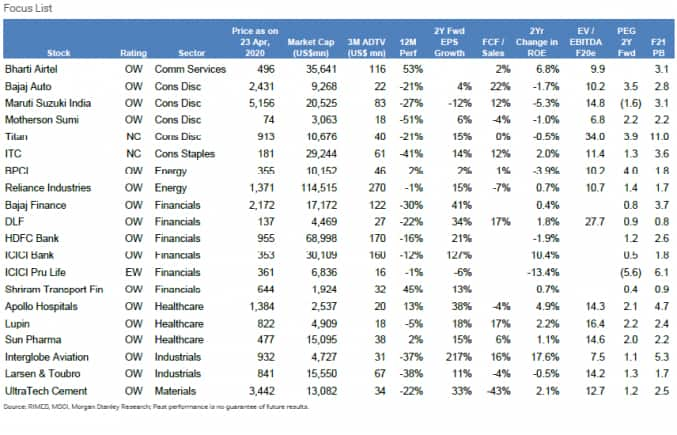

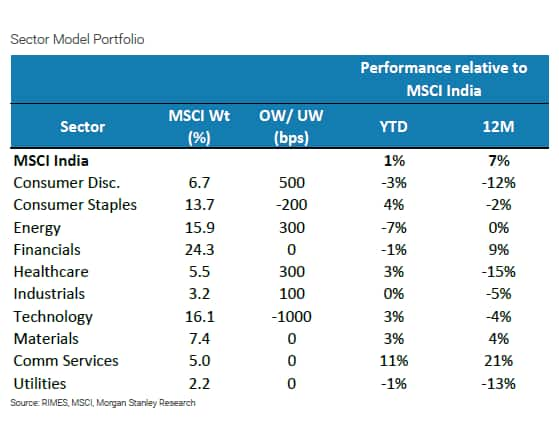

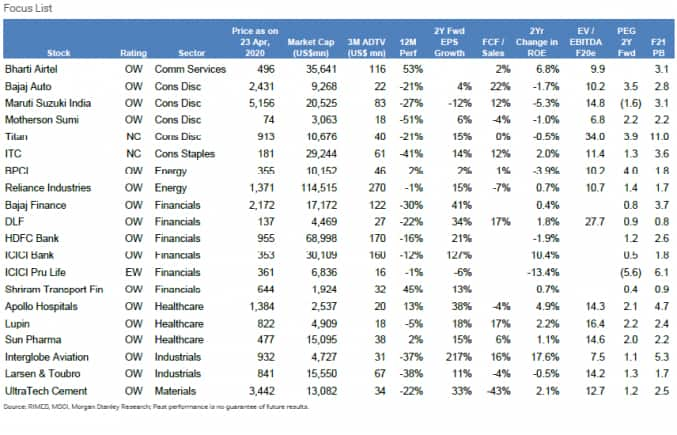

In terms of sectoral positioning, Morgan Stanley trimmed financials by 500bps to neutral and consumer staples by 200bps to underweight (from neutral).“We add 500bps to healthcare and go 300bps overweight. We add another 100bps to our overweight position in energy, raising it to +300bps. Our biggest overweight and underweight positions are +500bps in consumer discretionary and -1,000 bps in technology,” said the report. Morgan Stanley is also adding 100 bps to its industrials position and going overweight on the sector. This reflects the likely flow of orders from the government to the sector in order to improve the economy's growth prospects. Here is a list of 20 stocks in Morgan Stanley’s focus list that include names like Bharti Airtel, Bajaj Auto, DLF, HDFC Bank, ICICI Bank, etc. among others. It removed Godrej Consumer, HDFC, and MCX and added Sun Pharma, Apollo Hospitals, and Lupin to the focus list.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!