The top three quick commerce firms -- Blinkit, Zepto and Swiggy Instamart -- together delivered a total of 4.15-4.45 million orders across India each day in March, according to industry insiders who shared the data with Moneycontrol on the condition of anonymity.

The data also showed that Blinkit continued to be the market leader, in terms of order volume, ahead of Zepto and Swiggy Instamart in March. To be sure, the data is collated after the end of a month and is typically an 8-10 day exercise, which means March is the latest available record.

In March, Eternal-owned Blinkit delivered around 1.65-1.75 million orders each day putting it ahead of Zepto which recorded a total of 1.45-1.55 million orders everyday during the same month. Swiggy Instamart was on the third spot with a total of 1.05-1.15 million orders each day in March, the data showed.

The three firms collectively more than doubled on a year-on-year (YoY) basis. The top three firms grew over 105 percent from around 1.95-2.25 million daily orders in March 2024 to 4.15-4.45 million daily orders in March 2025, underscoring the rapid growth of the quick commerce industry. On a longer-term basis, the industry has grown from near zero four years ago to over a $6.5 billion industry now, analysts said.

Blinkit, Zepto, Swiggy, BigBasket, and Flipkart did not respond to a request for comments.

Quick commerce market share based on order volumes

Quick commerce market share based on order volumesFor context, food delivery majors like Zomato and Swiggy deliver over 2 million orders each day in a relatively more mature market, which signals the quick commerce industry is catching up to become an equally big opportunity, as already signalled by top executives such as Deepinder Goyal and Sriharsha Majety.

Market leader Blinkit grew nearly 90 percent from delivering 0.85-0.95 million orders each day in March 2024 to 1.65-1.75 million orders each day in March this year, as per the data, as the company continued to build on its lead by executing well to stay ahead of rivals.

Similarly, Zepto scaled 200 percent from delivering 0.45-0.55 million orders each day during March 2024, to 1.45-1.55 million orders everyday in March 2025, largely on the back of aggressive cash burn which helped the company grow its dark store footprint and total customer base.

Swiggy Instamart, which delivered around 0.65-0.75 million orders each day in March 2024, registered a growth of around 60 percent to scale to a total of 1.05-1.15 million orders each day in March 2025, the data showed. The growth at Swiggy Instamart was a tad more muted, on a relative basis, because the company was IPO-bound and could not be aggressive with its cash burn.

Tata BigBasket and Flipkart MinutesWhile the top three players are the most dominant in the quick commerce space, and the battle to take the crown only intensifies further between them, there are two other rapid delivery companies which are scaling to give the remaining firms a run for their money: Tata’s BigBasket and Flipkart Minutes.

The same data set showed that BigBasket was fulfilling 0.4-0.5 million orders each day in March 2025, across India, but a YoY comparison was not available since BigBasket pivoted to quick commerce, from slotted deliveries, only in the recent months and hence the data would not paint an accurate picture.

Similarly, Flipkart Minutes was clocking around 0.1-0.2 million orders each day during March 2025, just a few months since being launched. Flipkart Minutes was launched only in August 2024 and has limited presence which makes it look smaller, in terms of order volume, than the existing players, the data set showed.

Zepto adds fewer new customersEven as Blinkit has remained the market leader and Zepto has gone past Swiggy Instamart, it is too early to conclude that a company has solidified its poisition and will remain there for several months.

A clear winner is yet to emerge.

Zepto for instance, which was burning over $30 million each month around November, to acquire customers and grow its network of dark stores, has reined in cash burn to grow more sustainably over the past few weeks.

ALSO READ: Flipkart board asks CEO Kalyan Krishnamurthy to slash spending as monthly cash burn hits $40 millionThat has impacted new customer acquisition at Zepto, a separate set of data showed.

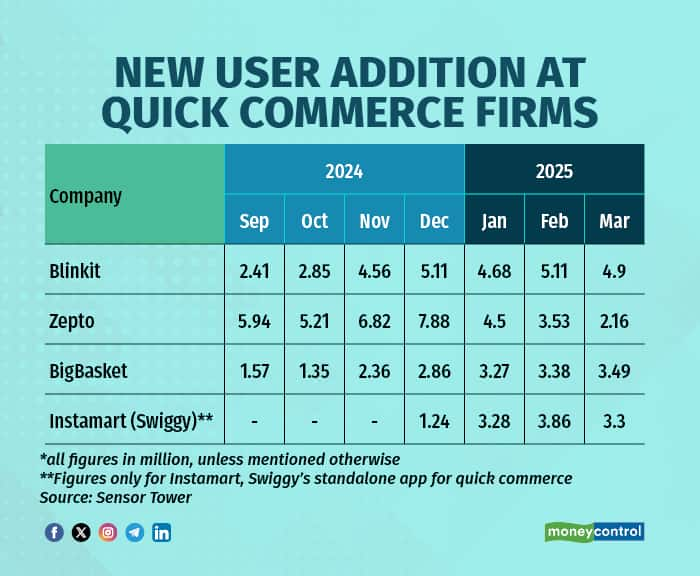

Zepto, which added around 7.88 million new customers in December 2024 has seen its new customer addition slow significantly to 2.16 million in March 2025, as per Sensor Tower.

That translates to a 73 percent drop in the pace of new customer addition on Zepto during a three month period.

Sensor Tower is a US-based mobile app for market intelligence and provides insights on downloads, active users, in-app revenue, traction within specific demographic and competition benchmarks, among others.

While Zepto lost out on the new customer additions in March, others like BigBasket and Instamart (the standalone app for Swiggy’s quick commerce business) made headway, Sensor Tower data showed.

Instamart saw new user additions climb from 1.24 million in December 2024 to 3.3 million in March 2025. To be sure, Instamart is a new and separate app from Swiggy and hence, the number of new user additions will be more pronounced since the app is new. Also, this data does not include new user additions that the main Swiggy app saw.

On the other hand, BigBasket, which added 2.86 million new users in December 2024, grew to add 3.49 million new users in March 2025, Sensor Tower data showed.

Market leader Blinkit also saw a marginal fall from adding 5.11 million new users in December 2024 to adding 4.9 million users in March 2025.

New user additions at quick commerce firms

New user additions at quick commerce firmsOne app’s gain is another app’s loss is not necessarily a fitting line here since the industry is so nascent and is only growing with several first-time users warming up to the idea of quick commerce.

As the industry continues to boom, time will tell which player becomes dominant and races past the others.

Several executives, such as Eternal CFO Akshant Goyal, expect the competitive intensity to only increase further. Eternal owns Blinkit.

“...our view is that competition is going to intensify further from here in the near term….beyond just the early quick commerce players, we will continue to see competition from next day delivery companies as they invest more in faster deliveries, especially in non-grocery categories,” CFO Goyal said in a letter to shareholders on May 1 while referring to heat from Flipkart and Amazon.

However, in the wake of rising competition, Eternal’s Blinkit “...will aggressively look to grow…market share, especially in the face of heightened competition, and will not let any short-term profitability goals come in the way of that,” CFO Goyal concluded.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.