Anubhav Sahu

Moneycontrol Research

For three quarters on a trot, the double-digit volume growth of fast moving consumer goods companies have been fuelled by rural India. It was a similar story with Godrej Consumer Products, with steady volume-led growth for the last four quarters. As the base effect fades and rising raw material cost warrants a price hike, topline trajectory is now entering difficult territory.

Quarterly update

Comparable sales growth of 10 percent year-on-year (YoY) was aided by 14 percent volume growth in the domestic business. International business was up 7 percent, on a like-for-like basis, driven by Indonesia. In case of the domestic business, topline growth was entirely volume driven, with across the board traction in all major product categories.

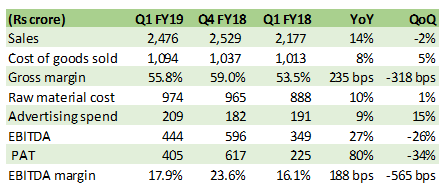

The 188 bps YoY expansion in earnings before interest, tax, depreciation and amortisation (EBITDA) margin was aided by improved gross margin (better product mix), lower advertising spend and other expenses. Net profits, adjusting for deferred taxes, was up 36.5 percent YoY.

Result snapshot

Source: Moneycontrol Research

Improved traction in household insecticides needs a close watch

As the management guided in its previous conference call (Q4 FY18), improved sales offtake for household insecticides was visible in the Q1 FY19 sales number. Household insecticide sales grew 17 percent on a comparable basis. Q1 result update from category peer, Jyoti Laboratories, echoed optimism when it reported a 28 percent comparable growth. Sequentially, sales tapered in Q1 but the management claims it gained from innovations. Investors need to keep in mind that improved growth numbers are also aided by a soft base, both on a sequential and annual basis.

The company maintains that new product launches like Goodknight Power Chip (uptrading for coil users) and higher efficacy liquid vaporisers are reviving growth.

Sales in the hair colour category grew 13 percent on Q4 FY18’s low base. Here one needs to keep in mind that Q4 sales were lower due to channel upstocking in Q3 (33 percent YoY) owing to Goods & Service Tax-led price cuts.

Another interesting aspect of this category is portfolio expansion in the herbal-based powder hair colour segment (Rs 1,000 crore opportunity) under the Godrej Nupur brand. With reasonable price points, the management expects increased access points to the target market.

In the soaps category (mainly Godrej No.1), the company continued to deliver a robust set of numbers (10 percent YoY versus 19 percent in Q4 and 24 percent in Q3 FY18), with strong sequential improvement and market share gain.

Indonesia stabilising; Africa requires monitoring

GCPL’s international business appears to be on track and stabilising, particularly Indonesia. However, EBITDA margin remains under pressure with increase in operating margin for Indonesia being offset by other regions. In Indonesia, company’s household insecticides remains in repair mode with improving market share.

Earnings from South African continues to be impacted by combination of external and internal events like transport strike, fuel price hike and higher marketing investments.

OutlookThe result was as per expectation, particularly traction in the domestic business, volume-led growth, an apparent revival of the insecticides business and stabilisation in Indonesia operations. As the advantage of soft base peters out in coming quarters, a pricing and demand-led recovery would be key factors to watch for. The quarter in review also cements the trend that rural growth is higher than urban in the FMCG space. In the case of GCPL, rural growth (17 percent YoY) is expected to remain ahead of urban areas (13 percent YoY) in coming quarters.

While the businesses are on the mend, volume-led growth so far have been the highlight, we expect pricing and innovation contribution to be tested in times to come. Also, fragile recovery in both Indonesia and domestic household insecticides needs a close watch.

The stock has risen ahead of the sector in 2018 so far (33 percent) and currently trades at a premium valuations (46 times FY20e earnings) which prices in the recent recovery. A FMCG stock with relatively higher exposure to international markets (50 percent of sales), wherein growth visibility and earnings stability are lower than the domestic market, warrants a lower multiple.

While there is a possibility of broad-based recovery in the domestic market, a credible growth in some categories like household insecticides at this juncture is needed for enhanced conviction in our opinion.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!