George Heber Joseph, CEO & CIO,ITIMutual Fund said that there is a possibility of inflation shooting above the RBI forecasts. From the Debt Funds perspective, he said that the short to medium end of the yield curve continues to offer better risk-adjusted returns than the long end.

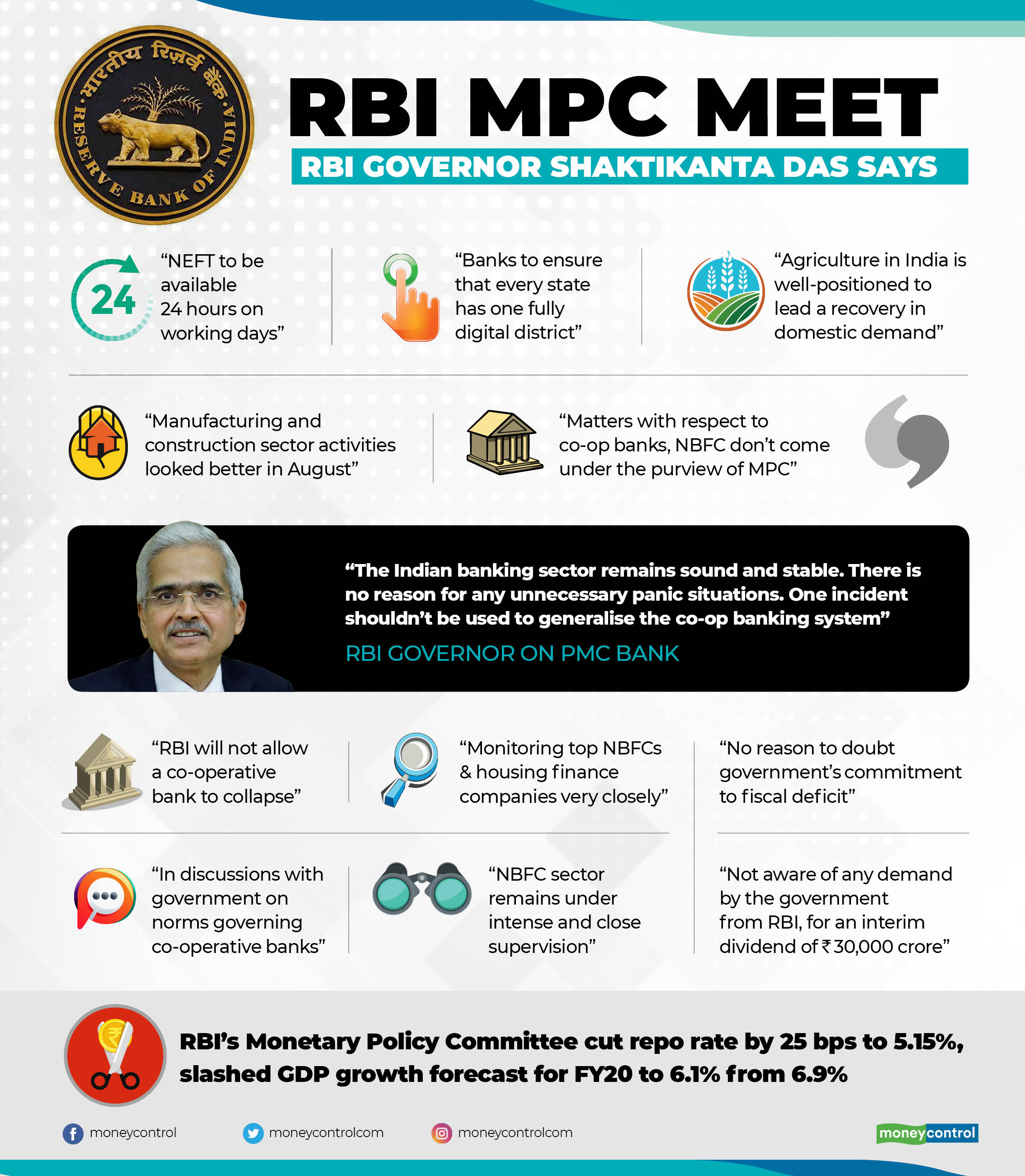

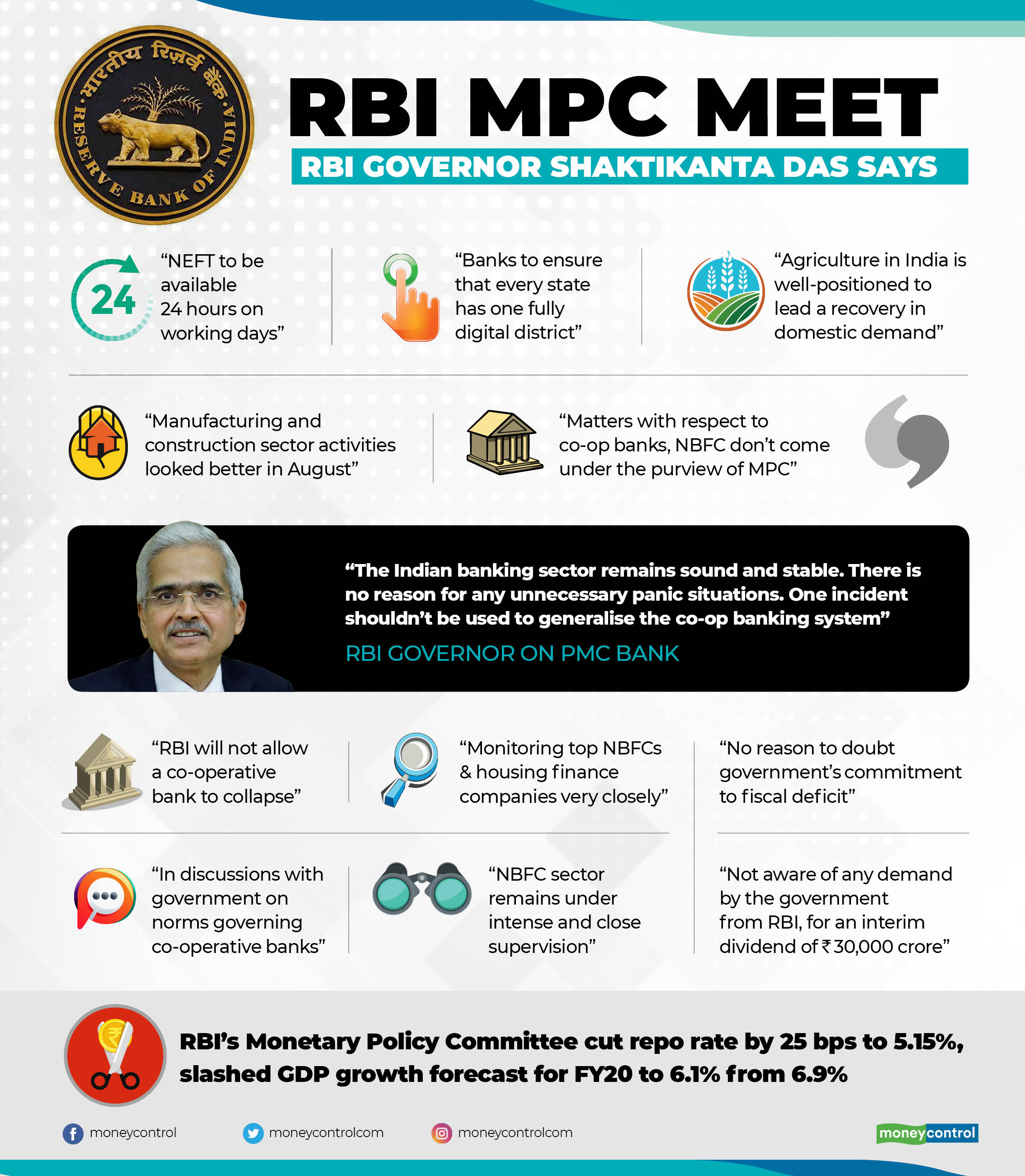

Naveen Kulkarni, Head of Research, Reliance Securities said the rate cut of 25 bps by the RBI has not enthused the market because it was building in a higher reduction. The RBI has also cut its GDP forecast for the year significantly, by 800 bps to 6.1 percent. He said that while the stance maintained by the RBI is mindful of the structural slowdown in the economy, the market feels a greater push was needed.

Abheek Barua, Chief Economist & Executive Vice President, HDFC Bank said that the monetary policy speech clearly focused on growth and has done so by reducing the repo rate by 25 bps. This indicates an immediate reduction in the borrowing cost for some segments of the borrowers. While for the others it will come down over a course of time. Barua expect more rate cuts in the forthcoming policy considering growth is somewhat tepid and the RBI's mission as it has made it clear today is to get growth up through a combination of rate cuts and keeping money moving in the system.

Arun Thukral, MD & CEO, Axis Securities said the rate cut by RBI was clearly, on reviving growth. Further, the measure to raise the lending limit for NBFC-MFI from Rs 1 lakh to Rs 1.25 lakh per eligible borrower will aid financial inclusion and improve the prospects of NBFC-MFIs. RBI since April 2019 has cut rates by 110bps, but the transmission of rate cuts to the end consumer is yet to happen fully. The transmission will greatly help in boosting overall demand and push up the consumption and investment environment in the economy. The overall tone of the policy was very dovish indicating an increased probability of rate cuts in future policy meets if growth in the economy doesn’t pick up.

RajeevRadhakrishnan, Head of Fixed Income & Fund Manager ofSBIMutual Fund said that even as macro challenges facing the economy cannot be addressed by monetary policy alone, given the extant growth - Inflation outlook and cyclical / structural factors impacting growth, the current easing phase can sustain for a while even as liquidity conditions may remain conducive for rates transmission.

SBIChairman Mr.RajnishKumar said the 25 bps rate cut, coupled with an explicit policy acknowledgement of further rate cuts would ensure that fiscal and monetary policy work in tandem in arresting growth concerns.On the development and regulatory frontthedecision to extend thecollateralisedliquidity support on round the clock basis is a welcome step as it will help banks extend theNEFTfacilityin a seamless and non-disruptive manner.

George Alexander Muthoot, MD - Muthoot Finance Limited said that he looked forward to recovery in consumption levels with banks eventually passing on the benefits to both corporates and consumers. With constant rate cuts, amendments in policies and the beginning of festive season, he expected the economy to be soon in its best health.

At first glance, it appears the RBI rate cut has failed to boost market sentiment as the equity benchmarks Sensex and Nifty fell after the central bank announced a rate cut of 25 basis points. Sensex plunged 407 points intraday and Nifty fell below 11,200 with most rate-sensitive stocks in the red. Market observers said while the rate cut is a positive move, the market felt disappointed as it was short of expectations.

MurthyNagarajan, Head-Fixed Income, Tata Mutual Fundfeels theRBI may cut rates in the coming months by another 50 basis points as both domestic and international growth is weak and inflation expectations globally continues to be lower.

A rate cut generally augers well for companies that are debt-laden (as it reduces interest cost), the auto sector, and banks as well as NBFCs, as it brings down the cost of funds for them. For the real estate sector, a fall in interest rates could also mean lower EMIs.

While RBI governor Shaktikanta Das did not elaborate on the Lakshmi Vilas Bank (LVB) issue, shares of LVBcontinued to remain under pressure as they were locked in lower circuit again on October 4. It was trading near 10-year low after the RBI initiated prompt corrective action (PCA) plan against the lender.