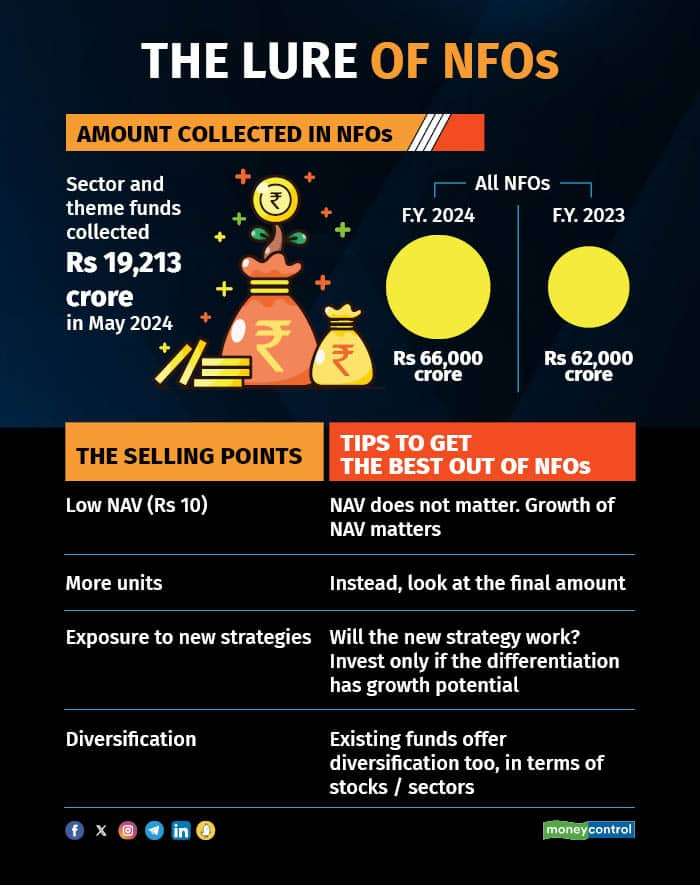

As per the Association of Mutual Funds of India (AMFI) data, the Indian mutual fund industry collected ₹66,000 crore in FY2024 and ₹62,000 crore in FY2023 through new fund offers (NFO). Typically, a fund house launches an NFO to expand its product basket, or to catch an upcoming investment trend.

Typically, there are four selling points to every NFO:

--> You get a low Net Asset Value (NAV).

--> You get more units.

--> Exposure to new strategies.

--> Diversification of your portfolio.

Also read: Sector and thematic funds log record inflows in May 2024.But are they all valid?

Low NAVA fund’s NAV changes depending on the performance of the underlying securities. Generally, at the time of launch of an equity fund, the NAV is ₹10. A fund that's been around for years may have a higher NAV due to the increase in value of its underlying securities.

For example, the NAV of the UTI Nifty 50 Index Fund - Regular Plan - Growth Option, as on 31 May 2024 was ₹155.0260. The fund was launched on 6 March 2000 with an NAV of ₹10. The average annual returns of the fund have been around 12.10 percent over the last 24 years.

Check the NFO suitability before investing in them

Check the NFO suitability before investing in themThus, the fund's NAV has gone up due to its performance over decades. But a new fund has no performance history. Therefore, it may not be correct to compare the NAV of an existing fund to that of an NFO.

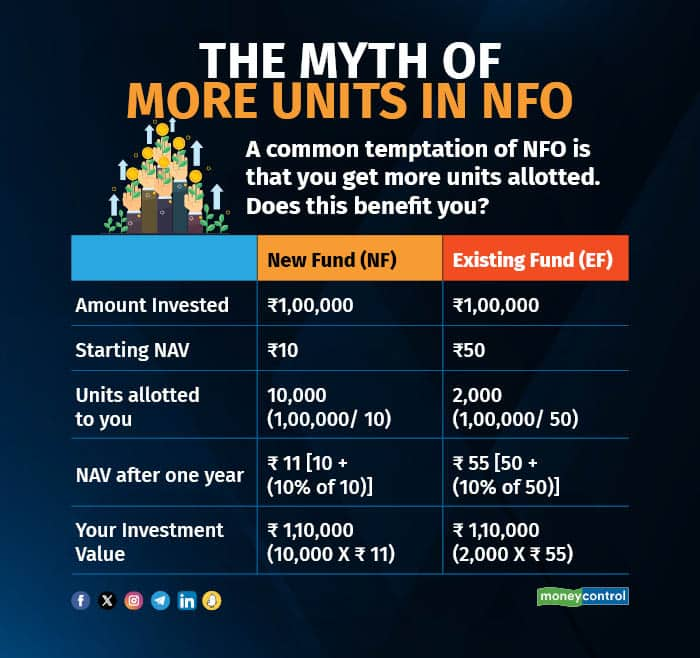

You get more unitsThis is correct. But does this benefit you? Here's the catch.

Let's compare an existing fund with a higher NAV (₹50), in which you get fewer units, with an NFO with a lower NAV (₹10), where you get more units (because of the lower NAV). For simplicity, let's name the existing fund ‘EF’ and the NFO as ‘NF.’ Let's also assume that their portfolios are identical, for the sake of comparison.

Say you invest ₹1 lakh in both, and both earn 10 percent returns. In that case, your investment in both these funds would grow to ₹1.10 lakh <see graphic>.

More than the number of units, the final amount matters

More than the number of units, the final amount mattersHence, despite the NF giving you 10,000 units as opposed to the EF that gave you 2,000 units, the value of your investment in each is the same. Here’s why.

The value of your investment depends on two things: the number of units, and the NAV. While investing in an NFO fetches you more units, it comes at a lower price. When you multiply lower units in an existing fund with a higher NAV, the resulting amount is equal to the new fund with higher units and lower NAV.

Here again, there is no real benefit of investing in an NFO just because you get more units. The value of your investment is what matters the most.

Exposure to new strategiesNFOs sometimes come with new strategies, offered as an add-on to your existing investment strategies.

A new strategy means its performance is not yet tested. So, it could go either way — good, bad, or in between. On the other hand, the existing strategies have a demonstrated history of performance. It is easy to make a decision based on that. Therefore, in the absence of a track record, an existing fund may be a better option to consider.

DiversificationNFOs are considered as an opportunity to diversify your portfolio.

First of all, you need to understand the true meaning and purpose of diversification. Diversification is spreading your money among different investments to improve your risk-adjusted returns. This is done by investing in securities that behave differently in different market cycles due to their inherent nature. For example, gold prices generally move up in times of uncertainty, while the price of equities go down. This is diversifying your portfolio among different asset classes — gold and equity.

Similarly, you can diversify within the same asset class also. A pharmaceutical company behaves differently from, say, a hotels or an auto company. This is diversifying your portfolio among different sectors.

An existing MF scheme already diversifies your investment across different securities. If the new fund does not differ much from your existing investments, diversification may not make sense. Simply adding more funds won’t translate into diversification if the securities or strategies aren't different.

Should you invest in NFOs?First, understand the purpose and benefits of an NFO. They may look tempting because of lower NAVs, higher units, and exposure to new strategies. But it's essential to analyse each claimed benefit carefully.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.