The assets under management (AUM) of India’s mutual fund (MF) industry tell a story.

That is, the AUM figure stood at Rs 26.5 lakh crore as of December-end 2019, an increase of 10 percent from a year ago, data released by AMFI (Association of Mutual Funds in India) on Wednesday showed. On a month on month basis, it declined by 1.5 percent in December.

Net inflow for the sector came in at Rs 1,394 crore as against Rs 802 crore in November. Liquid funds bore the brunt with large outflows while equity funds – the most awaited and a key data point – saw encouraging inflows.

Tracking AUM fortunesThe AUM graph has grown from strength to strength. From Rs 10.5 lakh crore as of December-end 2014 to Rs 26.5 lakh crore at the end of December 2019, it has more than doubled in 5 years.

No wonder, asset management companies (AMCs) had a dream run in 2019. The stock price of two listed asset managers – HDFC AMC and Reliance Nippon – more than doubled, too.

Read: Will the rally in HDFC AMC and Reliance Nippon continue in 2020?

The gradual shift of household savings away from physical to financial assets and the increasing share of MFs in part explain this stellar AUM growth. The trend, referred to as “financialisation of savings”, got a leg-up after demonetisation, translating into a sharp jump in inflows for the MF industry.

Outflow in liquid fundsBut liquid and overnight market funds are not that lucky. They saw outflows of Rs 80,000 crore in December because of seasonality issues. Fund houses usually see redemptions in December as corporates that are active investors in liquid funds tend to redeem their liquid investments to meet advance tax payment deadline.

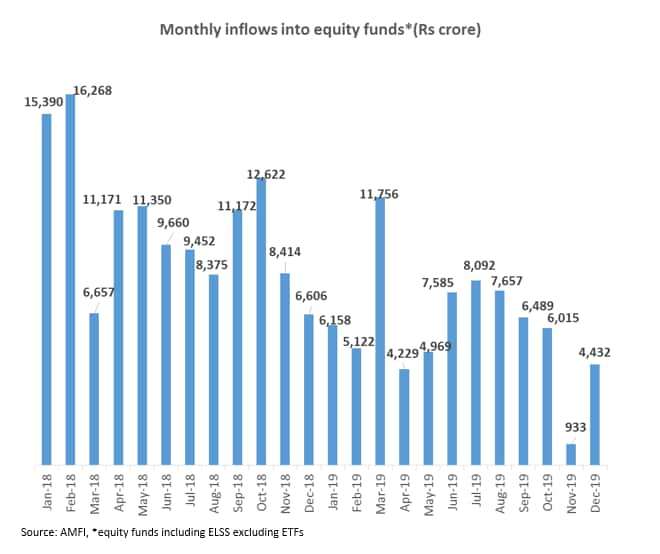

Inflows into equity funds, including closed-ended schemes, jumped to Rs 4,432 crore in December, from Rs 933 crore in the previous month.

Monthly net equity inflows have come off significantly from the peak of Rs 20,308 crore in November 2017. However, the underlying trend continues to be very healthy.

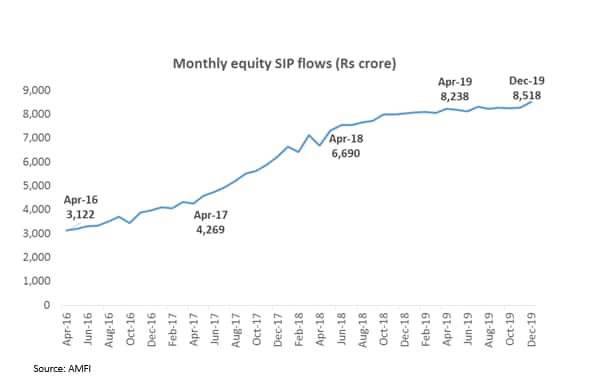

There is one trend that clearly stands out. Investment in equity funds through systematic investment plans (SIPs), which tend to be relatively sticky, continued to improve, given the highest-ever mobilisation at Rs 8,518 crore for December. This compares well with SIP flows of Rs 8,273 crore in November and is a positive sign, indicating buoyancy in retail flows.

While the overall equity flows have been on a shaky pitch, the MF industry has not seen rise in cancellation of SIPs.

The stability in SIP’s contribution is the key success story of MFs. Going by the current SIP monthly run rate of above Rs 8,000 crore, the industry will receive equity inflows of at least around Rs 1,00,000 crore in 2019-20, which is sizeable enough.

SIPs also have played a key role in bringing smaller investors into the MF fold. Individual investors now hold a higher share of MF assets at around 54 percent of total AUM as of November-end, according to AMFI.

Various marketing initiatives and investor awareness campaigns such as ‘Mutual Funds Sahi Hai’ by AMFI have further popularised MFs.

Most importantly, progressive reforms and regulations by the Securities and Exchange Board of India (SEBI) such as introduction of direct plans, capping of fees charged by MFs to investors, standardization of MF schemes and disclosures have been strong growth drivers.

Overall, MFs continue to break new ground in the financial services sector, making investor capital a key pivot for the country’s growth machinery.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!