Highlights:

-Targets to turn a zero debt company by March 2021

-Investment by Armaco to translate to Rs 100,000 crore inflow

-Adjusted net debt can potentially shrink by 1/3rd

-Moderating capex requirements adds to prospects for free cash flow sooner than earlier expected

--------------------------------------------------------

Reliance Industries has set itself a target of becoming a net-zero debt company by March 2021. A major push towards that is the deal with Saudi Aramco offering it a 20 percent stake in the oil-to-chemicals business, announced at RIL’s 42nd AGM.

With RIL’s 2021 vision in place, investors should expect major debt reduction moves through stake sale, asset monetisation and value unlocking through listing or strategic sale of key business divisions.

Along with these moves, RIL is doubling down on its consumer businesses—Reliance Retail and Reliance Jio Infocomm. These two consumer businesses contribute nearly 32 percent to the consolidated EBITDA currently and their share is likely to increase to 50 percent over next few years.

This transition to zero debt company along with transformation from commodity business to consumer oriented business should be value accretive for investors.

Pls read: Armaco & RIL – Tale of two transitions

Stake sale in oil to chemicals division

At the AGM, RIL Chairman Mukesh Ambani announced that Saudi Aramco will buy 20 percent in RIL’s oil-to-chemicals division for at an enterprise valuation of $75 billion. This ranks among India’s biggest inbound foreign investment with Armaco’s stake consideration translating to around Rs 100,000 crore for the refining and petrochemicals assets including petro-marketing joint venture.

In another announcement, RIL signed a joint-venture in the petroleum retailing business with BP wherein BP will acquire 49% in petro-retail business for Rs 7,000 crore.

Deleveraging benefit from new deals

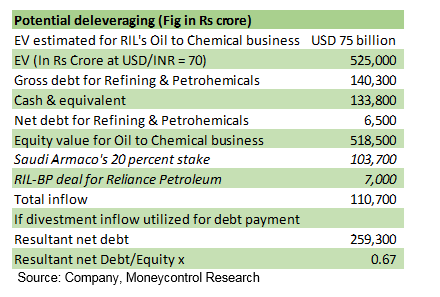

Our back of the envelope calculation suggest a 33 percent decrease in net debt if the inflows from the deals with Aramco and BP are used to repay debt. If we take account of all the off balance sheet items, net debt to equity ratio can reduce from around 1 x to 0.67x. Further, if the consolidated interest expense (reported + capitalised) are assessed, they constitute about around 45 percent of operating profit (EBIT) and this can reduce to around 30 percent. Thus, we may see a decent improvement in bottom-line as well.

Strong synergies

The deal with Saudi Armaco is a win-win situation for both parties in that Aramco would be able to seek a foothold in India's fast growing refining and petrochemical sectors, while Reliance would be able to gain from steady crude oil supply and financial support.

The deal will help state-owned Aramco to secure new markets for its crude as it sees growth in chemicals as central to its downstream strategy to reduce risk from weaker demand for oil.

For Reliance, the deal will guarantee a stable channel for crude supplies with Saudi Aramco supplying 500 KBPD of crude oils on a long term basis to RIL's Jamnagar refinery.

Earlier in June 2017, Reliance and BP had announced to jointly invest up to $6 billion to develop already-discovered deep water gas fields off the east coast of India (KG D6), which would help to boost gas output in a phased manner over 2020-2022. With an expected peak production of one billion cubic feet per day, equivalent to nearly 30% of India's current indigenous gas production, the JV is likely to emerge as a major contributor to India's energy security and has committed an investment of Rs 35,000 crore.

With BP already a partner in its upstream segment, now sealing a deal with BP on the downstream side means Reliance having the best of both worlds.

Capex down cycle

RIL’s capex run rate will decline significantly with the commissioning of majority of projects in petrochemical downstream and RIL reaching close to its target of 99 percent population coverage in the telecom business.

Among the key capex requirement in coming days would be for the Rs 35,000 crore needed for KG-D6 to augment production of methane. Here, the partnership with BP would be helpful. Other than that, the oil-to-chemicals business may not require any major commitment from RIL. The management has already declared that the capex cycle for telecom is over and any major capex requirement would expectedly be restricted to new business related to retail and connectivity. Lower capex along with these deals indicates that RIL is increasingly better positioned for a positive free cash flow cycle in days to come.

On an asset monetisation spree

Earlier this year, Reliance Jio Infocomm (RJIL), subsidiary of RIL, transferred its fibre and tower assets along with associated liabilities to two separate special purpose vehicles (SPVs). This was aimed at reducing RIL’s consolidated debt and monetising RIL’s investment in fibre and tower assets through outside investors. With commitments from reputed global investors, these transactions are likely to be completed by the end of FY20 investors as Ambani said in his speech.

RJIL has invested over Rs 350,000 crore towards creating a state-of-the-art digital infrastructure across India, with the largest optical fiber footprint. Divesting these assets into separate infrastructure investment trusts or InvITs is the way applied to monetise the investment.

Listing of the retail business

With turnover of more than Rs 130,000 crore, RIL has emerged as the largest and fastest-growing organised retailer in the domestic market. Increased emphasis on omnichannels and own brands and the ability to leverage RIL’s strengths (in terms of logistics, sourcing efficiencies, Jio’s vast customer base etc) boost its growth prospects noticeably. With improved margins and brisk pace of growth and retail stocks trading at rich valuation, an initial public offering of Reliance Retail may be just what the doctor ordered. But while an IPO may be some time away, the news of RIL warming up to a deal with a global retailer or strategic investor to help reduce its outstanding debt is already doing rounds.

Follow @nehadave01

Follow @anubhavsaysFor more research articles, visit our Moneycontrol Research page

Disclaimer: Reliance Industries Ltd. is the sole beneficiary of Independent Media Trust which controls Network18 Media & Investments Ltd. Moneycontrol Research analysts do not hold positions in the companies discussed here

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!