After falling 34 percent from its peak in the first quarter, the US equity market has gone on to stage one of the quickest rebounds in history. The S&P 500 index is up 16.5 percent on a total return basis this year (Chart 1), amidst major risk events such as the US-China trade war, the COVID-19 pandemic, and US presidential elections. Notably, some of these risk events still remain unresolved.

Relative to history, the overvaluation of the S&P 500 index is clear. The S&P 500 Index is currently trading at a forward PE of 20.7X based on consensus earnings estimates for FY 21. This is three standard deviations above its 10-year average of 13.9X (Chart 2).

It is not surprising then to hear US equities being cast off as expensive and unsustainable. Investors are also expectedly uncomfortable with such frothy valuation, with the high degree of economic uncertainty that will persist in the coming year.

However, our data shows that there are two major reasons why the current US valuations are justified in the current macroeconomic backdrop.

Global rates support further expansion in valuationGlobal interest rates are at near-zero levels in developed markets at the moment, and are expected to remain at these levels for foreseeable time. This is likely to support an expansion in equity valuations because lower rates:

-increase the discounted present value of future cash flows

-encourage risk-taking behaviour by making leveraged positions cheaper

-make the dividends and returns on equities more attractive to investors compared to fixed-income yields

The monetary and fiscal response of the US policymakers, of over $ 2 Trillion, has had a significant role in the inflation in asset valuations. With easy liquidity chasing limited real assets, the forward PE of the S&P 500 has been rising on a structural basis since the great financial crisis of 2008, alongside the Fed’s burgeoning balance sheet.

Another factor supporting the equity market is the willingness of US consumers and investors to look past 2020 for better days. This has supported sentiment and valuations in the market, while retail sales are already higher than the pre-pandemic levels. (Chart 3)

Looking forward, we believe that the US equity markets will have structural support from low interest rates globally, as well as organic growth in the US economy, which may happen as early as Q2 in FY21. This expectation is based on the following tailwinds: (i) improving global growth outlook; (ii) lagged effects of measures taken this year; (iii) supportive policy backdrop; and (iv) the possible mass distribution of the vaccine.

Increasing weight of technology lifting the overall S&P 500The second factor is the increasing weight of the IT sector in the S&P 500 index over the last few years. The largest and most dominant US companies today are tech giants and technology-related corporations. Investors are willing to look past the apparent high price multiples for these stocks due to their promising growth prospects. They are also comparatively less sensitive to the cyclical aspects of the economy, resulting in strong fundamentals, stable cash flows, earnings, and dividends streams, all of which are supportive of their high stock prices.

Technology and related sectors have increasingly displaced the more cyclical and cheaper-valued sectors such as financials and industrials in weightage the S&P 500 basket of stocks. This, in turn, has lifted the overall valuation of the basket.

In future, the growth environment expected to kick in next year predicates a strong year for corporate earnings. The negative impact of COVID-19 on industries such as Energy and Industrials will lead earnings this year to decline by at least 10 percent. Earnings will bounce back, however, jumping by more than 27 percent and 17 percent to reach USD 187 and USD 220 per share for FY2021 and 2022, respectively, in part due to the low base effect (Chart 4).

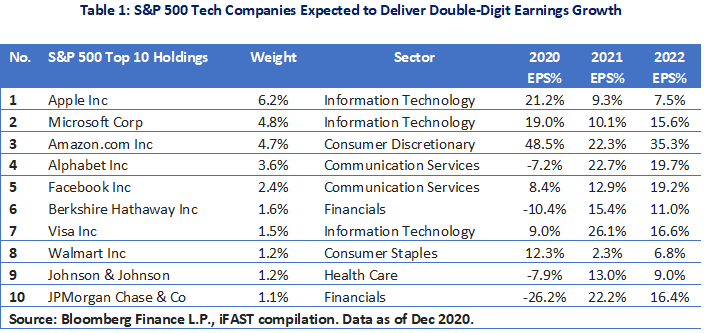

The COVID-19 pandemic has accelerated digitalisation globally. More and more, businesses, consumers and households are conducting their day-to-day tasks online. Additionally, consumption trends such as the 5G upgrade cycle, rising e-commerce penetration and online media consumption will continue to drive double-digit earnings growth for technology giants such as Apple, Amazon and Microsoft (Table 1).

Risks persist as we enter 2021. Specifically, the US markets have not priced in unresolved issues such as the US-China trade war, which can lead to a correction. Any sectoral rotation of the S&P 500 into cyclical sectors or a kick-up in the yield curve due to rising inflation or high growth expectations are other risk factors. In balance, however, we believe the US market will see new heights in the coming year. Coupled with our earnings projections for the next two years (28 percent in FY21 and 17 percent in FY22), we expect an upside potential of 20 percent from the closing price on December 11, 2020.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.