Voltamp Transformers stock fell as much as 4 percent after it was reported that the promoters sold a 12.9 percent equity stake in the company in bulk deals on September 26 for Rs 603.54 crore. On September 26, it was reported that a bulk deal had taken place on both NSE and BSE, resulting in around 12.9 percent equity in Voltamp Transformers changing hands.

While it is yet to be ascertained who the buyers are in the deal, sources had previously told CNBC Awaaz the promoters were looking to sell a combined 10 percent stake, or 12 lakh shares, of their total holdings through block deals.

As many as 13 lakh shares were sold and bought at an average price of Rs 4,650, totalling Rs 603.54 crore.

Also read: Voltamp Transformers drops 6% after Rs 603 crore block deal; promoter likely seller

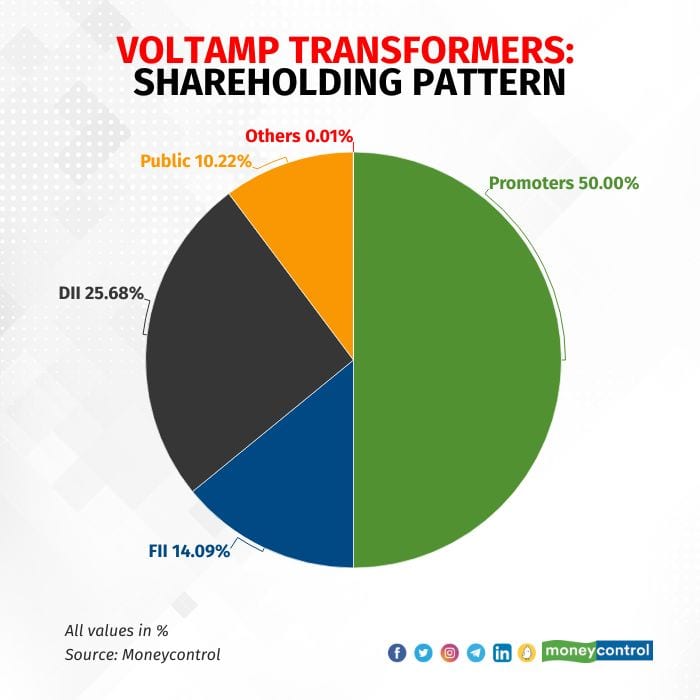

How Voltamp shareholding stacks up

As of June 2023, the promoters held around 50 percent stake in the Oil Filled Power and Distribution Transformers company, Mutual Fund scheme held around 25.4 percent and FII/FPI held around 13 percent.

.

.

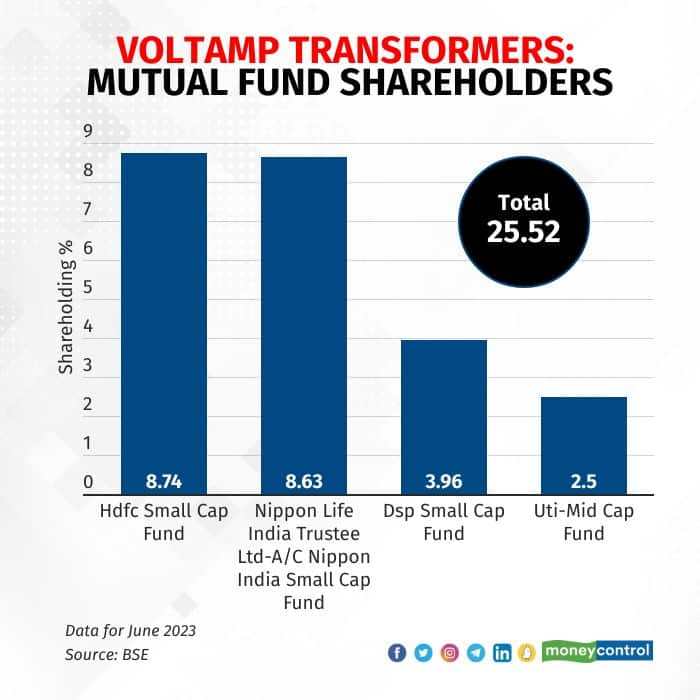

As for institutional investors, the number of mutual fund schemes in the stock has increased to nine from seven in the April quarter. Similarly, mutual fund holdings in Voltamp Transformers have fallen from 25.52-25.40 percent, as per June 2023 data. Currently, Nippon India Small Cap Fund – Growth, HDFC Small Cap Fund Growth and DSP Small Cap Fund Regular Plan Growth are the largest mutual fund shareholders in the stock. From March 2023 quarter to June 2023 quarter, while HDFC Small Cap Fund and Nippon India Small Cap Fund have not increased or decreased their holdings, DSP Small Cap Fund holdings have increased from 3.96 percent to 4.41 percent.

.

.

Stock Call: Strong business outlook, optimistic management

Analysts continued to be mostly positive on the stock due to a strong business outlook.

Prabhudas Liladher’s Amit Anwani and Nilesh Soni, in a September 2023 report, said that they are positive on the stock due to its market position in industrial transformers, robust business model, debt-free balance sheet, consistent free cash flow generation, and a healthy enquiry pipeline.

The brokerage raised the target price to Rs 4,611 from Rs 3,961 earlier, valuing it at a PE of 20x FY25E, up from 18x earlier, owing to the improved business outlook. The firm continues to have a ‘Hold’ call on the stock.

For the quarter ending June 2023, Voltamp reported a 19 percent YoY growth in sales to Rs 322.19 crore. Its earnings before interest, taxes, depreciation and amortisation (Ebitda) margin also grew 150 basis points year-on-year to 14.9 percent for the same period. Net profit for Q1FY24 was Rs 50.8 crore up 90 percent from the previous fiscal.

Yes Securities analysts maintain a ‘Buy’ rating on the stock after the strong Q1FY24 with volume-led revenue growth and a decadal high Q1 EBITDA margin, aided by easing of commodity cost pressures amidst a strong demand environment. The order book of Rs 1,190 crore (up 61 percent YOY) executable for the full year, according to Yes Securities, augurs well for the company’s near-term revenue and margin performance.

But they added that while the order book momentum is expected to sustain, the competitive intensity has increased especially in lower voltage class transformers, leaving little room for margin expansion in the near term. Yes Securities raised the Target Price to Rs 5,836 from the previous Rs 4,779. Analysts have also revised their earnings estimates for FY24 and FY 25 factoring in a continued healthy demand outlook, normalising the supply chain (CRGO lamination) and increasing utilisation of their Savli plant.

The management remains optimistic about the business outlook due to steady growth in domestic demand from metals, data centres, green energy, pharma, automobiles, etc, say analysts. For the fiscal, the company is also looking towards the export markets again after a gap of two years due to logistical challenges. They will also be targeting markets like Africa and Asia.

The Vadodara-based company with a market cap of Rs 4,986.22 crore, currently has two plants located in Makarpura, Vadodara and Savli, Vadodara in Gujarat.

As of 10:58 am, on September 26, stocks of Voltamp Transformers were trading at Rs 4770.35, 3.21 percent lower than its close on September 25. Over the last year, the stock price has gained over 88 percent.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!