August 17, 2021 / 15:08 IST

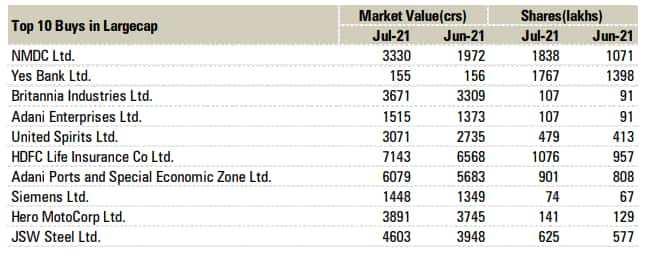

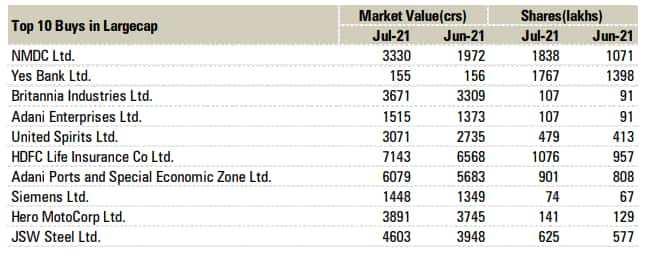

July turned out to be a flat month for the benchmark indices but equity funds attracted net inflows of Rs 22,583 crore, an almost fourfold increase from Rs 5,988 crore in June, according to the Association of Mutual Funds in India. “The past month has remained exceptionally good for equity funds, with the market witnessing a net inflow of Rs 22,583.52 crore,” said Kavitha Krishnan, senior analyst – manager research, at Morningstar India. “A majority of flows came into flexi-cap funds with the category witnessing flows to the tune of Rs 11,508.24 crore. Thematic funds also witnessed inflows to the tune of Rs 5,728.5 crore.” One reason could be because of new fund offers in July. Four new equity funds put together brought in Rs 13,709 crore. Fund managers used the volatility in July to infuse funds in quality stocks across large, mid- and small-cap stocks, experts said. “Flows are increasing and, in fact, domestic institutions have managed to offset most of the selling pressure from FIIs in the month of July. FIIs sold to the tune of Rs 23,193 crore while domestic funds infused nearly Rs 18,392 crore,” said Shrikant Chouhan, executive vice president at Kotak Securities. “Smart money is entering in large-cap but underperforming stocks. Smart money is searching for quality and value. Since the beginning of August we saw flows for Bharti, Britannia, Escorts, ITC and HDFC.” Mutual funds were net equity buyers of Rs 13,917 crore as of July 29 compared with net purchases of Rs 6,437 crore on June 30. FIIs were net sellers of Rs 12,746 crore in July. They were net buyers of Rs 10,932 crore in June, IDBI Capital said in a report. Fund managers poured money into NMDC, YES Bank, Britannia Industries, United Spirits, Her MotoCorp, and JSW Steel, according to a report from ICICIdirect.

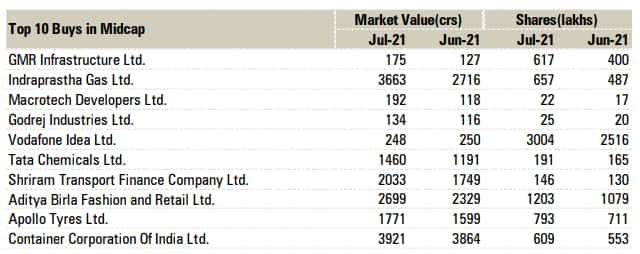

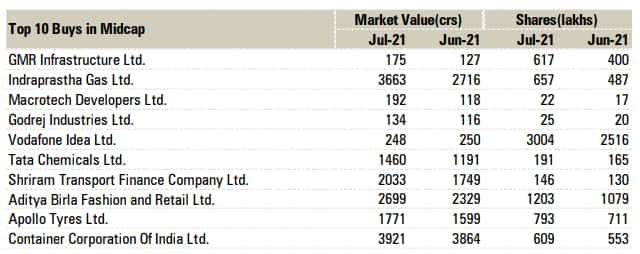

Source: ACE MF, ICICI Direct Research. Note: Largecaps/Midcaps/Smallcaps as defined by AMFI. Socks above Rs 50 crore holding were considered Small and mid-cap stocks outperformed the benchmark indices in July. The S&P BSE MidCap Index rose over 2 percent while the S&P BSE SmallCap Index rallied over 6 percent compared with a 0.2 percent gain in the Nifty 50 last month. The top 10 mid-cap stocks on the buy list of fund managers in July included GMR Infrastructure, Godrej Industries, Tata Chemicals, and Apollo Tyres.

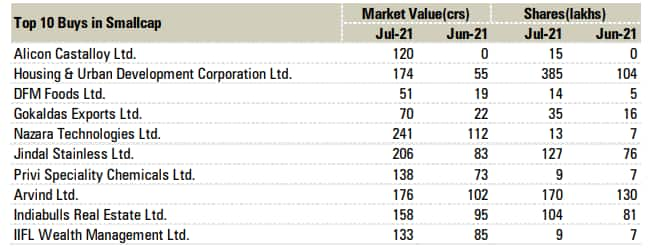

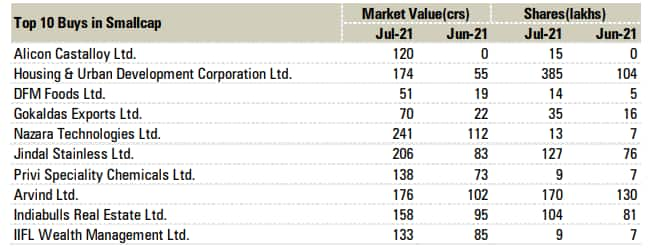

In the small-cap space, the top 10 stocks with buying interest included DFM Foods, HUDCO, Arvind, Indiabulls Real Estate and IIFL Wealth Management.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions. Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Source: ACE MF, ICICI Direct Research. Note: Largecaps/Midcaps/Smallcaps as defined by AMFI. Socks above Rs 50 crore holding were considered Small and mid-cap stocks outperformed the benchmark indices in July. The S&P BSE MidCap Index rose over 2 percent while the S&P BSE SmallCap Index rallied over 6 percent compared with a 0.2 percent gain in the Nifty 50 last month. The top 10 mid-cap stocks on the buy list of fund managers in July included GMR Infrastructure, Godrej Industries, Tata Chemicals, and Apollo Tyres.

Source: ACE MF, ICICI Direct Research. Note: Largecaps/Midcaps/Smallcaps as defined by AMFI. Socks above Rs 50 crore holding were considered Small and mid-cap stocks outperformed the benchmark indices in July. The S&P BSE MidCap Index rose over 2 percent while the S&P BSE SmallCap Index rallied over 6 percent compared with a 0.2 percent gain in the Nifty 50 last month. The top 10 mid-cap stocks on the buy list of fund managers in July included GMR Infrastructure, Godrej Industries, Tata Chemicals, and Apollo Tyres.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.