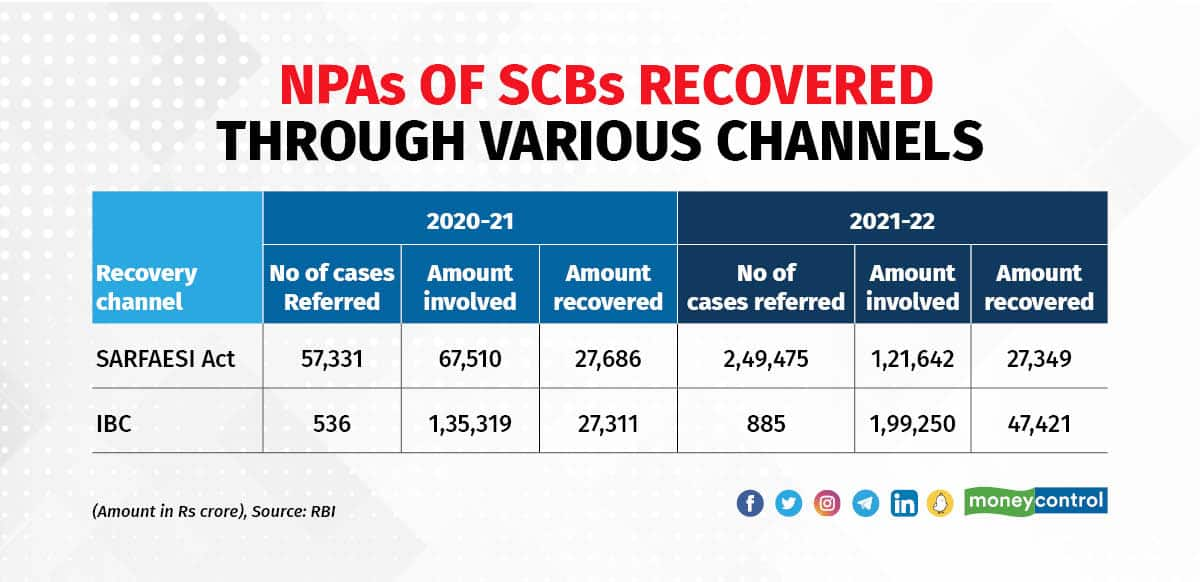

Schedule commercial banks (SCB) have recovered Rs 47,421 crore through the Insolvency and Bankruptcy Code (IBC) route during 2021-22, the Reserve Bank of India (RBI) said in a report.

During 2021-22, the amount involved in the IBC was Rs 1,99,250 crore, of which only 23.8 percent has been recovered by the banks, a report on the Trend and Progress of Banking in India 2021-22 showed.

The amount recovered during 2021-22 was sharply higher than Rs 27,311 crore recovered during 2020-21 by SCBs through IBC.

The number of cases referred has increased to 885 in 2021-22 as against 536 during 2020-21, the report added.

Meanwhile, the amount recovered through SARFAESI Act stood at Rs 27,349 crore during 2021-22, as against Rs 27,686 crore in the year-ago period.

As fresh insolvency cases could be admitted after the one-year suspension during COVID-19, admissions under the IBC increased by 65 percent during 2021-22.

Also read: IBC should not be seen as a recovery mechanism, says RBI governor

Although the number of cases referred under Lok Adalats and SARFAESI Act increased by 336 percent and 335 percent, respectively.

The pre-pack insolvency resolution process, introduced for micro, medium and small enterprises (MSME) in April 2021, is yet to gain traction and only two cases have been admitted under the channel so far (up to September 2022), the report said.

The pre-packaged insolvency process is an alternate and speedier resolution mechanism for MSMEs in financial distress. The entire resolution process has to be completed within 120 days from the date of initiation.

Also read: Rules likely for quicker resolution of real estate bankruptcies

This process seeks to achieve quicker, cost-effective and value maximising resolution and at the same time making it least disruptive for the continuity of businesses.

The report further added that sales to assets reconstruction companies (ARC) have gradually decreased over the years, and in 2021-22, only 3.2 percent of the previous year’s GNPAs were sold to ARCs.

On the frauds in banking sector front, the report said the average amount of fraud decreased substantially during 2021-22.

The number of fraud cases reported by private banks (PVB) outnumbered those by public sector banks (PSB) for the second consecutive year in 2021-22. In terms of the amount involved; however, the share of PSBs was 66.7 percent in 2021-22, as compared with 59.4 percent in the previous year.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.