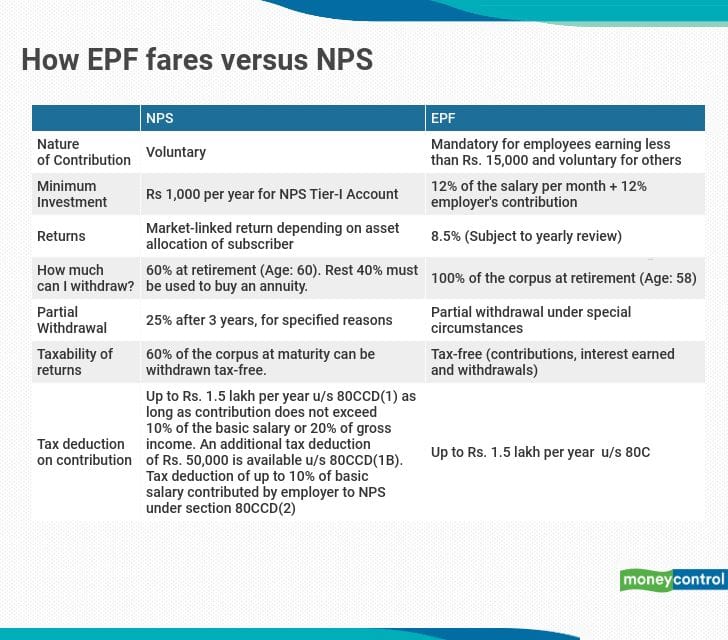

Saving for retirement can be done in multiple ways. A mix of equity, bonds and gold investments through the mutual funds route is one part of the story. The Employees’ Provident Fund (EPF) is another smart way of saving for retirement. In 2004, the National Pension System (NPS) was rolled out for government employees, which was extended to others in 2009. Though both the NPS and EPF are overseen by the government, they differ from each other on various parameters.

Also read | NPS returns: Check out the top-performing NPS schemes here

Where do EPF and NPS invest?

Both EPFO and NPS invest your money across equities and debt.

As an EPF subscriber do not get to decide the fund manager. Also, the returns are decided by the government.

NPS is a more evolved way to plan for your retirement. It takes into account your age and risk profiles and offers you suitable options. Under the ‘life cycle’ approach, subscribers can choose options that invest across equity, government debt and corporate bonds. NPS also gives the choice to decide on asset allocation, depending on your risk appetite and expectation of returns.

“If the subscriber opts for high equity allocation in NPS, then there is a chance for getting higher returns compared to the EPF,” says Jitendra Solanki, a SEBI-registered investment advisor.

How much do we get at withdrawal?

Upon reaching the retirement age, you can withdraw you entire EPFO corpus.

However, the NPS is devised as a pension scheme. So, you get to withdraw 60 percent of your accumulated corpus at retirement without paying any taxes. The remaining 40 percent must be converted into an annuity instrument (from an insurance company) and get monthly payments. This, experts say, makes NPS less attractive for those who want to use a substantial part of the retirement corpus for financial goals such as buying a house or funding children’s marriage. In many cases, EPF proceeds are used for financial goals other than funding retirement.

Also read: Investing in the NPS alone may not suffice for your retirement

“Subscribers at early age should subscribe to NPS and opt for high equity allocation to accumulate large corpus targeted to fund retirement needs,” says Parul Maheshwari, a Mumbai based certified financial planner. “In the later years of your career if you are not prepared to take market risk, then you should stick to EPF,” she adds.

Investors should not touch their retirement corpus for other financial goals, though there is a window for premature withdrawal.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!