The market remained in a positive terrain throughout the session and settled with moderate gains on September 14, supported by select banks, auto, and IT stocks. However, the weakness in select FMCG, metals, HDFC twins and Bajaj twins capped upside.

The BSE Sensex rose 69.33 points to 58,247.09, while the Nifty50 hit a fresh record high of 17,438.55 before closing at 17,380, up 24.70 and formed a bearish candle on the daily charts as the closing was lower than opening levels.

"A small negative candle was formed on the daily chart, after a gap-up opening. Technically, this pattern signals a continuation of rangebound action in the market," said Nagaraj Shetti, Technical Research Analyst at HDFC Securities.

He further said the rangebound action continued in the market and this action could hint at a possibility of a minor upside breakout of sideways range in the short term. "The upper area of 17,500-17,600 is expected to be a crucial overhead resistance and one may expect profit booking emerging from the new highs. The immediate support is placed 17,260."

The outperformance by broader markets continued as the Nifty Midcap 100 index jumped 1.35 percent and Smallcap 100 index rose 0.29 percent.

We have collated 15 data points to help you spot profitable trades:Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.Key support and resistance levels on the NiftyAccording to pivot charts, the key support levels for the Nifty are placed at 17,351.87, followed by 17,323.73. If the index moves up, the key resistance levels to watch out for are 17,423.37 and 17,466.73.

Nifty BankThe Nifty Bank gained 141.30 points to close at 36,613.10 on September 14. The important pivot level, which will act as crucial support for the index, is placed at 36,509.8, followed by 36,406.5. On the upside, key resistance levels are placed at 36,736.2 and 36,859.3 levels.

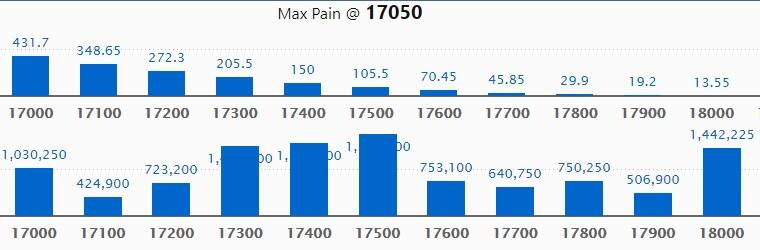

Call option dataMaximum Call open interest of 17.38 lakh contracts was seen at 17500 strike, which will act as a crucial resistance level in the September series.

This is followed by 17400 strike, which holds 15.63 lakh contracts, and 17300 strike, which has accumulated 14.90 lakh contracts.

Call writing was seen at 17900 strike, which added 1.38 lakh contracts, followed by 17600 strike, which added 1.27 lakh contracts and 17400 strike which added 20,200 contracts.

Call unwinding was seen at 17300 strike, which shed 1.08 lakh contracts, followed by 17000 strike, which shed 78,475 contracts, and 16800 strike which shed 26,150 contracts.

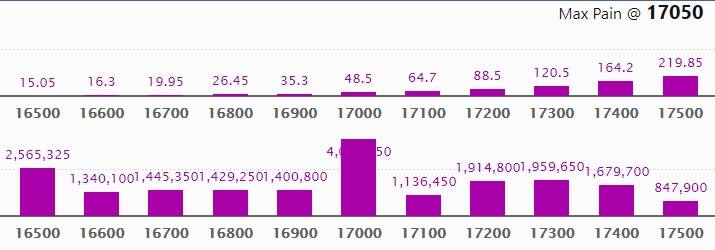

Maximum Put open interest of 40.87 lakh contracts was seen at 17000 strike, which will act as a crucial support level in the September series.

This is followed by 16,500 strike, which holds 25.65 lakh contracts, and 17,300 strike, which has accumulated 19.59 lakh contracts.

Put writing was seen at 17,400 strike, which added 5.68 lakh contracts, followed by 17,500 strike which added 46,700 contracts, and 17,000 strike which added 44,250 contracts.

Put unwinding was seen at 16,900 strike, which shed 2.9 lakh contracts, followed by 16,600 strike which shed 2.51 lakh contracts and 16,500 strike which shed 1.51 lakh contracts.

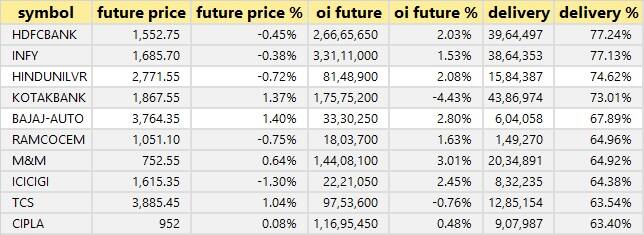

A high delivery percentage suggests that investors are showing interest in these stocks.

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

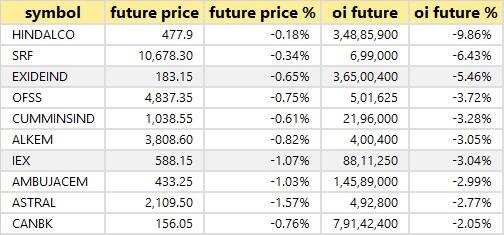

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

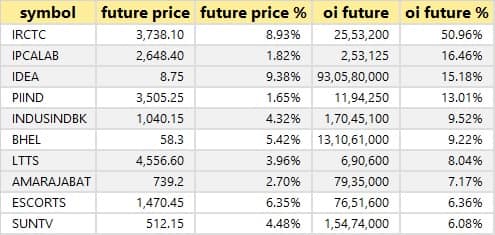

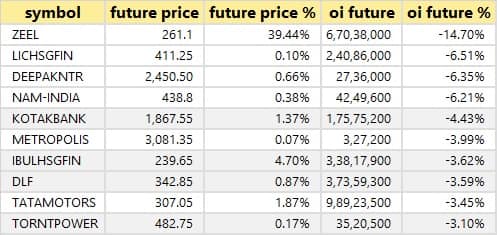

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

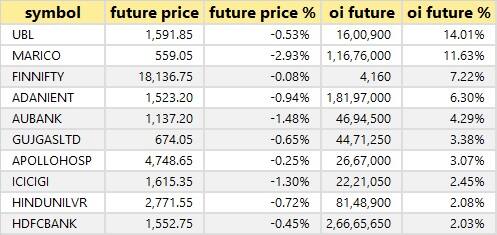

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen. Zee Entertainment Enterprises witnessed higher short covering, followed by LIC Housing Finance and Deepak Nitrite.

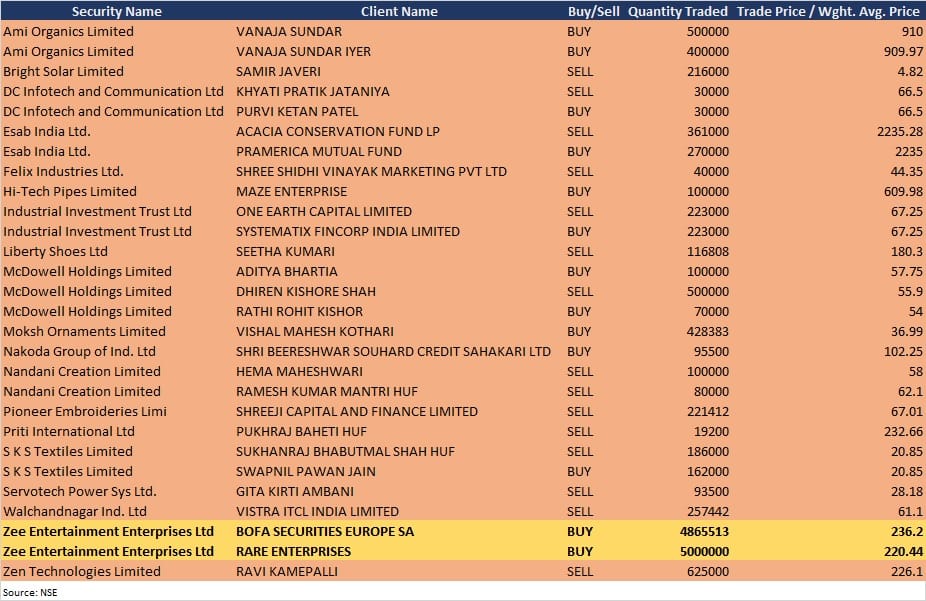

Zee Entertainment Enterprises: Rare Enterprises, a stock trading firm owned by ace investor Rakesh Jhunjhunwala, bought 50 lakh equity shares in the company, representing 0.52 percent of the total paid-up equity, at a price of Rs 220.44 per share on the NSE, the bulk deals data showed. The stake is valued at Rs 110.22 crore. BofA Securities Europe SA also acquired 48,65,513 equity shares in Zee today at Rs 236.2 per share.

Ami Organics: Vanaja Sundar acquired 5 lakh shares in the specialty chemical company at Rs 910 per equity share and Vanaja Sundar Iyer bought 4 lakh shares at Rs 909.97 per share on the NSE, the bulk deals data showed.

Esab India: Acacia Conservation Fund LP sold 3.61 lakh equity shares in the welding and cutting equipment manufacturer at Rs 2,235.28 per share. Pramerica Mutual Fund was the buyer for some of shares, acquiring 2.7 lakh equity shares at Rs 2,235 per share on the NSE, the bulk deals data showed.

(For more bulk deals, click here)

Analysts/Investors MeetingUltraTech Cement: The company's officials will meet AIA Investment Management, Manulife Asset Management, and Skerryvore Asset Management on September 15.

Piramal Enterprises: The company's officials will meet investors in CLSA Investor Conference on September 15-16.

Krishna Institute of Medical Sciences: The company's officials will meet analysts and investors through a virtual conference call hosted by Motilal Oswal on September 15.

Kamdhenu: The company's officials will meet a group of investors / mutual funds / institutional investors/analyst / external parties on September 15.

Ramco Systems: The company's officials will meet investors in DART India Virtual Conference Series 2021 on September 15.

Symphony: The company's officials will meet investors in Equirus Virtual Mid/Small Cap Conference on September 21, and meet Taiyo Pacific Partners on September 24.

Stocks in NewsSetco Automotive: 16.25 percent stake pledged by promoter entity Setco Engineering against loan taken has been released.

Liberty Shoes: Investor Seetha Kumari sold 2.57 percent stake in the company via open market transactions, reducing shareholding to 2.73 percent from 5.3 percent earlier.

Dynacons Systems & Solutions: The company won an e-governance contract worth Rs 7.46 crore for development & management of GMDMA website, disaster management app and command & control system along with comprehensive maintenance of automatic weather stations, flow level sensor from the Municipal Corporation of Greater Mumbai.

Power Finance Corporation: UBS Group AG increased stake in the company to 5.67 percent from 3.4 percent earler, through the rights issue.

LIC Housing Finance: Life Insurance Corporation of India's stake in the company increased to 45.239 percent from 40.313 percent post preferential allotment.

Jindal Steel & Power: CRISIL has upgraded its rating from 'A' with 'stable' outlook to 'A+' with 'Positive' outlook on the long term bank facilities and from "A2+" to "Al+" for short term bank facilities of the company.

Fund flow

Foreign institutional investors (FIIs) net bought shares worth Rs 1,649.60 crore, while domestic institutional investors (DIIs) net sold shares worth Rs 310.31 crore in the Indian equity market on September 14, as per provisional data available on the NSE.

Stocks under F&O ban on NSEEight stocks - Canara Bank, Escorts, Exide Industries, Vodafone Idea, IRCTC, LIC Housing Finance, NALCO and Sun TV Network - are under the F&O ban for September 15. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!