Choosing the right mutual fund in your portfolio is not a simple task. Most investors look at the past performance of either the past 1 year or 3 years and select the best performing mutual fund. If you are also doing this, you need to watch this episode of Managing Money with Moneycontrol as this could be an incorrect way of investing in mutual funds.

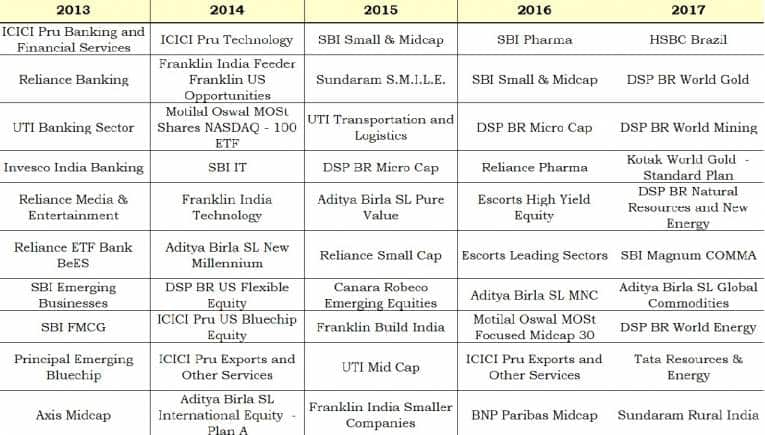

Constructing a mutual fund portfolio just on the basis of past performance is a recipe for creating an underperforming lop-sided MF portfolio. There is more than just past performance that is required to create the right mutual fund portfolio. To validate this, we did a simple exercise for the last ten years. At the beginning of first year starting from CY 2008, we chose the top 10 best performing mutual funds of the previous year.

We allocated our investments equally across these top 10 performing mutual funds. At the end of the year one, we again re-did the same exercise i.e. once again re-allocated our corpus to the best performing funds of the current year. This is how your portfolio would have panned over the last ten years (Portfolio in CY2008, will be the top performers in CY2007).

As you would see the top performers of a particular year, rarely repeat even over a 10-year time frame. Hence choosing the top performer of the past, rarely helps you get a market winning performance in the future.

The more important point to note is that such a strategy of choosing past performers actually dilutes your portfolio value. If you had invested Rs. 100/- at the beginning of 2008, and followed the above process, at the end of 2017 the value of this portfolio would have been Rs. 112/- only. Whereas if you had just bought the Nifty instead your portfolio value would have been Rs. 167/- or if you had just bought a couple diversified mutual funds and stuck with them your portfolio value would have been Rs. 238/-.

Chasing past performance and churning portfolio based on immediate performance diminishes value greatly and holding on to mutual funds for the long term creates significant value for long term investors.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!