The market hit fresh record high during the session, but continued to see rangebound action with volatility for fourth consecutive day and closed moderately higher on August 10. The broader markets witnessed sharp correction today with the Nifty Midcap 100 index falling 1.09 percent and Smallcap 100 index down 2.3 percent, which experts feel could be a cause of concern.

The BSE Sensex gained 151.81 points to close at 54,554.66, while the Nifty50 rose 21.80 points to 16,280.10 and formed Doji kind of pattern on the daily charts as the closing was near opening levels.

"A small positive candle was formed with upper and lower shadow. Technically, this action signal a formation of high wave type candle pattern. Normally, such high wave formation after a reasonable upmove or decline more often act as a reversal. But, having formed this pattern amid sideways range movement, the significant predictive value is ruled out," said Nagaraj Shetti, Technical Research Analyst at HDFC Securities.

He further said, "The Nifty continues to trade in a narrow range with volatility and this market action could continue for the next session. After the upside breakout of the broader range recently, the Nifty sustaining with the upside breakout could be positive indication with regards to a trend of index."

"A decisive move above 16,360 is expected to open next upside towards 16,500 levels in the near term. Immediate support is placed at 16,200-16,150 levels," he added.

We have collated 15 data points to help you spot profitable trades:Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.Key support and resistance levels on the NiftyAccording to pivot charts, the key support levels for the Nifty are placed at 16,201.8, followed by 16,123.5. If the index moves up, the key resistance levels to watch out for are 16,358.8 and 16,437.5.

Nifty BankThe Nifty Bank rose 5.15 points to close at 36,034.10 on August 10. The important pivot level, which will act as crucial support for the index, is placed at 35,844.07, followed by 35,654.04. On the upside, key resistance levels are placed at 36,270.57 and 36,507.04 levels.

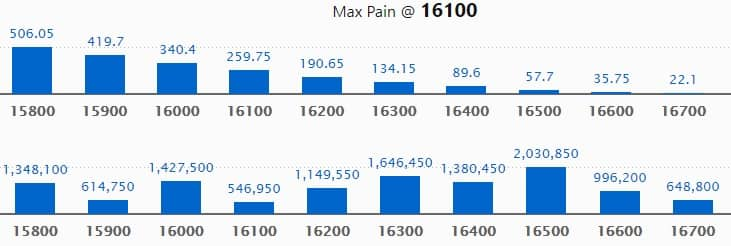

Call option dataMaximum Call open interest of 20.30 lakh contracts was seen at 16,500 strike, which will act as a crucial resistance level in the August series.

This is followed by 16,300 strike, which holds 16.46 lakh contracts, and 16,000 strike, which has accumulated 14.27 lakh contracts.

Call writing was seen at 16,500 strike, which added 2.34 lakh contracts, followed by 17,000 strike, which added 1.15 lakh contracts and 16,300 strike which added 1.03 lakh contracts.

Call unwinding was seen at 16,100 strike, which shed 88,250 contracts, followed by 15800 strike which shed 51,550 contracts, and 16,000 strike which shed 49,050 contracts.

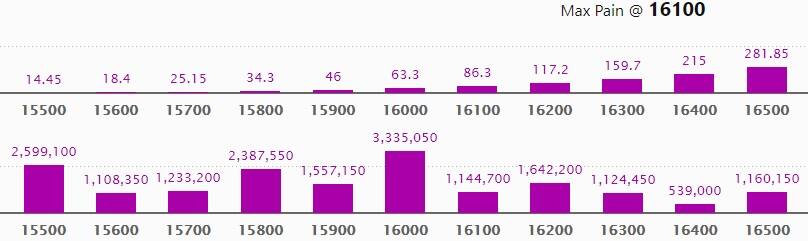

Maximum Put open interest of 33.35 lakh contracts was seen at 16,000 strike, which will act as a crucial support level in the August series.

This is followed by 15,500 strike, which holds 25.99 lakh contracts, and 15,800 strike, which has accumulated 23.87 lakh contracts.

Put writing was seen at 16,500 strike, which added 2.52 lakh contracts, followed by 16,200 strike which added 1.57 lakh contracts, and 15,600 strike which added 1.04 lakh contracts.

Put unwinding was seen at 15,500 strike, which shed 1.76 lakh contracts, followed by 15,900 strike which shed 57,500 contracts, and 15,800 strike which shed 40,100 contracts.

A high delivery percentage suggests that investors are showing interest in these stocks.

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

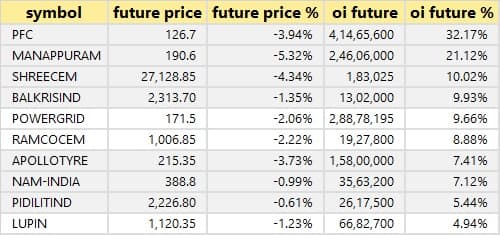

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

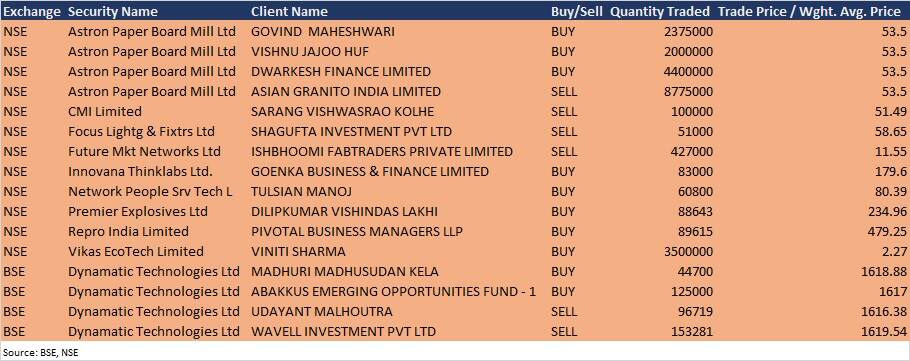

Dynamatic Technologies: Madhuri Madhusudan Kela acquired 44,700 equity shares in the company at Rs 1,618.88 per share and Abakkus Emerging Opportunities Fund - 1 bought 1.25 lakh shares in the company at Rs 1,617 per share. However, promoters - Udayant Malhoutra sold 96,719 equity shares in the company at Rs 1,616.38 per share and Wavell Investment sold 1,53,281 equity shares in the company at Rs 1,619.54 per share on the BSE, the bulk deal data showed.

(For more bulk deals, click here)

Results on August 11, and Analysts/Investors MeetingResults on August 11: Cadila Healthcare, Aptech, Aries Agro, Ashiana Housing, Aster DM Healthcare, Antony Waste Handling Cell, Bajaj Electricals, Bata India, BF Utilities, Birla Cable, Bharat Road Network, CESC, CreditAccess Grameen, Cummins India, Endurance Technologies, Equitas Holdings, Force Motors, Greaves Cotton, HEG, IDFC, India Cement, Kolte-Patil Developers, Lemon Tree Hotels, Novartis India, Pidilite Industries, PNC Infratech, Rupa & Company, Take Solutions, VIP Industries, and VA Tech Wabag will release their quarterly earnings on August 11.

Angel Broking: The company's officials will meet investors on August 11 in a conference call hosted by Citigroup Global Markets India.

VIP Industries: The company's officials will meet analysts and institutional investors on August 11, for discussing company's performance for June quarter.

India Cements: The company's officials will meet investors and analysts on August 11 post financial results.

Motherson Sumi Systems: The company's officials will meet investors in Investment delegation Conference organised by Spark Capital on August 11, and Annual Corporate Conference by Emkay on August 12.

Max Healthcare Institute: The company's officials will meet Fidelity Management & Research (Hong Kong) on August 11, Briarwood and TR Capital on August 12.

Welspun Corp: The company's officials will meet Authum Investment & Infrastructure on August 11.

Globus Spirits: The company's officials will meet investors and analysts on August 11, in Emkay Confluence Conference.

Mrs. Bectors Food Specialities: The company's officials will meet analysts aqnd investors on August 12 post announcement of financial results.

Can Fin Homes: The company's officials will meet My Lead Fintech on August 12, and Quantum Securities on August 16.

AIA Engineering: The company's officials will meet investors on August 13, to discuss the financial performance.

Stocks in NewsAarey Drugs & Pharmaceuticals: The company reported higher profit at Rs 2.5 crore in Q1FY22 against Rs 1.35 crore in Q1FY21, revenue increased to Rs 97.51 crore from Rs 25.21 crore YoY.

Fortis Malar Hospitals: The company reported consolidated loss at Rs 1.34 crore in Q1FY22 against loss of Rs 2.91 crore in Q1FY21, revenue rose to Rs 23.18 crore from Rs 9.43 crore YoY.

Nath Bio-Genes (India): The company reported higher profit at Rs 44.91 crore in Q1FY22 against Rs 41.25 crore in Q1FY21, revenue increased to Rs 215.1 crore from Rs 193.64 crore YoY.

Pricol: The company reported consolidated profit at Rs 5.94 crore in Q1FY22 against loss of Rs 30.85 crore in Q1FY21, revenue rose to Rs 319.91 crore from Rs 120 crore YoY.

Gujarat Alkalies and Chemicals: The company reported higher consolidated profit at Rs 63.12 crore in Q1FY22 against Rs 31.81 crore in Q1FY21, revenue increased to Rs 716.44 crore from Rs 469.61 crore YoY.

Ahluwalia Contracts (India): The company reported higher consolidated profit at Rs 34.78 crore in Q1FY22 against Rs 7.47 crore in Q1FY21, revenue jumped to Rs 580.09 crore from Rs 249.84 crore YoY.

Fund flow

Foreign institutional investors (FIIs) net sold shares worth Rs 178.51 crore, while domestic institutional investors (DIIs) net bought shares worth Rs 689 crore in the Indian equity market on August 10, as per provisional data available on the NSE.

Stocks under F&O ban on NSESeven stocks - Canara Bank, Indiabulls Housing Finance, NALCO, Punjab National Bank, RBL Bank, SAIL and Sun TV Network - are under the F&O ban for August 11. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!