The market ended flat for the week ended November 22 as it remained volatile throughout amid no major domestic cues and no concrete signs of progress on the US-China relations.

In the past week, the Sensex ended flat at 40359.41 against November 15 close 40,356.69, while the Nifty also ended flat at 11914.4.

In last week, Cabinet gave the in-principle approval for disinvestment in select CPSEs. This includes the government's stake of 53.2 percent BPCL, excluding BPCL’s equity shareholding in Numalighar Refinery, based in Assam.

Also, the in-principle approval has also been granted for the government's 63.75 percent in Shipping Corporation of India, 30.8 percent of Container Corporation of India, to a strategic buyer.

Further, 74.23 percent of THDC and 100 percent in North Eastern Electric Power Corporation (NEEPCO) will be sold to NTPC.

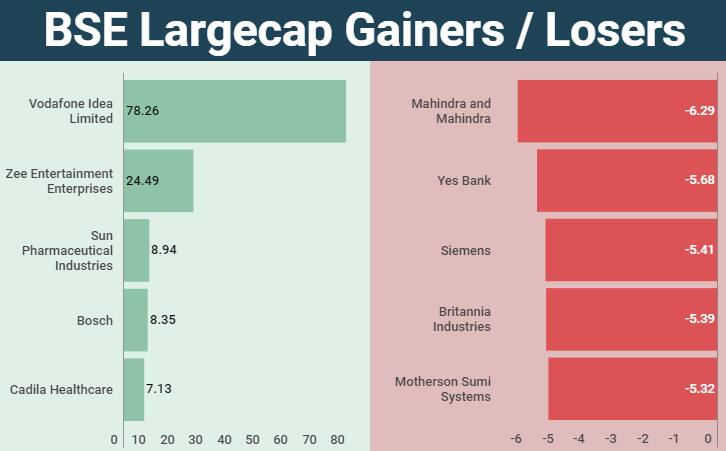

Essel Group on November 20 announced plans to sell 16.5 percent stake in its flagship company Zee Entertainment Enterprises to financial investors.

"We expect the Indian markets to remain under pressure in the near-term, as there are no visible positive triggers, which could boost investor sentiments. Further, market participants would continue to track global factors such as US-China trade deal, crude oil price and currency movement. We would recommend investors to follow stock-specific approach," said Ajit Mishra Vice President, Research, Religare Broking.

Foreign Institutional Investors (FIIs) remained net buyers the past week as they bought equities worth Rs 4,709.75 crore, while Domestic Institutional Investors (DIIs) also bought equities worth of Rs 330.1 crore.

On a weekly basis, the rupee rose 8 paise to end at 71.71 on November 22 versus the November 15 closing of 71.79.

"On the technical front, the level of 12,000 is seen as a key resistance by many market participants which adds up to the selling pressure. We believe post the short duration of profit booking, markets should reverse on a much more stronger footing," Joseph K Thomas Head of Research, Emkay Wealth Management said.

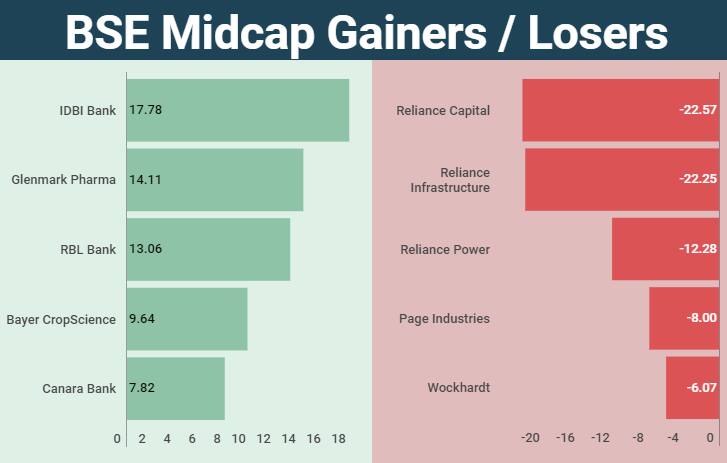

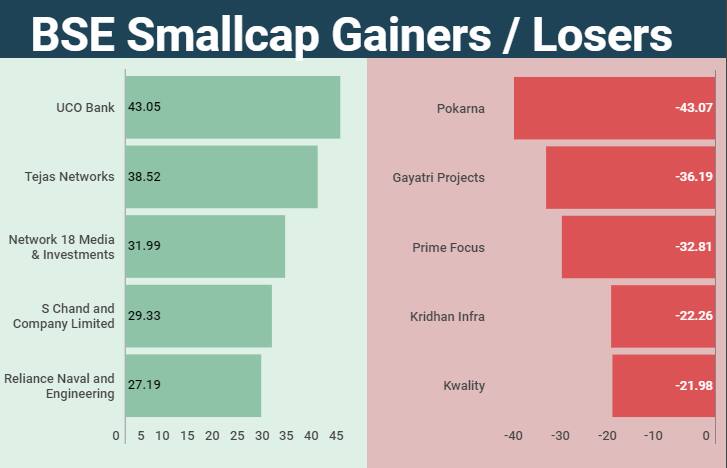

The BSE mid-cap index was down 0.23 percent, while the small-cap index rose 0.21 percent and the BSE large-cap index was up 0.15 percent in the past week.

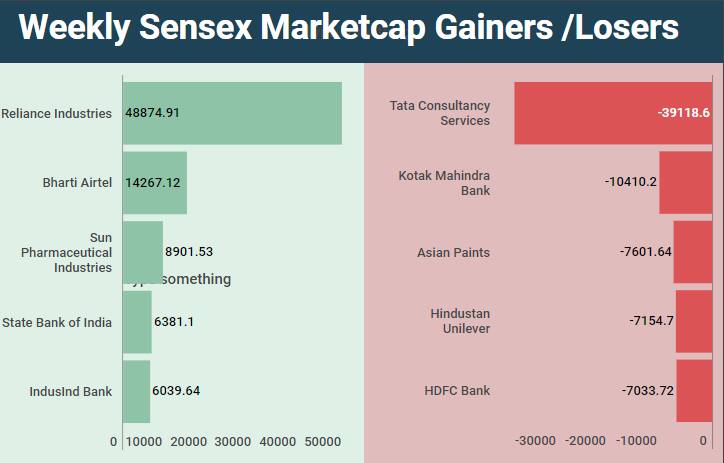

On the BSE, RIL added the most in terms of market value, followed by Bharti Airtel and Sun Pharma. On the other hand, TCS lost the most in terms of market value.

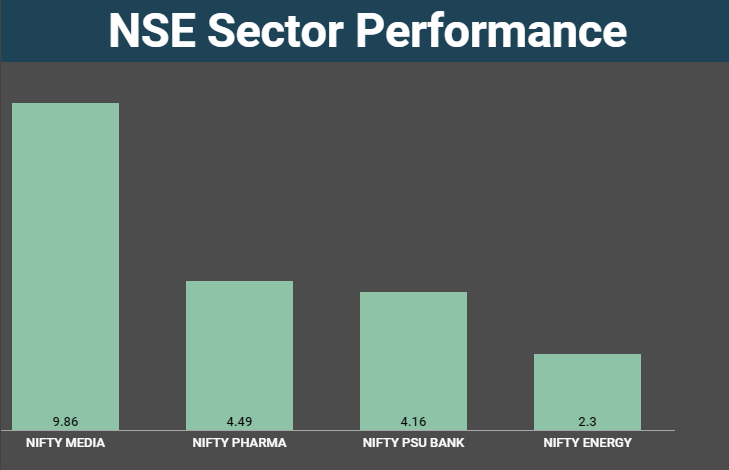

The Nifty Media index outperformed the sectoral indices with a gain of nearly 10 percent during the week.

Disclaimer: Reliance Industries is the sole beneficiary of Independent Media Trust which controls Network18 Media & Investments.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.