While investing in fixed deposits (FDs) on Moneycontrol, you get attractive interest rates, up to 8.5 percent p.a. for regular citizens and an even higher 9.1 percent p.a. for senior citizens. You can begin your investment journey in FDs with as little as Rs 1,000.

You have the option to diversify your investments across four financial institutions — Bajaj Finance, Shriram Finance, Utkarsh Small Finance Bank and Shivalik Small Finance Bank. Over time, fixed deposit schemes from other banks and non-banking finance companies (NBFCs) will be added, which will help you diversify your FD portfolio even further.

Also read: Invest in FDs without a bank account, through Moneycontrol

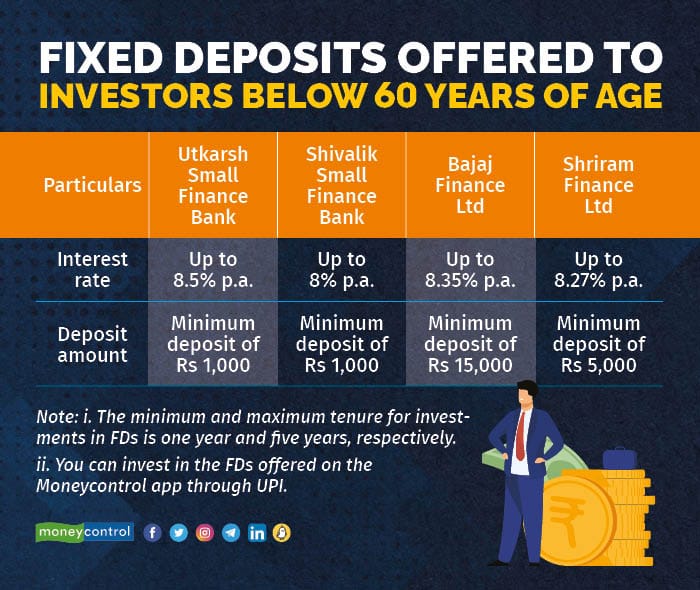

FD investment plans for investors below 60 yearsUtkarsh Small Finance Bank has been offering the highest interest rates on FDs, i.e., 8.5 percent p.a. for a two to three year tenure. The minimum deposit is Rs 1,000 in Utkarsh Small Finance Bank and Shivalik Small Finance Bank.

Among NBFCs, at present Bajaj Finance offers the highest interest rate on deposits, i.e., 8.35 percent p.a. for a tenure of three years eight months tenure. The minimum deposit is Rs 5,000 in Shriram Finance and Rs 15,000 in Bajaj Finance.

Also read | Diversify your fixed investments with Moneycontrol platform

Women investors get to earn 0.10% extra returns on deposits from Shriram Finance.

Here are the features and benefits of FDs offered to investors below 60 years of age.

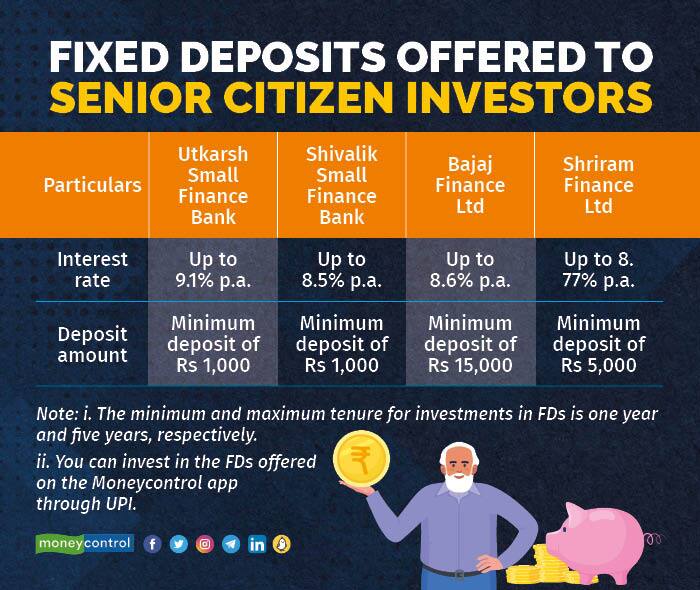

In banks, Utkarsh Small Finance Bank is offering the highest interest rates to senior citizens on FDs - 9.1 percent p.a. for a two to three year tenure. The minimum deposit is Rs 1,000 in Utkarsh Small Finance Bank and Shivalik Small Finance Bank.

Among NBFCs, Shriram Finance is offering the highest interest rate on deposits of 8.77 percent p.a. for four years and two months tenure. The minimum deposit is Rs 5,000 in Shriram Finance and Rs 15,000 in Bajaj Finance.

You can now Invest in Fixed Deposits on Moneycontrol app.

Here are the features and benefits of FDs offered to senior citizen investors, i.e., above 60 years of age.

For an investment amount of Rs 50,000, below is the interest earned and FD maturity amount for investors below 60 years of age.

For an investment amount of Rs 50,000, below is the interest earned and FD maturity amount for senior citizen investors.

To reduce the risk associated with a single bank, you should invest in FDs with different banks and financial institutions. That way, your FD investment will not be concentrated in one financial institution, thus reducing risk.

The central bank secures deposits in public sector banks, private banks, and small-finance banks. The Deposit Insurance and Credit Guarantee Corporation (DICGC), a subsidiary of the central bank, guarantees investments in fixed deposits of up to Rs five lakh.

Moreover, the NBFCs associated, like Bajaj Finance, hold a high AAA / Stable rating by CRISIL. Shriram Finance is rated AA+ / Stable by ICRA.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.