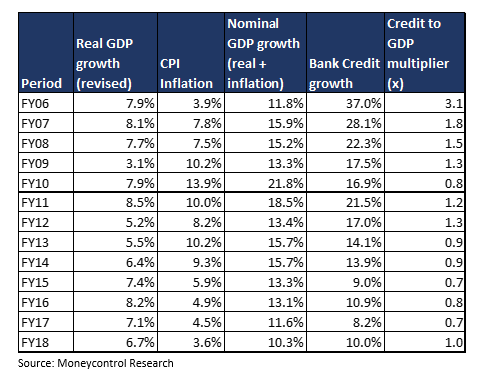

Credit is a necessary and probably most important ingredient for economic growth which is reflected in positive co-relation between credit and GDP growth. However, the link between bank credit and GDP has weakened over the years as banks started accommodating companies through other sources like CPs, bonds, etc. and more importantly, as NBFCs enhanced their share. As a result, bank credit multiplier to nominal GDP fell below 1x after recording a high of 3x in FY06.

Coming to the current period, in a statement after monetary policy, RBI governor Dr. Urjit Patel alluded that credit growth is comfortably in excess of nominal GDP growth indicating sound health of economy. The nominal GDP growth is hovering around 10 percent with real growth around 7.1 percent and retail inflation as measured by CPI declining to 3.3 percent in October. At the same time, banking system credit growth has improved to around 15 percent, the highest in five years. While this is definitely a positive trend, the moot question that arise: Is the mid-teen credit growth sustainable? While this is difficult to predict, we look at the 2 main drivers of banking system credit growth in Oct’18 to pre-empt a trend, if any.

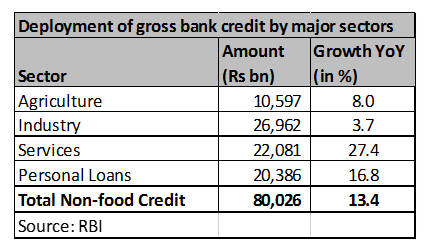

Credit to industries has been the one of the main culprit behind falling credit growth numbers in past 7-8 years. From expanding at more 20 percent in FY11, credit to industry has seen contraction and flattish growth in recent years. Though sluggish, it expanded by 4 percent YoY as at end October, hitting a 12-month high. Industrial credit growth is showing signs of revival after a marked loss of share in outstanding bank credit. The recovery is corroborated by increase in capacity utilization from 73.8 percent in Q1 to 76.1 percent in Q2 as per RBI data.

Recent monetary policy statement clearly mentioned that there has been significant acceleration in investment activity and high frequency indicators suggest that it is likely to be sustained. It further specified that industrial activity has been improving in Q3. Given these prospects, industry credit growth could continue to expand and support overall credit growth.

Sharp growth driven by lending to NBFCsThe latest credit growth is broad based with credit to services continuing to lead the growth, increasing by 27 percent YoY.

Within services, credit to NBFCs grew by whopping 56 percent, a 7 year high. While bank credit to NBFCs has been accelerating over the last 18 months, thanks to recent steep growth, the share of NBFCs in bank credit touched a record high of 7 percent as at October end. The current spurt in credit to NBFCs reflects the bid to provide liquidity to NBFCs.

To ease liquidity situation and enable NBFCs to raise funds from banks, just recently, RBI increased the concentration limits for banks’ exposure to individual NBFCs, including housing finance companies (HFCs), from 10 percent to 15 percent. The measure will create more headroom for bank on-lending to NBFCs in near term. Having said that, banks are increasingly preferring to buy retail portfolios/assets as against direct lending to NBFCs which is reflected in increasing volume of securitization transactions. This means that credit to NBFCs may moderate and likely be replaced by personal loans like housing, vehicle and other retail categories. Given this scenario, retail loans will continue to dominate credit – a trend that is likely to persist.

After clocking a robust 20 percent increase in H1 FY19 and growing at 18 percent CAGR in past five fiscals, non-bank (NBFCs and HFCs) credit growth is expected to halve to around 9 -10 percent in the H2 FY19 because of funding-access constraints, as per Crisil. However, overall credit pie will still continue to expand at healthy pace as NBFCs are expected to cede their market share in favor of banks, giving boost to the banking system credit growth.

Follow @nehadave01For more research articles, visit our Moneycontrol Research page.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.