The recovery in last hour of trade helped the market close with moderate gains on June 28, backed by auto, metal, IT, select FMCG stocks and Reliance Industries. However, the gains were limited due to selling in private banking and financial services.

Positive global cues also supported the market. The BSE Sensex rose 16 points to 53,177, while the Nifty50 climbed 18 points to 15,850 and formed bullish candle on the daily charts.

"This pattern indicates an emergence of buying interest from the lows. After the display of lack of strength during upside breakout of significant resistance at 15,800 levels (resistance as per change in polarity), the market showed minor upside bounce from the dips and closed at the highs," said Nagaraj Shetti, Technical Research Analyst at HDFC Securities.

Having sustained above the important area of 15,750-15,800 levels, there is a possibility of further upside from here towards the next important resistance of 16,180 levels (opening downside gap of June 13), the market expert believes. "Immediate resistance is placed at 15,950 levels."

India VIX, which measures the expected volatility in the market, rose by 2.1 percent to 21.45 levels, discomforting bulls. Having volatility above 20 levels is a major concern for bulls and hence unless and until it falls and sustains below 20 levels the stability is unlikely, experts said.

There was a mixed trend in broader space with the Nifty Midcap 100 index climbing third of a percent and Smallcap 100 index declining third of a percent.

We have collated 15 data points to help you spot profitable trades:

Key support and resistance levels on the Nifty

As per the pivot charts, the key support level for the Nifty is placed at 15,743, followed by 15,636. If the index moves up, the key resistance levels to watch out for are 15,925 and 15,999.

Nifty Bank underperformed the broader space, falling 169 points to 33,642 on Tuesday. The important pivot level, which will act as crucial support for the index, is placed at 33,515, followed by 33,388. On the upside, key resistance levels are placed at 33,757 and 33,872 levels.

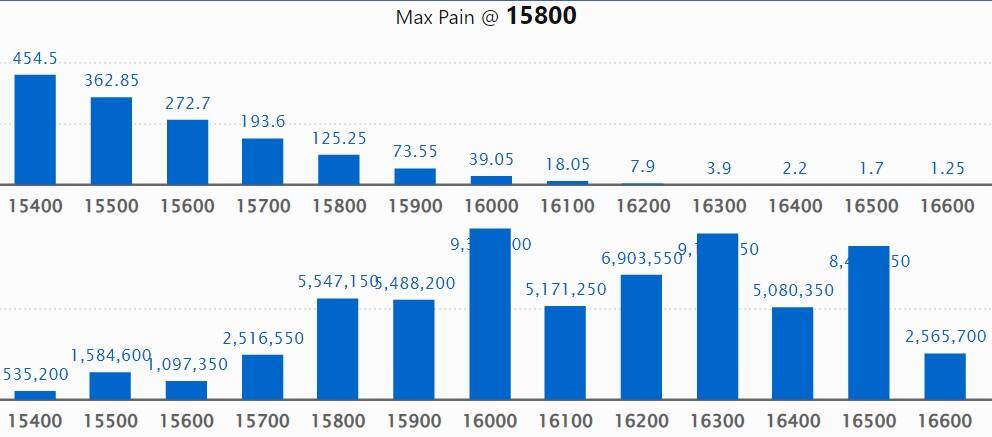

Maximum Call open interest of 93.8 lakh contracts was seen at 16,000 strike, which will act as a crucial resistance level in the June series.

This is followed by 16,300 strike, which holds 91.35 lakh contracts, and 16,500 strike, which has accumulated 84.52 lakh contracts.

Call writing was seen at 16,300 strike, which added 32.38 lakh contracts, followed by 15,800 strike that added 17.31 lakh contracts and 16,200 strike, which added 13.59 lakh contracts.

Call unwinding was seen at 16,700 strike, which shed 7.17 lakh contracts, followed by 17,000 strike which shed 4.91 lakh contracts and 16,600 strike which shed 3.17 lakh contracts.

Maximum Put open interest of 80.07 lakh contracts was seen at 15,000 strike, which will act as a crucial support level in the June series.

This is followed by 15,500 strike, which holds 73.4 lakh contracts, and 15,700 strike, which has accumulated 60.06 lakh contracts.

Put writing was seen at 15,800 strike, which added 17.91 lakh contracts, followed by 15,600 strike, which added 13.49 lakh contracts and 15,300 strike which added 13.25 lakh contracts.

Put unwinding was seen at 14,900 strike, which shed 7.36 lakh contracts, followed by 15,000 strike which shed 5.96 lakh contracts, and 14,700 strike which shed 5.75 lakh contracts.

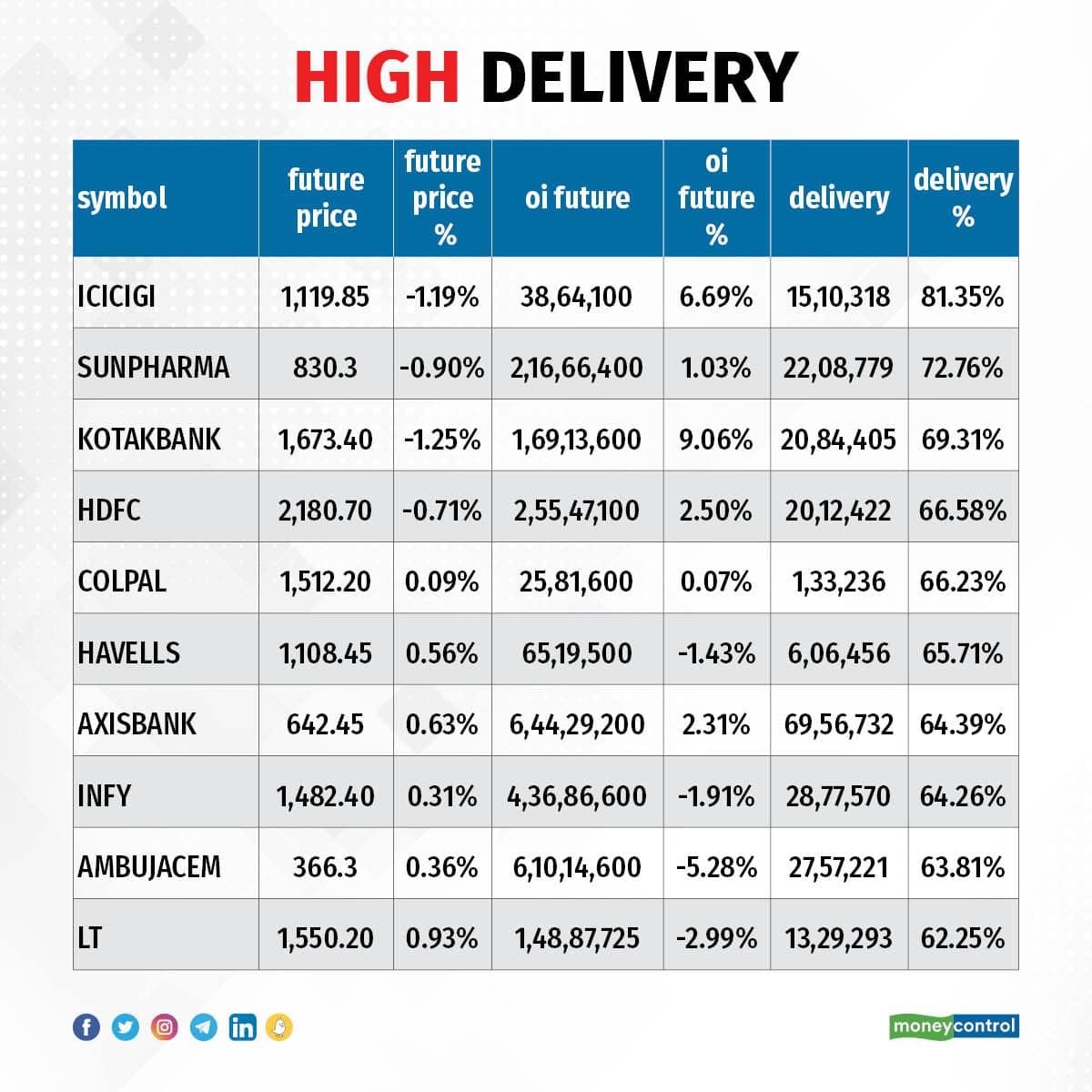

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks. The highest delivery was seen in ICICI Lombard General Insurance, Sun Pharma, Kotak Mahindra Bank, HDFC, and Colgate Palmolive, among others.

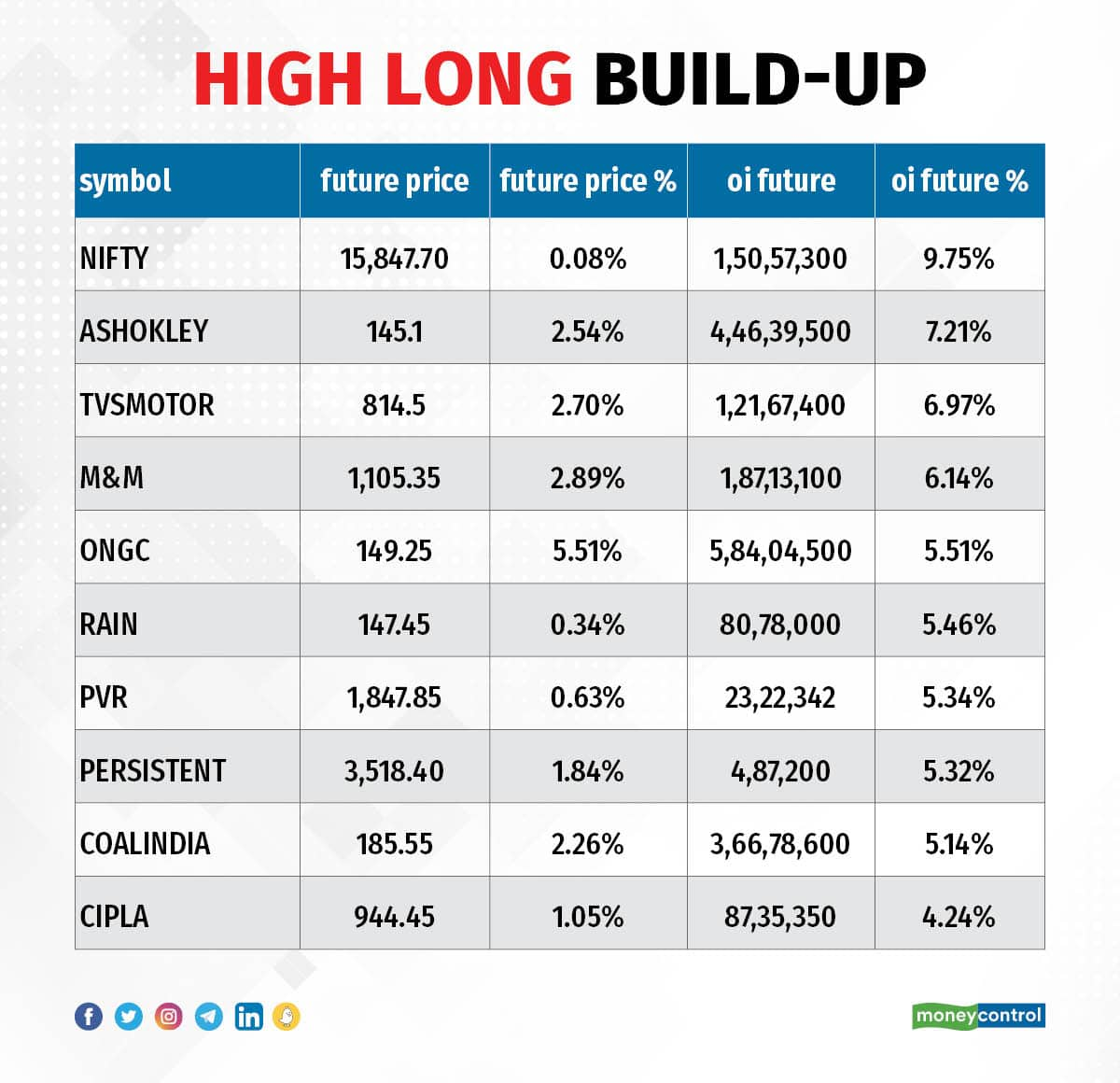

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks including Nifty, Ashok Leyland, TVS Motor Company, Mahindra & Mahindra, and ONGC, in which a long build-up was seen.

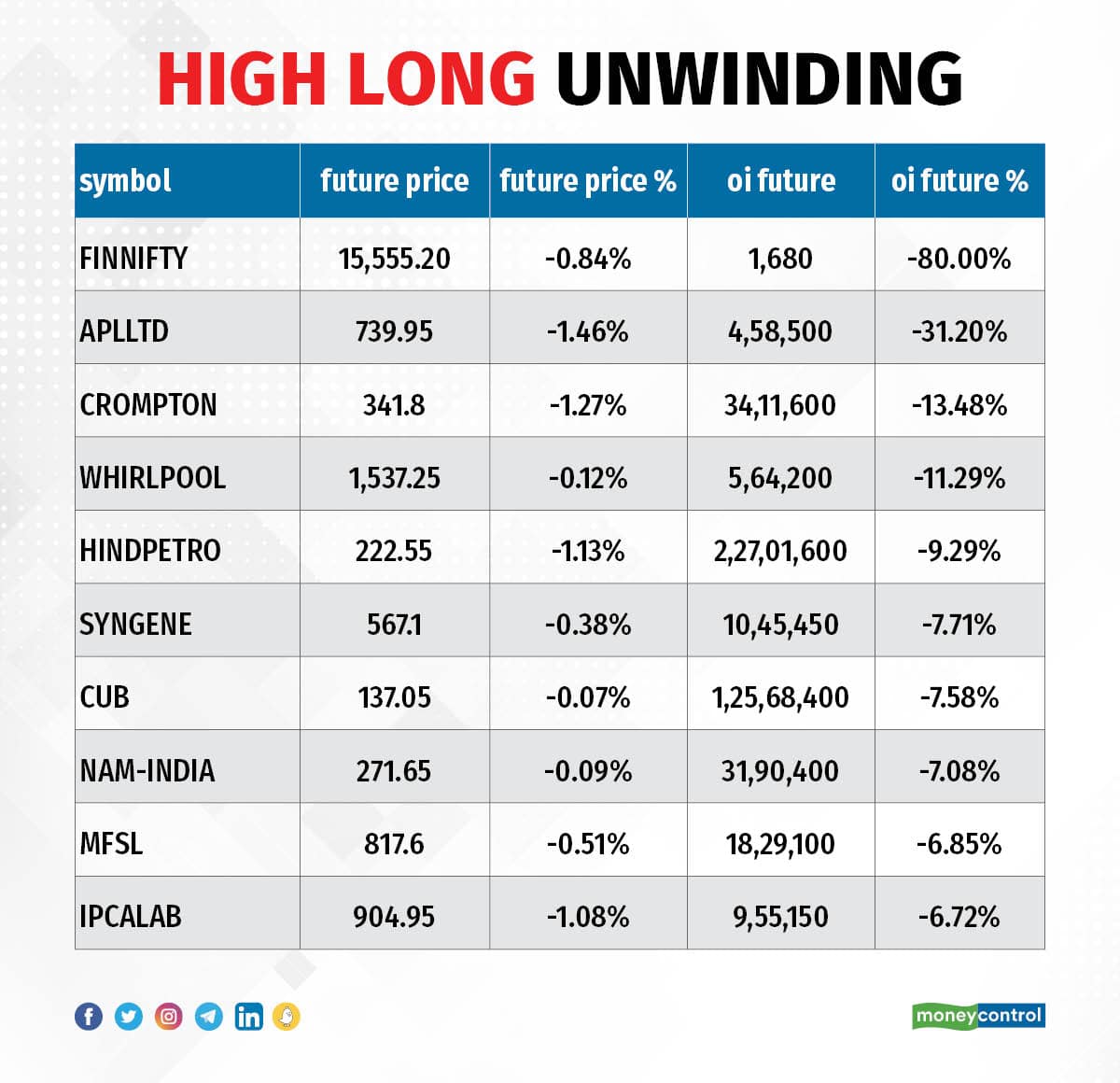

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks including Nifty Financial, Alembic Pharma, Crompton Greaves Consumer Electricals, Whirlpool, and HPCL, in which long unwinding was seen.

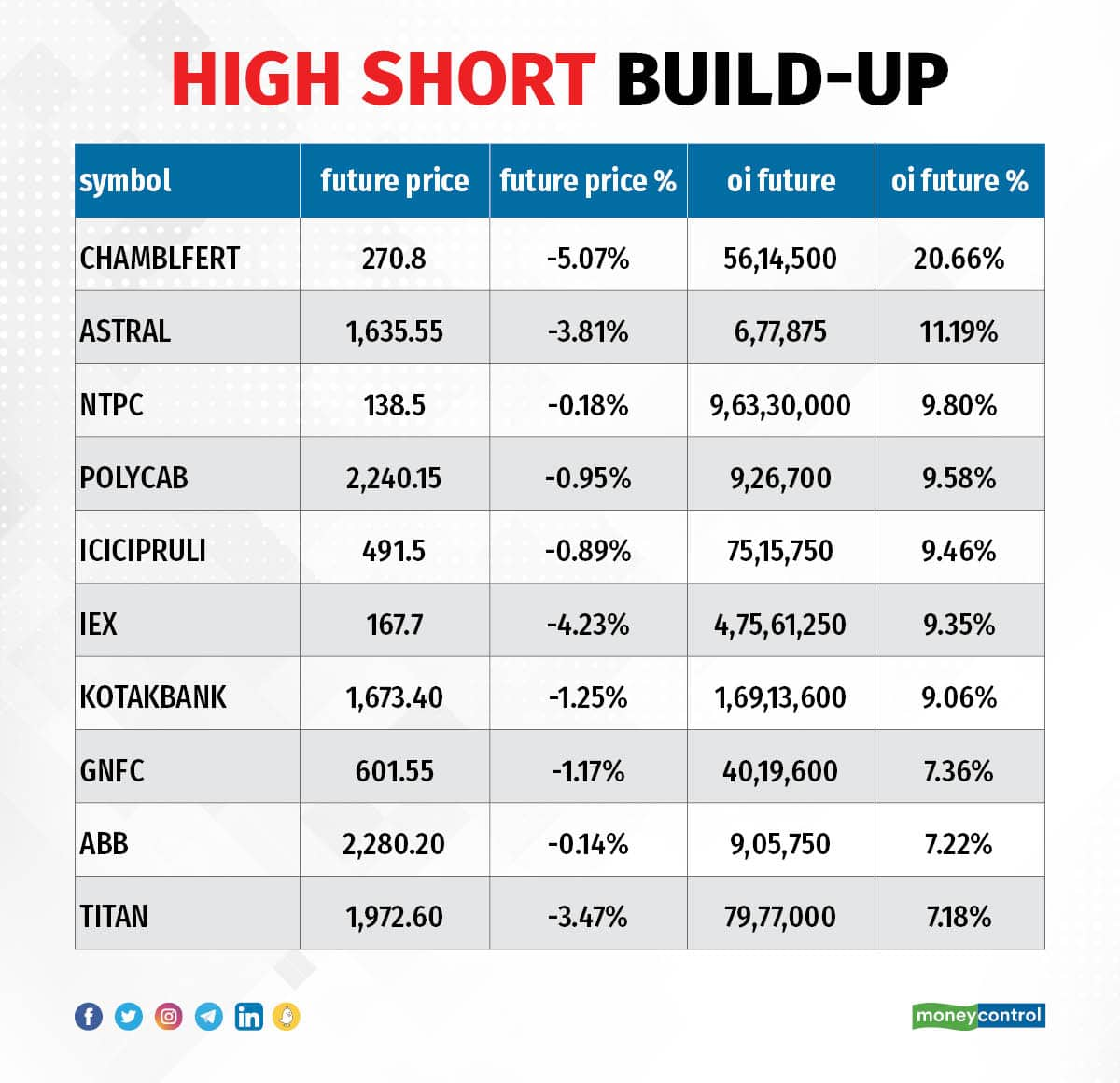

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks including Chambal Fertilizers, Astral, NTPC, Polycab India, and ICICI Prudential Life Insurance, in which a short build-up was seen.

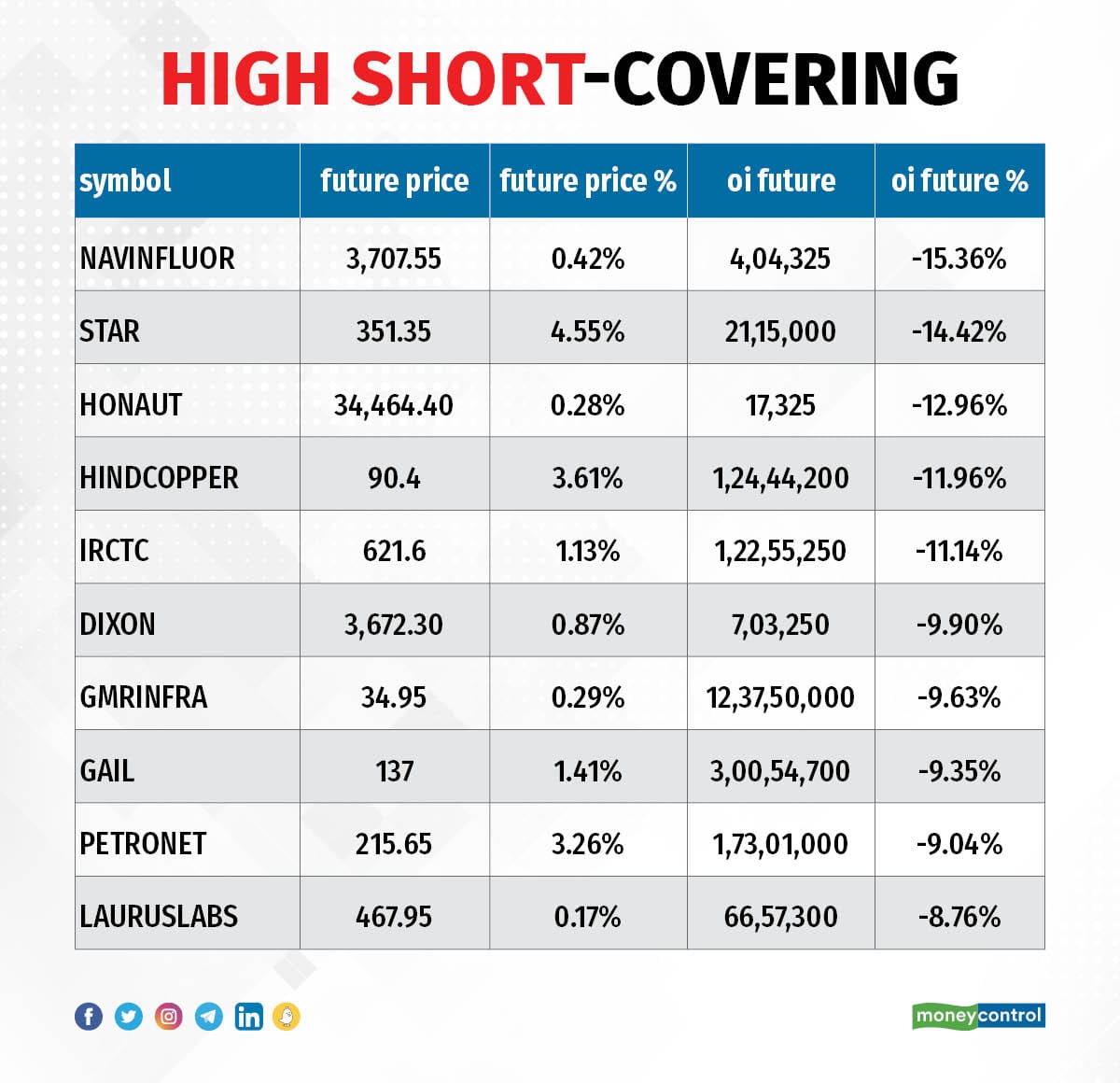

69 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks including Navin Fluorine International, Strides Pharma Science, Honeywell Automation, Hindustan Copper, and IRCTC, in which short-covering was seen.

(For more bulk deals, click here)

Investors Meetings on June 29

Polycab India: Officials of the company will meet Dolat Capital, Morgan Stanley, Unifi Capital, and Julius Baer Wealth Advisors (India).

Sapphire Foods India: Officials of the company will meet Motilal Oswal Financial Services.

CSB Bank, Raymond, India Pesticides, Ashoka Buildcon: Officials of the companies will attend Arihant Rising Star Summit 2022.

Maharashtra Seamless: Officials of the company will meet Kitara Capital LLP.

Indian Energy Exchange: Officials of the company will meet Dhandho Funds.

Kirloskar Ferrous Industries: Officials of the company will meet Monarch Networth Capital.

Graphite India: Officials of the company will meet DSP Mutual Fund.

HeidelbergCement India: Officials of the company will meet Franklin Templeton MF.

Dr Lal PathLabs: Officials of the company will meet Investec Capital.

Greaves Cotton: Officials of the company will attend ULJK Financial Services Investor Conference.

Radico Khaitan: Officials of the company will meet Bajaj Allianz Life Insurance.

Mahindra & Mahindra: Officials of the company will meet several funds and investors in non-deal roadshow in New York.

Infibeam Avenues: Officials of the company will meet Investec Capital Services (India).

Stocks in News

Route Mobile: The company said the board has approved the proposal of buyback of equity shares of the company up to Rs 120 crore at a price of up to Rs 1,700 per share. With this, the size of maximum buyback shares would be 7.05 lakh equity shares, which is 1.12 percent of paid-up equity.

Orient Bell: The company announced on-time completion of two of projects involving capex of Rs 20 crore. GVT Tile plant capacity in Sikandrabad (UP) has increased by 0.7 million square metres (MSM) per annum and there was a conversion of Dora plant (Gujarat) from ceramic floor to vitrified floor with incremental volume potential being around 1.2 MSM per annum.

State Bank of India: The country's largest lender has entered into an agreement for investment of Rs 4 crore in equity shares of Perfios Account Aggregation Services Private Limited, the NBFC-account aggregator. This investment would be subject to RBI approval. SBI will hold 9.54 percent stake in Perfios Account Aggregation Services.

Hazoor Multi Projects: The company has received work order from Nagpur Mumbai Super Communication Expressway Ltd for execution of change of scope work in district Ahmednagar of package-11 on EPC mode for Rs 14.11 crore.

Jammu & Kashmir Bank: The bank said the board has approved raising of equity capital upto Rs 500 crore in one or more tranches, and another Rs 1,500 crore through debentures on a private placement basis.

Godawari Power & Ispat: The company has acquired 37.79 lakh equity shares of Alok Ferro Alloys (AFAL) at a fair value comprising of 78.96 percent of the paid-up capital of AFAL. AFAL is into ferro alloys with captive power generation, having operations in Raipur, Chhattisgarh only.

Shri Bajrang Alliance: The company has signed a contract with LULU Group International LLC, Abu Dhabi for supply of GOELD frozen food items in Middle East Markets (UAE, KSA etc.) and also through their Indian network. The purchase orders for the first 2 lots have been received.

Fund Flow

Foreign institutional investors (FIIs) have net sold Rs 1,244.44 crore worth of shares, whereas domestic institutional investors (DIIs) remained net buyers, to the tune of Rs 1,205.63 crore worth of shares on June 28, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Two stocks - Delta Corp and Sun TV Network - are under the NSE F&O ban for June 29. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Disclaimer: Moneycontrol is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.