Minority shareholders are contemplating next steps to counter ICICI Banks' plan to delist ICICI Securities, making it a 100 percent subsidiary of the bank.

Talking to Moneycontrol on April 24, minority shareholder Manu Rishi Gupta said that they are still contemplating the next course of action but reiterated that shareholders are feeling terribly short-changed and cheated as all their representations have pretty much fallen on deaf ears.

"At this instance, it's all a strong conjecture. We will wait and watch for the response from the two institutions. In the meanwhile, we sincerely hope that the conscience of the two boards gets stirred and they do the thing that's right , fair , ethical and morally correct," Gupta noted.

ICICI Securities said that 83.8 percent of the institutional investors voted in favour of the scheme, while 67.8 percent of the non-institutional investors voted against the demerger.

In an eight-page letter to ICICI Bank and the regulator on April 10, Quantum Mutual Fund's Managing Director and CEO, Jimmy A Patel, said that the fund house had raised various concerns on the valuation as well as the process put in place.

Also read: Quantum Mutual Fund votes against ICICI Bank and ICICI Securities merger

Quantum MF is a minority shareholder with about 0.09 percent stake in ICICI Securities through Quantum Long Term Equity Fund and Quantum ELSS Tax Saver Fund.

It had requested ICICI Bank and ICICI Securities to respond to their queries within five days and refrain from taking action on the scheme of merger.

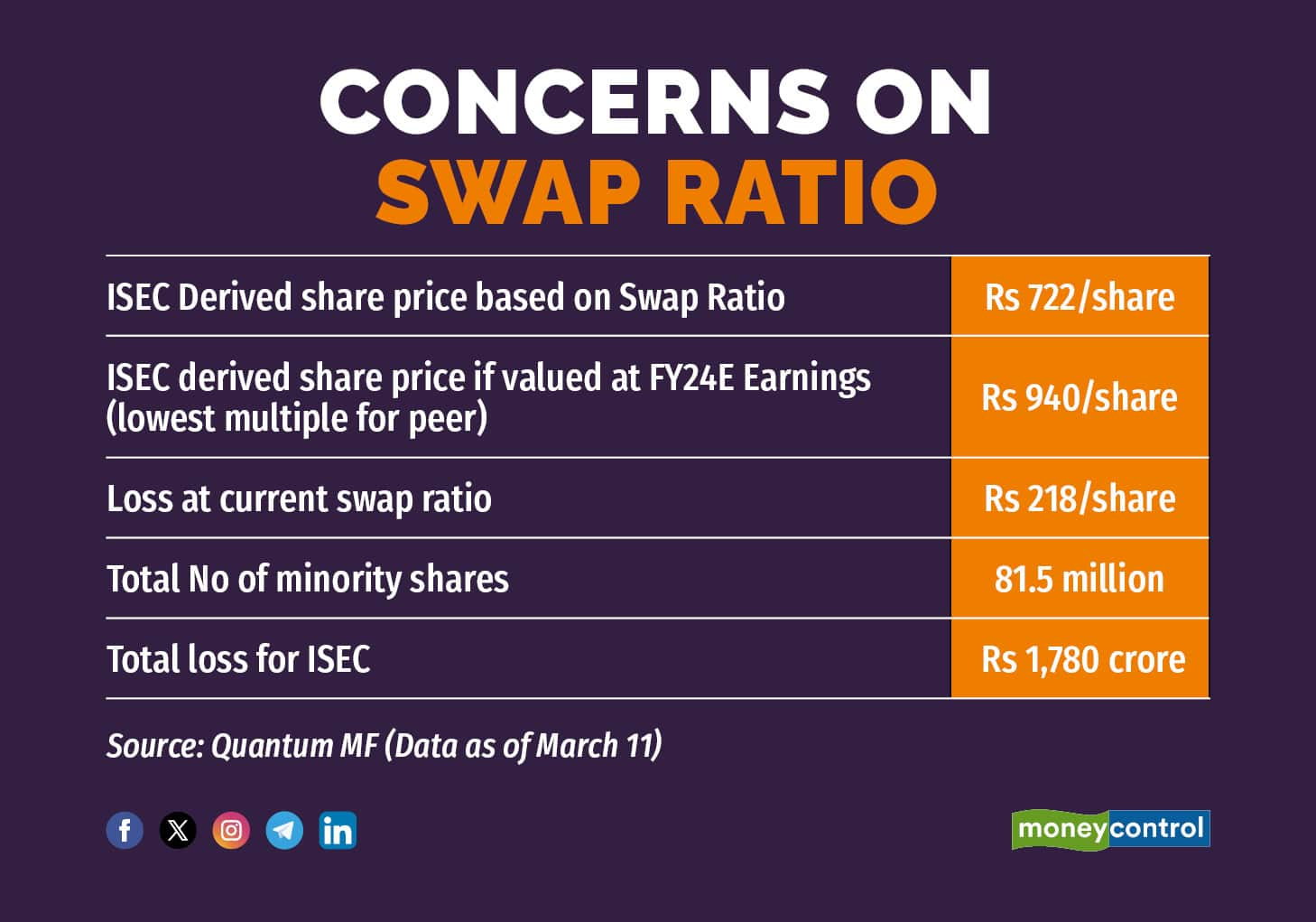

Under the scheme of merger, around Rs 1,780 crore will be transferred to ICICI Bank shareholders from I-Sec minority shareholders.

Quantum MF had previously raised these concerns with the management of I-Sec on December 28, 2023, and ICICI Bank on March 5, 2024, asking them to "redo their valuation". They estimate that the swap ratio will lead to a net loss of at least Rs 1776.7 crore to I-Sec minority shareholders, including around Rs 6.1 crore to the unit holders of the schemes of Quantum MF.

Also read: ICICI Bank faces backlash for attempting to sway minority voters on ICICI Securities' delisting

What are the concerns?On the swap ratio, concerns have been raised that the valuation reports dated June 29, 2023, could not have been used to determine it during the March 27, 2024 meeting.

These reports, Quantum MF says, fail to account for the various changes that have taken place in the market over the last nine months, thereby making the valuation inaccurate. I-Sec has been valued around Rs 628 per share.

Quantum also noted that the bull market rally over the last nine months have been in favour of I-Sec but has not been factored in. "As per our assessment, in the fourth quarter of fiscal year ending March 2023, I-Sec has started expanding its retail cash market volume share of the broking business. I-Sec has also seen a spectacular 66 percent growth in net profits for the quarter ending December 2023. However, the share price has barely moved due to the cap limit placed by the arbitrary and unjust swap ratio," the letter noted.

The third concern was that the valuation for ICICI Securities was done by comparing it to its peers. I-Sec has been valued at a 30-77 percent discount to its listed peers, based on the consensus earnings forecast for FY2024. Quantum notes that, even if one were to take the lowest valuation of its peers, in this case, Angel One at 24x, the merger offer would have been at least 30 percent higher.

Minority shareholders have also raised concerns that prior to the board meeting, ICICI Securities and ICICI Bank had been contacting retail shareholders of I-Sec and "coaxing them to vote in favour of the scheme of merger."

In a clarification to the exchanges, ICICI Bank had said that the "outreach programme was to encourage more voting" and not to influence their decision-making. Quantum MF, in its letter, called the clarification a "smokescreen" and an attempt to hide the "mala fide" motives of I-Sec.

"Based on a prima facie perusal of the clarification response, there is no justifiable reason provided to the query raised by the stock exchanges. The notice convening the shareholder's meeting had already been issued in February 2024 itself, and, therefore, there could have been no reason to contact the shareholders separately," they noted.

Gupta added that the actions have also led to minority shareholder data being compromised as the calls were made by ICICI Bank and not even by ICICI Securities, which means that the details were shared with them.

"When I sought the shareholder register around months ago, by paying the required fees and by following due process, I received only names and the email addresses. How do other people in the public domain get the phone numbers? We believe that obviously someone is not acting in the right manner," he said.

Speaking to Moneycontrol, Quantum MF also said that as of now, they are considering all options to protect their shareholder interest.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!