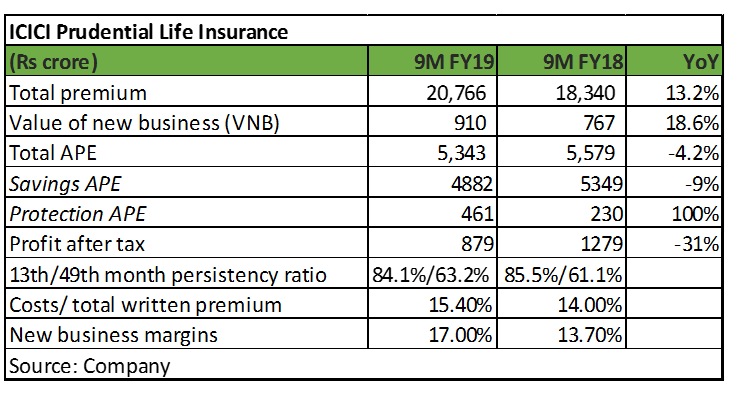

ICICI Prudential Life (ICICI Pru) reported a muted performance with April-December net profit declining 31 percent year-on-year (YoY). The performance was dragged down by decline in total annualised premium equivalent (APE, a measure of ascertaining business sales in the life insurance industry) and increase in operating expenses.

The insurer reported a 4 percent decline in total APE. This was mainly on the back of savings APE declining 9 percent YoY due to many factors including high base effect. However, the highlight of the period was very strong growth in protection APE, which doubled YoY.

The share of unit-linked insurance products (ULIPs) in total new business APE stood at 81 percent, while that of the protection business improved further to 8.6 percent (4.1 percent in 9M FY18).

Total expenses (including commission) increased 19.4 percent on the back of increase in commission expenses as well as advertising and other expenses. As a result, the cost to total written premium ratio deteriorated to 15.4 percent compared to 14.10 percent last year.

Total expenses (including commission) increased 19.4 percent on the back of increase in commission expenses as well as advertising and other expenses. As a result, the cost to total written premium ratio deteriorated to 15.4 percent compared to 14.10 percent last year.

Despite the rising cost, new business margin expanded significantly to 17 percent in 9M FY19 compared to 13.7 percent a year ago. Better product mix with increasing share of high margin protection business drove margin expansion.

In nutshell, ICICI Pru delivered a mixed performance on its 4P strategy articulated for future growth. While there was good progress on 2Ps (protection and persistency) in 9M FY19, the other 2Ps (premium growth and productivity) dragged overall performance.

Follow @nehadave01Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.