Indian benchmark indices touched the fresh record high last week supported by the positive cues as FIIs turned buyers once again and the vaccination drive picked up pace in the country.

Benchmark indices, Sensex and Nifty, touched their record high levels of 54717.24 and 16,349.45, on August 5. For the week, BSE Sensex rose 1,690.88 points (3.21 percent) to close at 54,277.72, while the Nifty50 added 475.15 points (3 percent) to end at 16,238.2 levels.

In the broader market, the BSE Midcap index touched a fresh record high of 23478.8 on August 4 and ended the week with a 0.5 percent gain, while the BSE Smallcap index also touched a fresh record high of 27323.18 on August 4 but ended flat for the week.

However, 35 smallcap stocks rose 10-32 percent during the week gone by. These include names like Hindustan Oil Exploration Company, Tejas Networks, Steel Strips Wheels, Gokaldas Exports, Aarti Surfactants, Sanghi Industries, Cosmo Films, BASF India and Fairchem Organics.

"Technically, Nifty formed a Bearish candle or an Inside Bar on the daily scale but continued the formation of higher lows of the past seven sessions. It came out of its trading range and formed a Bullish candle on the weekly scale which bodes well for the bulls to start the next leg of the rally," said Siddhartha Khemka, Head - Retail Research, Motilal Oswal Financial Services.

"We expect the index to witness an up move towards 16400-500 zones, while on the downside 16,000 could act as a key support," he added.

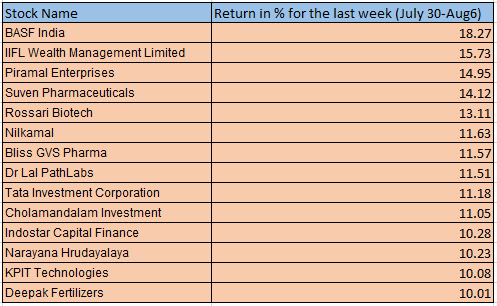

The BSE 500 index gained 2 percent with 14 stocks rising 10-18 percent. These include BASF India, IIFL Wealth Management, Piramal Enterprises, Suven Pharmaceuticals, Rossari Biotech, Nilkamal, Bliss GVS Pharma, Dr Lal PathLabs and Tata Investment Corporation.

"Markets traded volatile for the second consecutive session and ended marginally lower. After the flat start, it traded range-bound till the end, however, movement on the stock-specific front kept the participants busy. In between, the announcement of the status quo on key rates with an accommodative stance from the RBI review meet fell in line with the expectation," said Ajit Mishra, VP - Research, Religare Broking.

"However, the SC ruling regarding the Reliance-Future merger in favour of Amazon didn’t go well with the market and triggered a sharp reaction in Reliance and Future group stocks".

"In absence of any major event, earnings and global cues will dictate the market trend. We suggest keeping a close watch on the banking and financial pack as they have the potential to further fuel the momentum. Going ahead, in case of any dip, the 16,150-15,950 zone would act as a cushion in the Nifty," he added.

Where is Nifty50 headed?"The medium-term trend is bullish and buying on dips and selling on rallies would be the ideal strategy for the positional traders. The 16150-16050 level would be the strong support zone for the index," said Shrikant Chouhan, Executive Vice President, Equity Technical Research at Kotak Securities.

"Trading above the same, the uptrend wave is likely to continue till 16400-16550 levels. Below 16050, breakout traders may prefer to exit from trading in long positions,” Chouhan added.

"In the coming week, all eyes will be on key economic data and ongoing results of companies. Although market sentiment is expected to remain buoyant, specifics on important economic indicators ranging from India Industrial numbers to inflation rate and manufacturing production will keep markets on their feet," said Nirali Shah, Head of equity research, Samco Securities.

"It is highly likely that some of these expectations would be priced in however any miss on this front could mellow down the optimism."

"In a bull market like this, investors are advised to seek out fundamentally resilient stocks and resist the urge to invest in fancy fast moving stocks," Shah added.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.