Jitendra Kumar Gupta

Moneycontrol Research

State-owned trading company MSTC kicked off its initial public offering (IPO) but an in-depth look at its business model and financials shows subscribing to the issue is a risky bet.

MSTC is into trading, e-auction and recycling business, and enjoys government patronage, which ensures steady business. The industry in each of its verticals is growing fast, ensuring MSTC has gained a large share.

The company was incorporated to undertake trading of goods on behalf of the different government organisations and departments. This activity included procurement of industrial raw materials such as iron ore, steel, coal, petroleum and petrochemical products.

The second segment is e-commerce, which is largely e-auction of various economic activities of the government.

Third, the company has recently started recycling business along with a JV with the Mahindra. However, the contribution of this vertical is negligible as of now.

Operating performance

The trading business has low (1 percent) margins but it brings in volumes. On the other hand, the e-commerce business is lucrative because of the low cost capital employed in the business. Hence, a bulk of the contribution to overall profits of the company comes from e-commerce business.

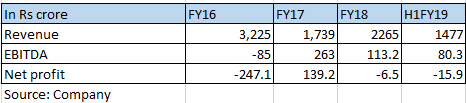

The trading business, despite having a huge size, has been a big drag on the profitability because of the volatility in revenues.

That apart, low margins, delayed payment cycles, frequent provisions and write-off pertaining to the sticky debtors have been causes of concern. This is why the company has incurred losses several times in the past.

Because of volatility in commodity prices, MSTC’s clients have defaulted or delayed payment or did not take responsibility of the goods procured. The company had to write off some of these accounts.

Nevertheless, the company is taking corrective measures by way of securing payments through bank guarantees and new revenue models such as cash and carry etc.

The company says that most of its provisions are behind it and going forward, it is expected such accounting write-offs and provisions will be eliminated, thus improving profitability.

That could be a huge positive -- if one removes the impact of provisions for doubtful advances and debt of Rs 222.5 crore and bad debt write off of Rs 460 crore, the company would have reported a significant profit as against the reported net loss of Rs 6.5 crore in FY18.

Valuations

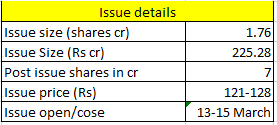

Because of the losses, earnings-based valuations may not be good indicator of value. On price to book value, the issue at the upper price band of Rs 128 is priced about 2.7 times, which is attractive only if the company started reporting normalised profits.

In FY17, the company made a net profit of Rs 139 crore. In that year, the provisions and writebacks were one-tenth of what was in fiscal 2018.

Even at 4-6% net margin, on an annual revenue of Rs 2,800 crore, it should report a profit of Rs 112-167 crore. At that profitability, the issue is priced at 5-8 times.

However, this comes with many assumptions and seems to be quite a high risk for an investor to take the plunge.

For more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!