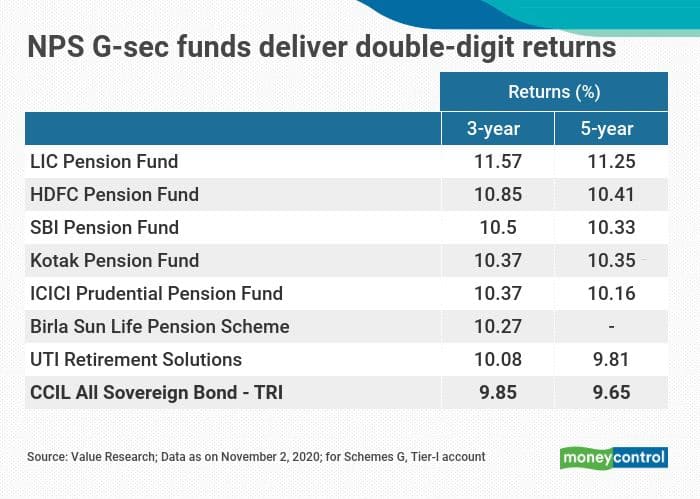

The scheme G of National Pension System (NPS) fund managers – government securities – has delivered an impressive performance over three as well as five-year horizons. The seven pension fund managers’ schemes have yielded returns in the range of 10.08 percent to 11.57 percent annually over three years, with LIC Pension Fund being the best performer, as per data from Value Research. HDFC Pension Fund (10.85 percent) and SBI Pension Fund (10.5 percent) were the next in the list. All the schemes beat the category benchmark, CCIL All Sovereign Bond’s 9.85 percent returns over the three-year periods. NPS G-sec funds have consistently delivered stellar returns in the backdrop of the benign interest rate scenario. All these NPS gilt funds have outperformed the benchmark index over the five-year time horizon too.

What’s more these schemes have also outperformed their mutual fund peers. Gilt mutual funds delivered 8.48 percent over three years as a category on an average, while the five-year returns stood at 8.72 per cent. So, NPS gilt fund managers have delivered a healthy outperformance of 1.5-2 percentage points over the long term.

Good retirement vehicle

The National Pension Scheme (NPS) is a retirement planning vehicle that gives tax deduction benefits. It offers you a choice of equity and debt assets, depending on what your risk profile is. You can either invest in the equity fund (known as Scheme E) or corporate bond fund (Scheme C) or government securities fund (Scheme G). There is an auto choice, which means that your asset allocation will be decided automatically depending on your age. The NPS gives you three options with varying equity allocation. Once you select your fund, the equity-debt split will automatically change as you age. The other option is the active choice. Here you select your own asset allocation, but there are some limits.

Scheme G, which is a plan that invests in government securities, is meant for the conservative investor who doesn’t want to take any credit risk. Since these are government-issued debt securities, they are safe and also liquid. But because they are liquid, they are also volatile. Mutual funds too offer government securities funds, but they are open-ended and you can withdraw from them anytime.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.