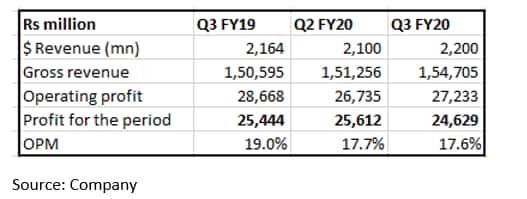

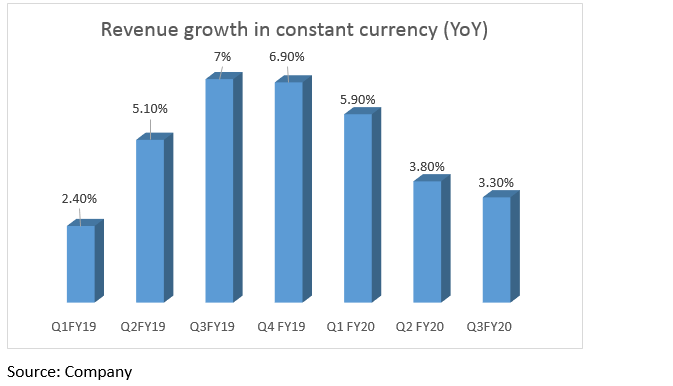

Wipro delivered a decent third quarter (October-December) on the back of muted expectations. Revenue growth stood at mid-point of its stated guidance, margin was not disappointing and the management stated no overt deterioration or improvement in the operating environment.

While there was weakness in certain verticals, the overall outlook has not worsened, post the Q3 FY20 earnings report.

The subdued performance so far has resulted in significant underperformance of the stock as against the benchmark Nifty as well as the IT index. The stock is not far from its 52-week low.

While the undemanding valuation at 13.7x FY21e earnings protects the downside and hence could be considered as a defensive strategy, we do not see outperformance as long as Wipro lags its peers in growth. We expect mid-single digit earnings growth over the next couple of years.

Key positives The software service provider reported IT services revenue of $2,095 million – a sequential growth of 2.2 percent in reported currency and 1.8 percent in constant currency, the midway of its revenue guidance of 0.8-2.8 percent for the quarter. Wipro’s recent acquisition of US-based International TechneGroup Incorporated (ITI) contributed 30 basis points to the quarterly growth.

Growth in digital stood out at 23 percent year on year (YoY), making up 40 percent of total revenue.

In terms of verticals, consumer business, healthcare as well as manufacturing gained traction. While e-commerce aided the consumer business, seasonal uptick in US operations of HPS-aided healthcare and ITI had a positive rub-off on manufacturing.

The HPS business refers to HealthPlan Services, a US-based health insurance market-based company which Wipro acquired in 2016.

Growth in the key market of the US -- revenue share close to 59 percent -- was decent, though softer than the previous September quarter (Q2).

The management highlighted that the company is entering 2020 with a better order book position than the previous calendar.

On demand environment, it said there was neither an improvement nor deterioration.

The IT player reported a sequential improvement of 30 basis points (bps) in margin for IT services, thanks to depreciation of the rupee and favourable cross-currency dynamics. Its attrition rate too fell to 15.7 percent sequentially.

Wipro continued to add a number of sales and support staff with an eye on stepping up the deal flow momentum. It added one client in $100 million bucket and the number of new customers has been on the rise over the past two quarters.

Key negatives

The story is not without its share of negatives. Weakness was seen in the banking, financial services and insurance vertical (BFSI), which was partly because of furloughs and weak macros. However, the management is optimistic that the deal funnel is bigger than ever and project size is rising.

The company’s top client is from BFSI. In fact, 50 percent of top clients are from this vertical. Over time, the share of the top five clients in revenue has come down.

Communications as well as energy and utility have seen a moderation in pace and technology has contracted, hit by furloughs.

In terms of geographies, European operations shrank sequentially during the quarter.

The utilisation rate saw a drop to 78.6 percent from 82.1 percent earlier. A lower attrition along with vertical related weakness due to furloughs partly explain the same.

The guidance for Q4 stands muted at 0-2 percent growth.

Major observations and outlook

With its inability to catch up with peers in terms of growth, Wipro has underperformed the Nifty and the BSE IT index. However, the strategic clarity with respect to key drivers of growth like digital, cloud, engineering services and cyber security is in place. The company is adding people to accelerate growth.

The build-up in momentum comes at a time when global macro is turning hostile, which is likely to ripple through its spending across sectors. Moreover, some of the key verticals are already showing signs of stress. Hence, a runaway improvement from hereon looks unlikely.

While we see limited downside, given a better execution and undemanding valuation, we do not expect significant upside unless Wipro matches its peers in growth sweepstakes.

For more research articles, visit our Moneycontrol Research page

Disclaimer: Moneycontrol Research analysts do not hold positions in the companies discussed here

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!