The market extended its northward journey for the third consecutive session on July 19 with the benchmark indices climbing 0.4 percent, supported by banks, auto, and metal stocks.

The BSE Sensex rose 246 points to 54,768, while the Nifty50 jumped 62 points to 16,340 and formed a bullish candle on the daily charts with higher high higher low formation for yet another session.

"On the daily charts, the Nifty has sustained above the previous day's gap and maintained higher top higher bottom formation indicating strong positive undertone of the index. The bulls are showing a strong grip over the market," Vidnyan Sawant, AVP - Technical Research at GEPL Capital said.

The momentum indicator RSI (relative strength index) has maintained its upward stance and sustained above the 60 mark for the first time after three months which confirms the strong positive momentum of the index, Sawant added.

The market expert said now the Nifty has immediate resistance levels at 16,561 (20 weeks SMA) followed by 16,794 (swing high), whereas it has strong support levels placed at 16,142 (2 days low) and 16,066 (gap support).

Looking at the overall price action and indicator setup, Sawant feels that the Nifty is moving towards its immediate upward target of 16,561, followed by 16,794 in the coming future.

The buying was also seen in broader space as the Nifty Midcap 100 index gained 0.67 percent and Smallcap 100 index rose 1 percent on positive market breadth.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.Key support and resistance levels on the Nifty

As per the pivot charts, the key support level for the Nifty is placed at 16,232, followed by 16,123. If the index moves up, the key resistance levels to watch out for are 16,404 and 16,468.

The banking stocks continued to support the benchmark index with Bank Nifty rising 362 points or 1 percent to 35,720 and forming a bullish candle on the daily charts. The important pivot level, which will act as crucial support for the index, is placed at 35,300, followed by 34,880. On the upside, key resistance levels are placed at 35,951 and 36,182 levels.

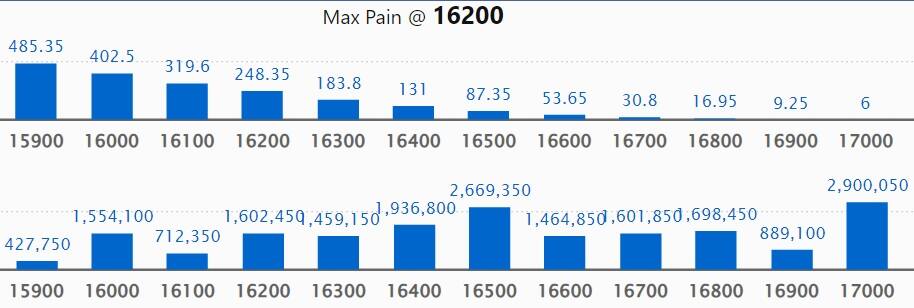

Maximum Call open interest of 29 lakh contracts was seen at 17,000 strike, which will act as a crucial resistance level in the July series.

This is followed by 16,500 strike, which holds 26.69 lakh contracts, and 16,400 strike, which has accumulated 19.36 lakh contracts.

Call writing was seen at 16,700 strike, which added 4.59 lakh contracts, followed by 17,000 strike which added 3.62 lakh contracts and 16,800 strike which added 2.94 lakh contracts.

Call unwinding was seen at 16,000 strike, which shed 1.38 lakh contracts, followed by 16,100 strike which shed 1.01 lakh contracts and 16,200 strike which shed 30,200 contracts.

Maximum Put open interest of 32.95 lakh contracts was seen at 16,000 strike, which will act as a crucial support level in the July series.

This is followed by 15,500 strike, which holds 27.44 lakh contracts, and 15,000 strike, which has accumulated 23.53 lakh contracts.

Put writing was seen at 16,300 strike, which added 6.95 lakh contracts, followed by 16,000 strike, which added 3.35 lakh contracts and 16,200 strike which added 3.3 lakh contracts.

Put unwinding was seen at 15,200 strike, which shed 3.13 lakh contracts, followed by 15,000 strike which shed 2.78 lakh contracts, and 15,600 strike which shed 2.33 lakh contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks. The highest delivery was seen in Power Grid Corporation of India, HDFC, Ambuja Cements, ICICI Lombard General Insurance, and Max Financial Services, among others.

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks including Polycab India, City Union Bank, AU Small Finance Bank, Ramco Cements, and Bank of Baroda, in which a long build-up was seen.

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks including Abbott India, Havells India, NBCC, Navin Fluorine International, and Cummins India, in which long unwinding was seen.

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks including Coforge, GAIL, HDFC Life Insurance Company, Biocon, and Muthoot Finance, in which a short build-up was seen.

53 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks including REC, Escorts, Nifty Financial, Bharti Airtel, and Crompton Greaves Consumer Electricals, in which short-covering was seen.

(For more bulk deals, click here)

Wipro, IndusInd Bank, Havells India, Ceat, Century Plyboards, Gland Pharma, Syngene International, Tata Communications, Hathway Cable & Datacom, JSW Ispat Special Products, Lloyds Steels Industries, Mastek, Agro Tech Foods, MIC Electronics, Newgen Software Technologies, Oracle Financial Services Software, Rane Engine Valve, Reliance Industrial Infrastructure, Sagar Cements, Sasken Technologies, and Som Distilleries & Breweries will be in focus ahead of quarterly earnings on July 20.

Stocks in News

Hindustan Unilever: The FMCG major recorded an 11% year-on-year growth in profit at Rs 2,289 crore for the quarter ended June 2022, with underlying volume growth of 6%, but EBITDA margin contracted 100 bps YoY to 23.2% amid unprecedented inflationary headwinds. Revenue grew by 20% to Rs 14,272 crore during the same period YoY.

Ambuja Cements: The cement maker registered a 25.5% year-on-year decline in consolidated profit at Rs 865.44 crore for the quarter ended June 2022 (Q2CY22), impacted by higher power & fuel cost, and freight & forwarding expenses. However, revenue increased 15.1% YoY to Rs 8,033 crore for the quarter.

Vedanta: The company said the board has approved second interim dividend of Rs 19.50 per equity share on face value of Re 1 per share for the financial year 2022-23. The dividend is amounting to Rs 7,250 crore. The record date for payment of dividend is July 27, 2022.

Grasim Industries: The Aditya Birla Group flagship company said the board has approved a foray into B2B e-commerce platform for the building materials segment with an investment of Rs 2,000 crore over the next 5 years. This investment adds a new high-growth engine with clear adjacencies within Grasim's standalone businesses as also that of its subsidiaries and associate companies.

ICICI Lombard General Insurance Company: The general insurance company reported a 80% year-on-year growth in profit at Rs 349 crore for the quarter ended June 2022. Total income grew by 3.8% to Rs 3,978.3 crore compared to year-ago period, and net premium earned jumped 10% to Rs 3,468 crore.

L&T Finance Holdings: The non-banking finance company has clocked a 47.4% year-on-year growth in profit at Rs 262 crore for the quarter ended June 2022, driven by fall in impairment on financial instruments. Revenue from operations declined 2.1% to Rs 2,988.40 crore during the same period YoY. The company reported highest-ever quarterly retail disbursements at Rs 8,938 crore, up 148% YoY.

Krsnaa Diagnostics: The company received order from Rajasthan Medical Education Society (Directorate of Medical Education), for supply, installation, operation and maintenance of CT Scan Center at Raj - MES Medical College at Churu, Rajasthan on public private partnership (PPP) basis. As per the tender awarded, the company will set up a CT Scan machine 64 slice scanner at MES Medical College. The tenure of contract will be 10 years.

Rallis India: The Tata Group company recorded a 18.1% year-on-year decline in profit at Rs 67.5 crore for the quarter ended June 2022, impacted by higher raw material cost. However, revenue increased 16.5% YoY to Rs 862.8 crore in Q1FY23 backed by 17.1% growth in domestic crop care business and 51% growth in exports.

Fund Flow

Foreign institutional investors (FIIs) have net bought shares worth Rs 976.40 crore, whereas domestic institutional investors (DIIs) net sold shares worth Rs 100.73 crore on July 19, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

The National Stock Exchange continued to keep Delta Corp under its F&O ban list for July 20 as well. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.