India has been a bright spot in the world economy and has been projected to grow, on an average, at a staggering seven per cent for the next 15 years. According to a PwC report, India is slated to be the 2nd largest economy by 2050, only behind China.

Therefore, by investing in the equity market, one could accrue the benefits of long-term investing by virtue of the rapid growth in the economy. Investing has never been easy and must be done by taking the advice of a professional, who takes into account your risk tolerance, financial goals or objectives, tenor of investment etc. and then recommends the best possible investment. We have often seen that some wealth management outfits and banks tend to waylay their clients to make them invest in products not best suited for them. Hence, getting good advice remains a constant challenge for the industry. It is here that we see that NRIs face the biggest dilemma of investing in India. The lack of awareness of funds to invest in and the intricacies of the local market have often been big hurdles for NRIs. We would like to summarise factors that NRIs should keep in mind so that they can take informed decisions while investing.

Understanding RegulationsIt is important to understand regulations while investing as an NRI. It begins with ensuring that your residential status in your KYC is updated as an NRI and investing is only made through Non-Resident bank accounts. This does involve some amount of paperwork initially; but it is important to remain compliant with these regulatory guidelines. Compliance with FATCA regulations is also critical, as we have seen that non-compliance often leads to stoppage of investments or delays in processing of redemptions. Another important regulation is regarding NRIs based in the US or Canada, as only some fund houses accept applications from them.

TaxationAs an NRI investor, if the country that one resides in has a Double Taxation Avoidance Treaty (DTAA) with India, you would not have to pay double taxation in India and the country you resides in. The principle of this treaty is that you needn’t pay tax on the same income twice. For example: If the tax on capital gains is paid in India, you would not need to pay taxes on the same income elsewhere, provided a DTAA has been signed. Currently, India has DTAA with more than 85 countries and covers most of major economies in the world.

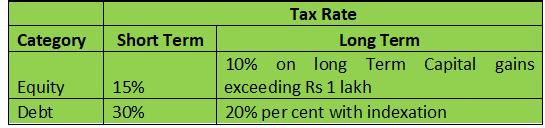

Tax on Capital Gains on Mutual Funds remains the same for Resident and Non Resident Indians. The only difference lies in the fact that, for NRIs, tax is deducted at source by the AMC (asset management company) and deposited with the government. The taxation on mutual funds is as under:

A big deterrent for NRIs in getting unbiased advice is the fact that their stay in the country is for a limited period and investment decisions are taken in haste due to paucity of time and is not based on quality of advice. A visit to your bank for updating information in your NRO account would often culminate in your buying an insurance product positioned by your relationship manager. A lot of wrong investment choices are driven by recommendations that come from someone who does not have a conflict-free approach towards advising. These are traps that NRIs must avoid, as investments that do not suit your need or objective often turn out to be the ones that are least profitable.

Some aspects to keep in mind for choosing the right advisor:While investing as an NRI, basic research needs to be done and help must be sought from a professional person or entity. It is important to have basic checks in place to understand that you have aligned yourself with right advisor. As they say investing is a journey and your financial advisor is the guide that helps you reach your destination!

Technology needs to be a huge enabler in achieving your investment objectives. A lot of companies invest heavily in their electronic interface to ensure that clients are able to view their investments real time and are provided with transactional ease. This remains a standard offering on most investment platforms. However, technology needs to be used better to provide superior and customized investment solutions to clients. Technology should be able to aid the advisor in providing conflict-free, timely and productive advice to clients. As an NRI, when one is based far away from India, the investment advisor should be able to communicate regularly by providing sound advice on portfolios. If technology does not empower your advisor, he would not be able to provide the best possible advice at the time it is needed most.

(The writer is Co-Founder & CEO, FinEdge Advisory)Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.