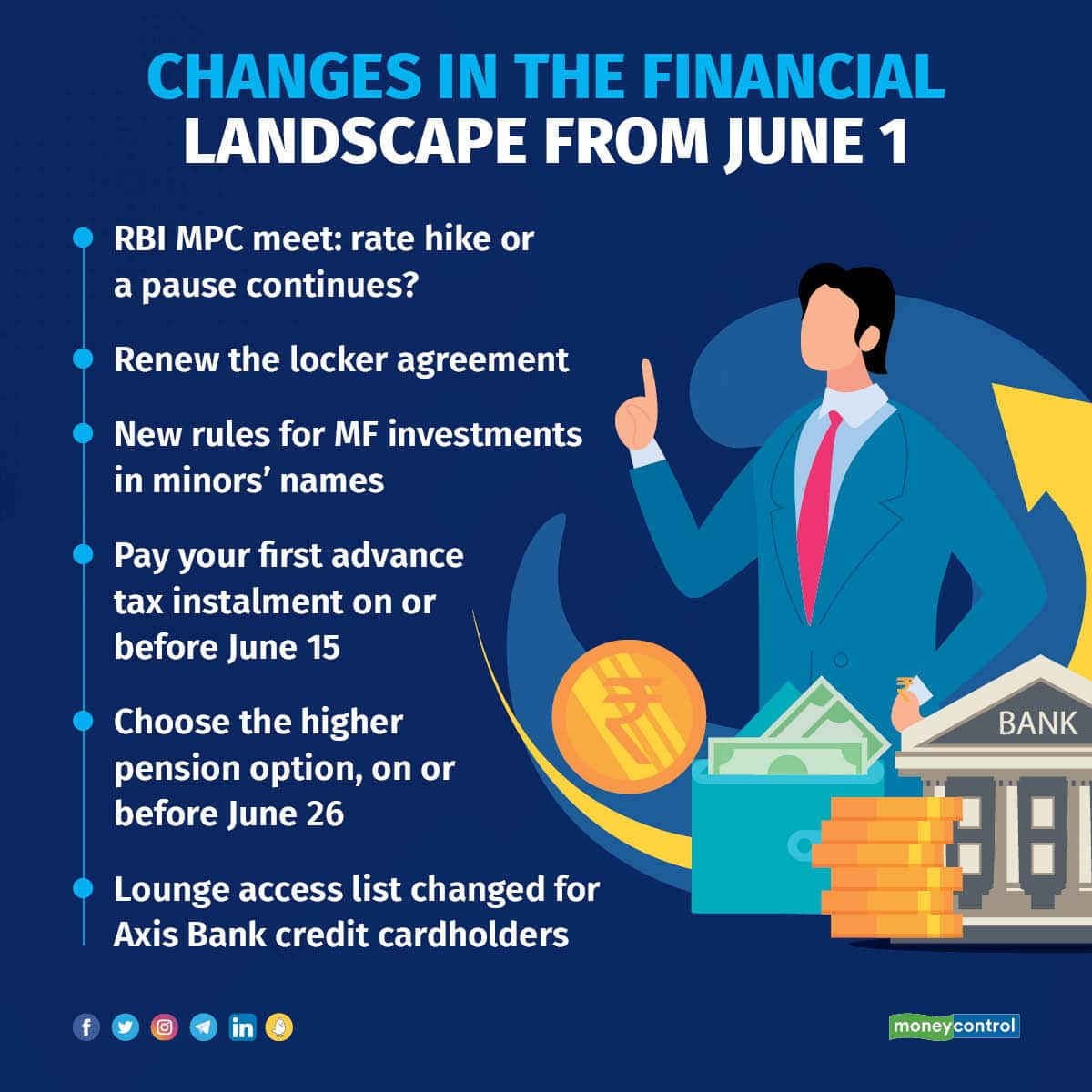

The Reserve Bank of India (RBI) kept the policy repo rate unchanged in April, but you need to watch whether the pause continues or the central bank raises the rate. The announcement will impact you if you have an existing loan or plan to take one.

Also, you need to know about the revised locker agreement and new rules for mutual fund investments in minors’ names. You also need to pay the first advance tax instalment -- and more.

So, what are those changes in June 2023 that will hit your wallet?

RBI monetary policy: will pause continue or the rate be raised?The RBI’s second monetary policy announcement in the financial year 2023-24 is due on June 8.

Borrowers heaved a sigh of relief when RBI decided to keep its policy repo rate unchanged at 6.5 percent in the first bi-monthly monetary policy review of FY 24.

The Monetary Policy Committee (MPC) of RBI paused on rates in April 2023, contrary to industry expectations, terming the move ‘temporary’ and retaining its ‘withdrawal of accommodation’ stance, taking into account the turmoil caused by a banking crisis in the US and Europe and contagion risks.

You need to watch out whether the pause continues or there is a rate hike in the June MPC meeting. If there is another rate hike, banks will once again increase interest on home loans and other loans linked to the repo rate as an external benchmark in line with the terms of loan agreements.

Sign revised locker agreementsState Bank of India (SBI), Bank of Baroda, and a few other banks are urging customers who maintain lockers at their branches to sign revised locker agreements by June 30, 2023. Soon, all banks are likely to follow suit.

In January 2023, RBI had extended the deadline for banks to complete the process of renewal in a phased manner by December 31, 2023. The first milestone of renewal of 50 percent of the agreements is due on June 30, 2023.

There are important things you must keep in mind while renewing the locker agreement, as explained here.

Under a new rule introduced by the capital markets regulator, the Securities and Exchange Board of India (SEBI), that will come into force on June 15, investments in mutual funds will be accepted from the bank account of the minor, parent or legal guardian of the minor, or a joint account of the minor with a parent or legal guardian.

Earlier, banking norms insisted on routing the money through a bank account held in the name of the child. It has been observed that the absence of a bank account in the name of the child is an obstacle to investing money in the name of the child.

ALSO READ: SEBI nudges AMFI to form ethics committee to catch bad apples in timeFor existing mutual fund folios, the fund houses will have to insist on a change of pay-out bank mandate before redemption is processed.

Further, all redemption proceeds will have to be credited only in the verified bank account of the minor, i.e. the account the minor may hold with the parent/ legal guardian after completing all Know Your Customer formalities.

SEBI seeks comments on consultation paper on deterrence of insider trading at MFsSEBI has proposed setting up surveillance and internal control systems to catch frauds like front running and insider trading. At the minimum, SEBI has said that such a system should be able to catch front-running, insider trading, mis-selling of products, misuse of information by an Asset Management Company (AMC), its employees, distributors, brokers, dealers and so on and delay in execution of orders by brokers and dealers.

Originally the feedback to be submitted by June 3, SEBI has now pushed the deadline to June 8.

SEBI invites views on proposals to overhaul expense ratio mechanismThe regulator recently came out with a proposal wherein it suggested that a scheme’s Total Expense Ratio (TER) must include costs such as brokerage, Goods and Services Tax (GST), Securities and Transaction Tax (STT), and incentives paid for getting investments from so-called B-30 cities. The present TER structure keeps these expenses over and above the base expense ratio.

SEBI has also proposed a regulatory sandbox around performance based fee for mutual funds. Mutual fund houses can charge a higher TER if they outperform the benchmark. Such an arrangement has not been hitherto available in the Indian mutual fund industry. The regulator has suggested that either the fund house will charge a higher TER and pay back the excess over base TER if the scheme underperforms, or the fund house charges base TER and more if the scheme outperforms at the time of redemption by the investor.

Originally the feedback to be submitted by June 1, SEBI has now pushed the deadline to June 8.

ALSO READ: Do you exhaust your credit card limit often? Your credit score could come under pressureJune 15 is the deadline for the first advance tax instalmentIf you are a salaried individual and think the “Advance Tax” provision is not applicable to you, you’re wrong. Advance tax liability may arise for a person having a salary as the primary source of income, but also having earning from other sources such as interest from deposits, rental income, capital gains and so on. So, you need to assess your advance tax liability.

According to section 208 of the income-tax Act 1961, every person whose estimated tax liability for the financial year is Rs 10,000 or more, after taking into consideration tax deducted and collected at source (TDS and TCS), is required to pay advance tax.

Taxpayers are required to pay their annual estimated advance tax liability in four instalments. On or before June 15, the taxpayer needs to pay 15 percent of the advance tax.

If you miss advance tax payments or delay them, there is penal interest on the taxes due, under section 234C, at the rate of 1 percent per month / part of the month.

Apply for higher pension on actual salary by June 26The Employees' Provident Fund Organisation (EPFO) extended the deadline for choosing the higher pension option from May 3 to June 26.

Employees who were members of EPFO and Employees’ Pension Scheme (EPS), prior to September 1, 2014, and who continue to be in service but missed availing the higher pension option earlier are eligible to apply. Those who retired before this date and had signed up for the higher pension option will have to validate the information.

You will have to take a call on whether you want to file a joint application - with your employer - to claim higher pension on your actual salary or not. You will have to complete this process by June 26 through the online facility provided on the EPFO’s member portal.

Currently, your employer deducts 12 percent of your basic salary as your Employees’ Provident Fund (EPF) contribution. The organisation also contributes an equal amount to create your retirement kitty. A part of it (8.33 percent) is directed to the EPS while the balance flows into your provident fund. However, it is calculated on the statutory wage ceiling of Rs 15,000. So, at present, out of your employer’s contribution, Rs 1,250 (8.33 percent of Rs 15,000) goes towards EPS. This amount joins the pool created under EPS to pay regular pension income to member-employees with at least 10 years’ service and their dependent family members.

You can, however, now choose to direct 8.33 percent of your actual salary towards the pension pool, translating potentially into higher pension post-retirement, thanks to the Supreme Court verdict in November 2022. Additionally, 1.16 percent from your employer’s contribution will also be funnelled into EPS, with the balance 2.51 percent flowing into your EPF.

You will have to exercise this choice by June 26. If you spot errors in your application, you can delete the application and file it again. However, you cannot do so if your employer has already validated the application. Next, the EPFO officers will evaluate and approve your application to pay the way for a higher pension.

Several grey areas around the process and final pension formula persist, making it difficult for employees to exercise their choice.

ALSO READ: Parag Parikh Flexi Cap Fund: So far, so good. But can it do an encore?Lounge access list changed for Axis Bank credit cardholdersAxis Bank credit cardholders get complimentary lounge access at different airports in India. However, there is a limit on the number of complimentary lounge access according to variants of cards.

The bank has revised its airport lounge access program for its credit cardholders, effective from June 1, 2023 and it’s valid till August 31, 2025. Check the details on the lounge access on your credit card from the bank website or inquire with the customer service.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.