Kshitij Anand

Who said only largecgap stocks can make money for investors? Well, over the last four years, the biggest returns came from small ticket sizes. The S&P BSE Smallcap index has risen nearly 90 percent over the last four years, but as many as 377 stocks listed on it rose 100-6,000 percent over the same period.

Domestic and retail-focused companies have outperformed benchmark indices, whereas export-oriented companies have trailed them. Smallcap stocks have done well on expectations of pro-growth reforms initiated by the Narendra Modi-led government.

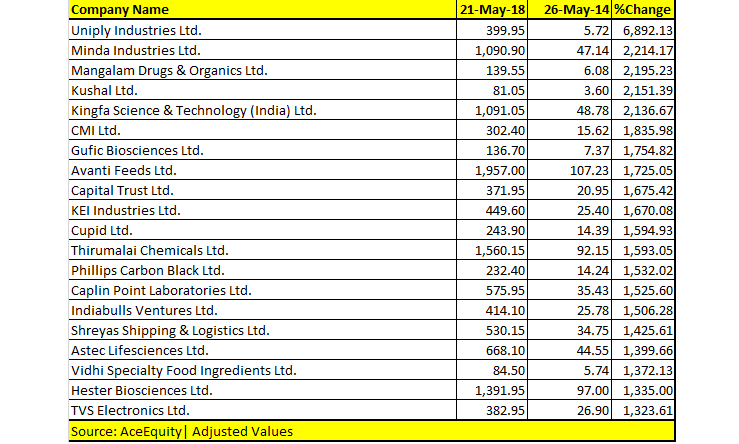

As many as 37 companies returned over 1,000 percent, including names like Uniply Industries (up 6,892 percent), Minda Industries (up 2,214 percent), Mangalam Drugs (up 2,195 percent), Kushal (up 2,151 percent), Avanti Feeds (up 1,725 percent), and KEI Industries (up 1,670 percent).

Among stocks which that returned 100-1000 percent were 8K Miles, KNR Construction, Venky’s India, Graphite India, Nocil, Subros, Jamna Auto, APL Apollo Tubes, Sterlite Technologies, Aarti Industries, NCL Industries, V-Mart, LT Foods, and Future Consumer, among others.

"Some of the companies mentioned above have run-up riding on the huge growth potential riding on a big addressable market while others have had good earnings growth of late which may/may not be sustainable," Pankaj Pandey, Head of Research, ICICI Securities told Moneycontrol.

"One should hold onto stocks which depict good management pedigree through healthy return ratios profile, have witnessed a structural change in the industry leading to sustainable growth prospects and are ahead of the curve in the adaptation of new technology and efficient management practices," he said.

However, not every smallcap stock has managed to return exponentially over the past one year. Some smallcaps have lost over 90 percent of their value over the same period.

As many as 167 stocks in the S&P BSE Smallcap index gave negative returns over the last four years. As many as 22 of them fell over 90 percent, including names like Amtek Auto, Videocon Industries, Nitin Fire, Gitanjali Gems, KSK Energy, among others.

What should investors do?

After rallying consistently for 3 consecutive years, smallcap stocks came under pressure in 2018, thereby putting an end to the upward momentum that had started with the formation of the Modi government back in 2014.

Apart from earnings, which have not picked up as expected, a deterioration in macro-economic metrics seems to be a big headwind for the sector, experts suggested.

"Although small and midcaps have corrected significantly in the past 4-5 months from their 52-weeks high, long-term investors who are ready to hold for 3-4 years should continue to hold good quality smallcap stocks," Foram Parekh, Fundamental Analyst – Equity, Indiabulls Ventures told Moneycontrol.

"However, currently when the smallcap index is underperforming, good quality stocks like KEI Industries continue to make 52-week high. Therefore, stocks of companies with a good set of consistent results and experiencing good demand for their products can be held for long-term," Parekh said.

She added that some of the stocks that may have already given multifold returns will continue to outperform the index over a period of time, albeit at a slower pace.

What is the right strategy to pick smallcaps?

Smallcaps have the tendency to give high returns and this theme is suitable for investors with a high risk appetite. As a thumb rule, investors should have a long holding period while investing in them.

Selecting which business to invest in is also key. Investors should stay with companies that promise decent growth in the medium-to-long term.

"Innovative product Line, theme-based approach and should be having overall good functioning of the business in the last 5 years are some of the factors/points which one should consider before investing in smallcaps," Mustafa Nadeem, CEO, Epic Research told Moneycontrol.

"We believe any company that has survived well in 2010 - 2014 with a good business growth will be a value creator in a current phase where we are seeing enough liquidity along with good policy focus and lower inflation," he said. "Post demonetisation and GST, we believe the pickup in underlying demand will further benefit the smallcaps, though it is critical which sector one invests in. We are upbeat on realty, construction, auto components, leisure and entertainment."

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!