Women’s empowerment is one of the biggest challenges a country like India faces. It can happen with education, financial literacy, and financial independence.

Women investors worry about making poor investment decisions. Some have shied away from asking questions for fear of being judged or being ridiculed over their investment choices.

Take the case of our client Rajani. When she was single, her father used to take all her investment decisions. After marriage, her husband took charge of the finances. Since her income wasn’t substantial in the household income pool, she feared taking money decisions.

Or take the case of Asha, another one of our clients. She, too, expects her husband to make decisions. Aside from now being side-lined from her job after getting pregnant, she is subjected to domestic violence. She does not assert herself.

In our financial literacy initiatives for women, the common questions asked are: ”What if my husband predeceases me; I don’t know what he owns; I don’t have details of his assets or investments or passwords. How will I manage financial matters in the absence of my husband’.

In reality, budgeting and finance comes naturally to women. Yet they shy away from important financial decisions because of their belief (or misbelief), built over decades, that it is for fathers, husbands or brothers to take important decisions on financial matters for the family.

If women are given a crash course on money decisions and investing, it would have a far-reaching impact.

The cost of financial ignorance

Investors make poor investment decisions because of high hidden costs, high lock-in periods, high taxation costs, and sometimes fall prey to complex products in the guise of high-net-worth services. These mistakes are made by men and women alike when in fact there are a host of simple investment solutions that can guide them on liquidity, tax efficiency and returns.

Today, because of technology and digitization, there is access to myriad distribution channels from banks to insurance houses. Investors are bombarded with various investment options. They often ignore and ask basic fundamental facts on risk, charges, diversification, and churn. This dilemma is faced by men and women alike.

If young minds are spoken to about the power of compounding, they can create millions in years. For example, if you invest just Rs 5,000 a month for the next 25 years, your money can grow to Rs 66 lakh (assuming your money grows at an average rate of 10 percent). That’s the power of compounding.

Pushing financial literacy among women

But financial literacy starts from the basics. How to use an ATM card? How to use UPI? How to deposit money with a bank? How to fill out a loan application form? How to compare loans? How to buy insurance? How to invest in stock markets? How to complain against your bank or insurance company or even a mutual fund?

Only 24 percent of Indians are financially literate, according to December 2021 Statistics from The Logical Indian. Some help is now at hand. The Reserve bank of India’s (RBI) National Strategy for Financial Education 2020-2025 program aims to boost financial literacy. In addition, the Insurance Regulatory and Development Authority (IRDA) and Pension Fund Regulatory Development Authority (PFRDA) also teach investors essential concepts such as the difference between savings and investments, the power of compounding, the importance of diversification and risk mitigation, and the difference between nominal and real interest

In addition, the RBI-led ‘Project Financial Literacy’ initiative has been targeting specific groups such as school children and college students, women, rural and urban poor, defence personnel, and others to disseminate information. But more needs to be done on the ground.

Capital market regulator Securities and Exchange Board of India’s (SEBI) initiatives are also worth mentioning here. SEBI has different modules in its financial literacy program for different segments, like financial education at the school level and college level. Modules are also available for executives, homemakers, and middle-income group investors.

However, until financial education is made mandatory, all the above measures will have limited success as part of the school curriculum criteria. A lot more needs to be done.

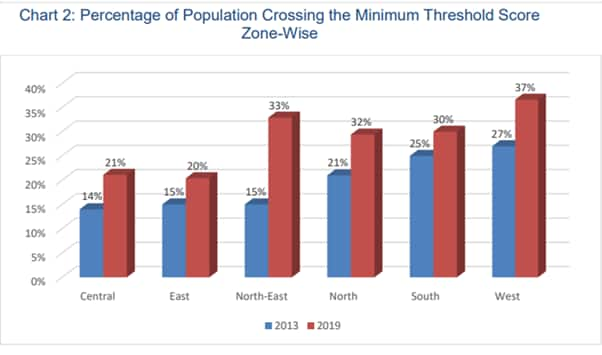

Source | www.ncfe.org.in

Source | www.ncfe.org.in

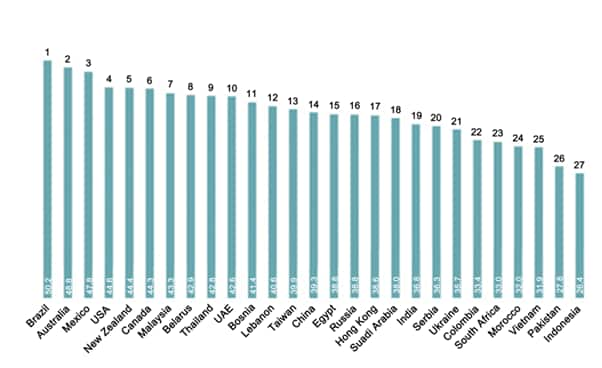

In April 2012, Visa released the results of its financial literacy survey, which was conducted between February and April 2012 with 25,500 participants from 28 countries. The Financial Literacy Survey revealed that Brazil had the highest level of financial literacy at 50.4 percent of the respondents, followed by Mexico (47.8 percent), Australia (46.3 pe, rcent) and the US (44 percent). India was ranked 23rd in the report, with only 35 percent of Indian respondents financially literate (Visa’s International Financial Literacy Survey, 2012). Below is the graph depicting the same.

The road ahead

In conclusion, we must do everything we can to help develop financial literacy for both men and women investors. The first step in this direction could involve women in all family finance discussions, create financial literacy/building awareness about involving women in all family finance discussions, and create literacy/building joint collaborative decision making.

It is rightly said that if a woman is literate, the whole family becomes literate. And further, the world becomes literate.

Let’s join hands to make this happen this Women’s Day!

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!