Anubhav Sahu Moneycontrol Research

Since its IPO listing, Prataap Snacks has nudged further about 10 percent after a listing gain of 33 percent. While it continues to ride on volume led India consumption growth in snacks industry, its recent result highlight improved operational performance. However, intense competition in the snacks industry, elevated valuation and the vagaries of the raw material costs make us wary about listed entities in this space.

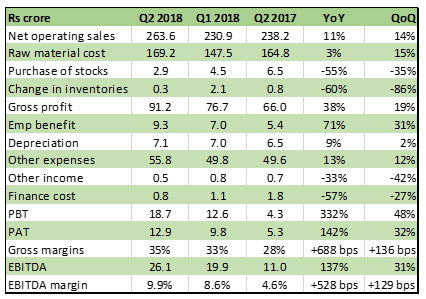

Stellar quarterly result

Prataap Snacks posted robust result with a sequential improvement in sales. In case of gross margins, there was a 688 bps (YoY) improvement on account of favorable raw material costs (64 percent of sales vs. 69 percent in Q2 FY17), rationalization of trade margins and better product mix. EBITDA margins expanded 528 bps as higher employee costs were more than offset by lower finance costs and moderation in other expenses. Consequently, net profit jumped more than two times.

Nearest peer DFM foods also registered decent growth

DFM foods quarterly result also showed a traction in sales (+20 percent YoY) and margin (EBITDA margin: +305 bps YoY). Company’s EBITDA margin at ~13 percent is still well ahead that of Prataap Snacks (9.9 percent).

DFM Foods benefitted from seasonality (school reopening), lower base and change in distribution strategy for regions other than North India.

IPO funds utilization

Prataap received net IPO proceeds of Rs 236.2 crore after deducting IPO expenses. The company had earlier marked Rs 50.98 crore for the repayment of borrowings, of which Rs 37 crore has already been utilized. Currently, company’s long term debt is about Rs 17.18 crore.

Higher share in urban market and improved capacity utilization to derive from volumes

The company’s next leg of growth is expected to come from improved presence in tier 1 cities. Adding to that new product launches would be handy. Capacity utilization till end of FY17 was in the upper band for most of the plants except for the Guwahati plants for “Chulbule” and pellets. We expect that better utilization in these plants can add about 5-6 percent to production volume in the near-term. The company also envisages further capacity expansion through IPO proceeds (Rs 67 crore).

In similar strategy, company’s nearest competitor, DFM Foods has recently completed a brownfield expansion leading to total capacity of 26,000 MT (from 16,000 MT) at a project cost of about Rs 62 crore. Further, it is looking for greenfield expansion in Pune to better serve western region.

Financials and valuation

Based on company’s H1 2018 results and better capacity utilization, we have made changes on the financial projections. Stock is currently trading at 57x 2019e earnings which is similar to its peers in snacks industry but ahead of the consumer staples price multiple (GICS average: 45x 2019e Earnings).

In the near-term, raw material costs remain the key variable to watch, in light of supply concerns emerging for potatoes. Further, intense competition in the urban snacks industry might make it a challenge.

The company’s entry in to the sweet snacks category through the launch of Yum-Pie needs to be tracked closely as well. It can possibly get some traction on account of pricing strategy and focus on tier 2 cities/hinterland, just as in the case of savoury segment. This category is otherwise getting contested by large players like Lottee and ITC, particularly, in tier 1 cities.

For more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!