The Indian market ended almost flat on August 25 owing to profit-booking in select heavyweights amid mixed Asian cues as investors turned cautious ahead of the release of US new home sales data and Federal Reserve Chairman Jerome Powell speech.

Sensex closed 45 points up at 38,843.88 and the Nifty settled just 6 points higher at 11,472.25.

"The recent buoyancy in the banking space is helping the index to inch higher while other index heavyweights are seeing a pause. We reiterate our bullish view on the market and suggest continuing with the 'buy on dips' approach," Ajit Mishra, VP-Research, Religare Broking, said.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support level for the Nifty is placed at 11,421.7, followed by 11,371.2. If the index moves up, the key resistance levels to watch out for are 11,524.3 and 11,576.4.

Nifty Bank

The Bank Nifty outperformed the Nifty, closing 1.13 percent higher at 23,092.15. The important pivot level, which will act as crucial support for the index, is placed at 22,906.64, followed by 22,721.07. On the upside, key resistance levels are placed at 23,229.04 and 23,365.87.

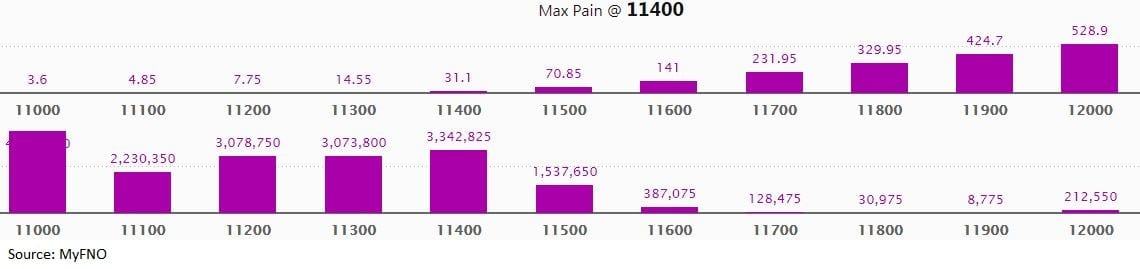

Call option data

Maximum Call OI of 41.08 lakh contracts was seen at 11,500 strike, which will act as crucial resistance in the August series.

This is followed by 11,800, which holds 35.28 lakh contracts, and 11,600 strikes, which has accumulated 34.11 lakh contracts.

Call writing was seen at 11,800, which added 8.40 lakh contracts, followed by 11,500, which added 4.91 lakh contracts, and 11,600 strikes, which added 4.81 lakh contracts.

Call unwinding was seen at 12,000, which shed 2.89 lakh contracts, followed by 11,400 strikes, which shed 2.33 lakh contracts.

Put option data

Maximum Put OI of 43.71 lakh contracts was seen at 11,000 strikes, which will act as crucial support in the August series.

This is followed by 11,400, which holds 33.43 lakh contracts, and 11,200 strikes, which has accumulated 30.79 lakh contracts.

Put writing was seen at 11,000, which added 4.38 lakh contracts, followed by 11,500, which added 1.75 lakh contracts, and 11,300 strikes, which added 1.28 lakh contracts.

Put unwinding was witnessed at 11,100, which shed 2.76 lakh contracts, followed by 11,400 which shed 82,050 contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

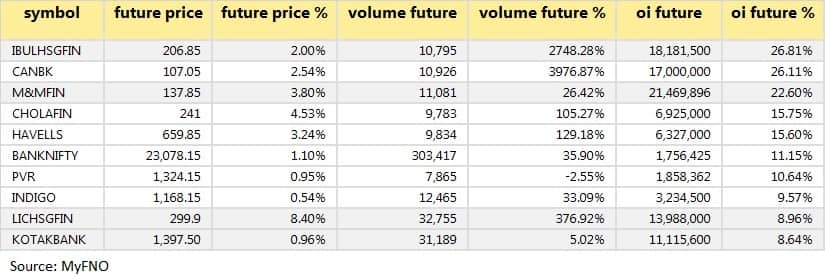

30 stocks saw long build-up

Based on the open interest future percentage, here are the top 10 stocks in which long build-up was seen.

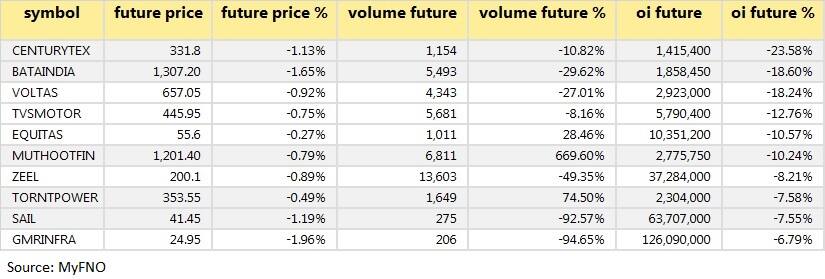

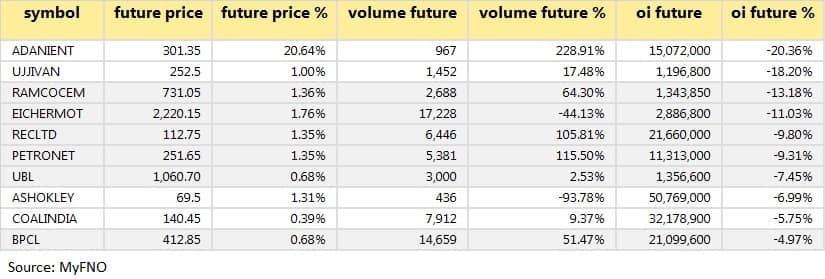

56 stocks saw long unwinding

Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

27 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which short build-up was seen.

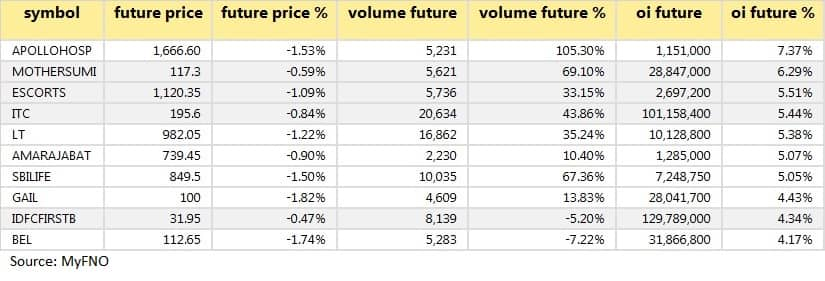

28 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

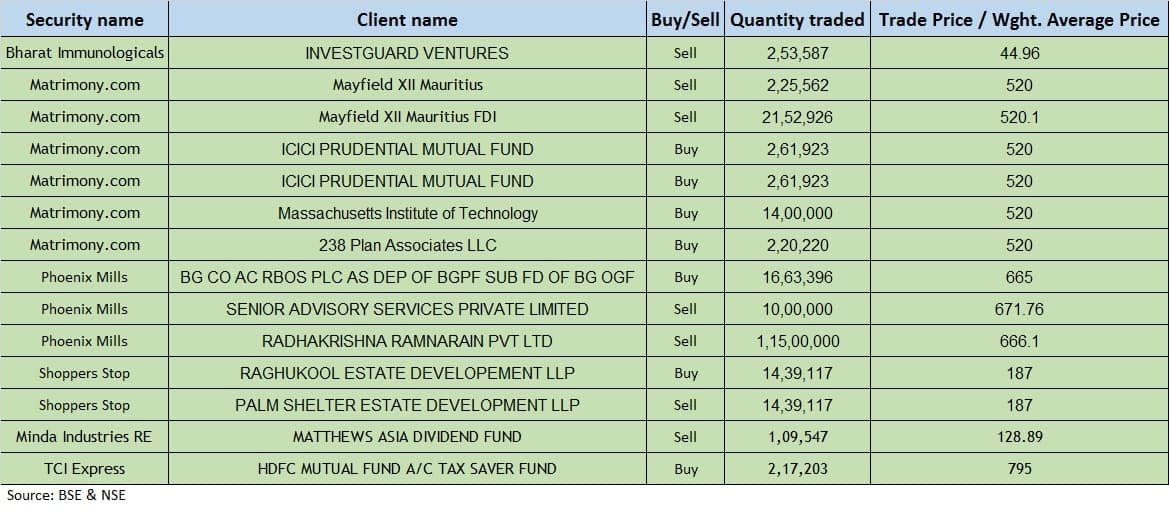

Bulk deals  (For more bulk deals, click here)

(For more bulk deals, click here)

Results on August 26 Agarwal Industrial Corporation, Ansal Housing, Cupid, DCM, Dolat Investments, Gillette India, Indraprastha Gas, Minda Finance, NACL Industries, Sharda Motor Industries, Shree Metalloys, Superb Papers, etc.

Stocks in the news State Bank of India: Moody's Investors Service has downgraded State Bank of India's standalone profile to ba2 from ba1 saying it sees the bank's asset quality and profitability deteriorating.

Indokem:Q1 income from operations at Rs 9.47 crore against Rs 20.62 crore YoY. Profit from continued operations at Rs 6 lakh against loss of Rs 1.04 crore YoY.

Adhunik Industries:Q1 revenue from operations at Rs 72.56 crore against Rs 158.95 crore YoY. Profit at Rs 34 lakh against Rs 2.6 crore YoY.

IRCON International:Q1 consolidated revenue at Rs 526.87 crore against Rs 1,069.85 crore YoY. Net profit at Rs 34.46 crore against Rs 144.66 crore YoY.

Can Fin Homes: Q1 total income at Rs 522.5 crore against Rs 484.14 crore YoY. Net profit at Rs 93.16 crore against Rs 80.98 crore YoY.

IL&FS Transportation Networks defaulted on interest payment on non-convertible debentures due on August 25.

Kalpataru Power Transmission:Subsidiary JMC Projects secured new orders worth Rs 554 crore.

FDC launched two variants of Favipiravir Drug (PiFLU and Favenza) meant to treat mild to moderate cases of COVID-19.

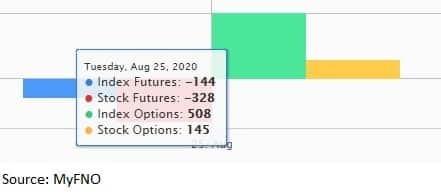

Fund flow

FII and DII data

Foreign institutional investors (FIIs) bought shares worth Rs 1,481.2 crore, whereas domestic institutional investors (DIIs) sold shares worth Rs 172.97 crore in the Indian equity market on August 25, as per provisional data available on the NSE.

Stock under F&O ban on NSE Ten stocks -- Ashok Leyland, Bharat Heavy Electricals (BHEL), Canara Bank, GMR Infra, Vodafone Idea, LIC Housing Finance, National Aluminium Company, Punjab National Bank, Steel Authority of India (SAIL) and Vedanta -- are under the F&O ban for August 26. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!