Highlights: - Largest player in the reinsurance space - Reinsurance sector in sweet spot, to track strong growth in non-life segment - Foreign players now permitted in the sector - GIC has competitive advantage due to obligatory business and first preference granted by regulations - Profit growth, aided by investment income and reasonable valuations, make it a buy -------------------------------------------------------

General Insurance of India (GIC Re) is India’s largest reinsurance company. Owned by the government of India, it accounted for around 60 percent of the premiums passed on by Indian insurers to reinsurers during FY18. With growing international presence, the company is now the 10th largest reinsurer in the world, based on net premium as per Standard & Poor's.

While there is inherent volatility in the risk-underwriting business, GIC Re is the only listed reinsurer, making it a stock worth looking at.

Reinsurance sector growing at a healthy rate The Indian reinsurance market, estimated to be around Rs 48,000 crore as at FY18-end, has witnessed a compounded annual growth rate (CAGR) of around 16 percent in the past 10 years. Most reinsurance premiums written in India comes from the non-life segment (an average of more than 95 percent in the past five years). Hence, future growth in reinsurance premiums is contingent on growth in the non-life insurance segment as well as percentage of premiums passed on to reinsurers.We see high-teen growth (16-17 percent) for the non–life insurance sector over the next few years as market is grossly underpenetrated and there are multiple growth levers for sub-segments like motor and health insurance. Thanks to the growing overall pie of non–life premium, reinsurance premium stands to increase even though proportion of premium retained by non-life companies is also rising. Crisil expects reinsurance premiums in India to increase 11-14 percent CAGR over the next three years to Rs 70,000 crore by FY22.

GIC Re has a competitive advantage Until recently, GIC Re was India’s only domestic reinsurer. However, the recent change in regulations enabled foreign reinsurance companies to compete in India. At present, 11 reinsurers operate out of India. In addition to GIC Re, nine are foreign reinsurers (Lloyds, Swiss Re, Munich Re, SCOR SE, RGA, Hannover Re, XL Catlin, Gen Re et al) and the other one is a private Indian reinsurer: ITI Re. Granted license in FY17, ITI Re is yet to commence the business.

Despite this change, we expect GIC Re to continue to retain its dominant position because regulation guarantees minimum business to it from primary insurers. The two main regulations that confers competitive advantage for GIC Re over other reinsurers in India are:

Mandatory cession of premium All direct insurers in India are required to cede a minimum five percent of their every non-life policies premiums to GIC Re. This minimum rate of cessions has been falling from 20 percent initially to 15 percent in FY06, to 10 percent in FY12 to 5 percent in FY13, where it remains currently. These obligatory cessions in a way guarantees business to GIC Re. That said, obligatory cessions may also require GIC Re to reinsure unprofitable business. For example, the company is required to accept five percent of third-party motor insurance risks in India, which has historically had high losses.

First preference in reinsurance Under regulations set out by the Insurance Regulatory and Development Authority of India (IRDAI), insurers are required to offer business to GIC Re first. The regulator recently relaxed the norms for foreign reinsurers that have set-up shop in India, but retained the right of first refusal for the state-owned GIC Re. If the latter declines to accept the risk, only then it would be given to the branches of foreign reinsurers.

However, to drive up competition in the market, which is currently dominated by GIC Re, regulations allow insurance companies to simultaneously seek terms from at least four foreign reinsurance branches. If the Indian reinsurers cannot match the rates quoted by their foreign counterparts, then they stand to lose business. The step likely to trigger intense competition in the country’s reinsurance space, but GIC Re still has an advantage.

Favourable investment income offsets modest underwriting performance GIC Re witnessed an around 71 percent CAGR increase in domestic gross premium between FY16 and FY18, driven by crop insurance, following the introduction of Pradhan Mantri Fasal Bima Yojana (PMFBY), the government’s push to raise the country’s insured crop area.

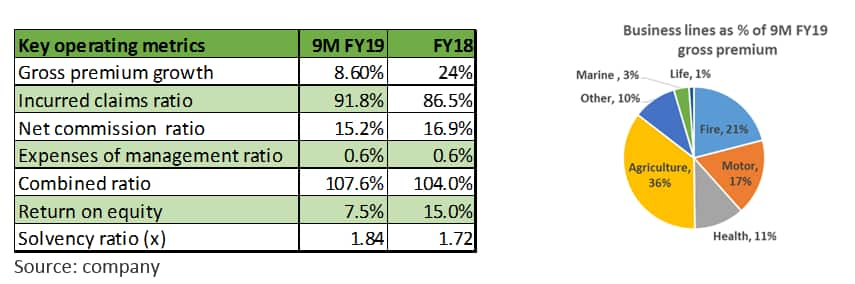

For 9M FY19, overall growth in gross premium moderated to 8.6 percent due to normalising crop insurance growth for non-life companies. Growth was mainly driven by its international business, which constitutes around 27 percent of total gross premium. Going forward, we can expect a low double-digit growth in premium driven by its overseas business.

Despite strong premium growth, the reinsurer reported an underwriting loss in FY18 and also in 9M FY19. The combined ratio, measure of insurance company’s profitability expressed as total cost to total revenue, stood at 107.6 percent for 9M FY19. The weak combined ratio was mainly on the back of higher claims/loss ratio at 92 percent, while the commission and expense ratio was slightly better at 15.2 percent.

Consistent and favourable investment income more than offsets the underwriting loss. As a result, the reinsurer reported a profit of Rs 1,621 crore in 9M FY19.

Solvency ratio, at 184 percent, was comfortably above the regulatory requirement of 150 percent. This, along with the double-digit return on equity (RoE), should help maintain growth for the next couple of years before having to raise fresh capital.

Reasonable valuation Being the leader in reinsurance in India, GIC Re has competitive strengths in terms of strong underwriting and actuarial capabilities. It is well poised for growth, with an increase in insurance penetration, focus on profitable segments and improvement in operating efficiency. Though we are comfortable about GIC Re in the long run, the stock will react to its underwriting performance in the short term and could be volatile.

The counter is already down more than 30 percent from its 52-week high and is currently trading at two times its trailing book. With FY20 RoE estimated at 12-15 percent, the current valuation looks reasonable.

In the absence of a comparable listed peer, GIC Re trades as a proxy for the sector. Investors with a long-term horizon and wanting to participate in the growth in the reinsurance sector can consider this stock.

Follow @nehadave01For more research articles, visit our Moneycontrol Research page

Disclaimer: Moneycontrol Research analysts do not hold positions in the companies discussed here

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!