The market extended losses for third consecutive session with the Nifty50 falling well below 15,800 at close on June 29, dented by banking & financials, auto, and metals stocks.

The BSE Sensex fell 185.93 points to close at 52,549.66, while the Nifty50 declined 66.20 points to 15,748.50 and formed bearish candle which resembles Spinning Top kind of pattern on the daily charts.

"A small negative candle was formed on the daily chart-two back to back negative candle formation, which signal profit booking in the market from the new highs, but sharp selling was lacking in the last two sessions," Nagaraj Shetti, Technical Research Analyst at HDFC Securities told Moneycontrol.

"Nifty slipped below the initial support of 10 period EMA at 15,760 on Tuesday and closed slightly lower. Further weakness below this support could drag towards another crucial support of 20 day EMA around 15,670 levels. In the last 10 sessions, the 20 period EMA has offered support for Nifty resulting into a sharp upside bounce," he said.

He feels the short term trend of Nifty is weak with choppy movement.

"The absence of sharp selling interest from the new highs in the last couple of sessions could signal a chances of halting of this decline and emergence of upside bounce in the next 1-2 sessions," Shetty adds.

The broader markets, too, closed the session lower as the Nifty Midcap 100 index declined half a percent, and the Nifty Smallcap 100 slipped 0.14 percent.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 15,703.03, followed by 15,657.57. If the index moves up, the key resistance levels to watch out for are 15,814.93 and 15,881.37.

Nifty Bank

The Nifty Bank fell 349.10 points to 1 percent to close at 35,010.30 on June 29. The important pivot level, which will act as crucial support for the index, is placed at 34,836.86, followed by 34,663.43. On the upside, key resistance levels are placed at 35,260.56 and 35,510.83 levels.

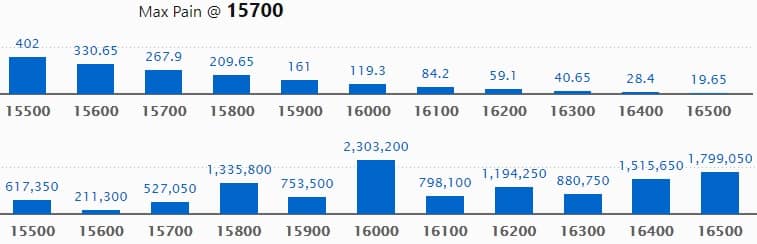

Call option data

Maximum Call open interest of 23.03 lakh contracts was seen at 16000 strike, which will act as a crucial resistance level in the July series.

This is followed by 16500 strike, which holds 17.99 lakh contracts, and 16400 strike, which has accumulated 15.15 lakh contracts.

Call writing was seen at 15800 strike, which added 2.69 lakh contracts, followed by 16000 strike which added 2.41 lakh contracts, and 16200 strike which added 87,950 contracts.

Call unwinding was seen at 15700 strike, which shed 23,200 contracts, followed by 15000 strike which shed 2,500 contracts.

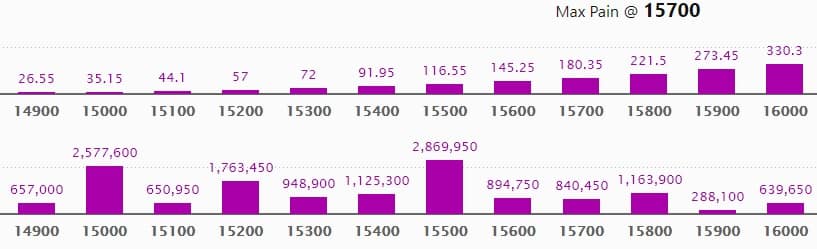

Put option data

Maximum Put open interest of 28.69 lakh contracts was seen at 15500 strike, which will act as a crucial support level in the July series.

This is followed by 15000 strike, which holds 25.77 lakh contracts, and 15200 strike, which has accumulated 17.63 lakh contracts.

Put writing was seen at 15500 strike, which added 1.38 lakh contracts, followed by 15800 strike which added 1.13 lakh contracts, and 15000 strike which added 91,400 contracts.

Put unwinding was seen at 16000 strike, which shed 68,500 contracts, followed by 15200 strike which shed 55,550 contracts and 15900 strike which shed 55,100 contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

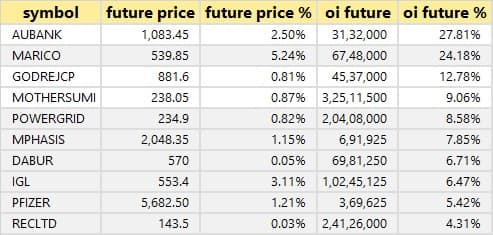

26 stocks saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

46 stocks saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

75 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

15 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

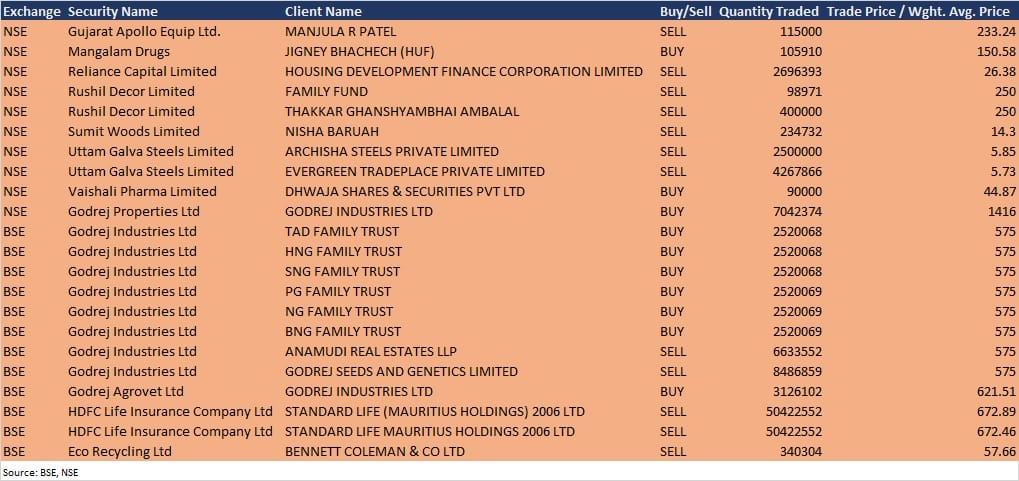

Bulk deals

Godrej Properties: Promoter Godrej Industries acquired 70,42,374 equity shares in the company at Rs 1,416 per share on the NSE, the bulk deals data showed.

Godrej Industries: TAD Family Trust acquired 25,20,068 equity shares in the company, HNG Family Trust bought 25,20,068 equity shares, SNG Family Trust 25,20,068 equity shares, PG Family Trust 25,20,069 equity shares, NG Family Trust bought 25,20,069 shares, and BNG Family Trust acquired 25,20,069 shares at Rs 575 per share. However, promoters Anamudi Real Estates LLP sold 66,33,552 equity shares, and Godrej Seeds and Genetics sold 84,86,859 shares in Godrej Industries at same price on the BSE, the bulk deals data showed.

Godrej Agrovet: Promoter Godrej Industries bought 31,26,102 equity shares in the company at Rs 621.51 per share on the BSE, the bulk deals data showed.

HDFC Life Insurance Company: Standard Life (Mauritius Holdings) 2006 Ltd sold 5,04,22,552 equity shares each at Rs 672.89 and Rs 672.46 per share on the BSE, the bulk deals data showed.

(For more bulk deals, click here)

Results on June 30, and Analysts/Investors Meeting

Results on June 30: More than 900 companies will release their quarterly earnings on June 30 including SpiceJet, Vodafone Idea, Alankit, Anant Raj, Archies, BF Utilities, BGR Energy Systems, Binani Industries, Dish TV India, Emami Realty, Fiem Industries, GM Polyplast, Indowind Energy, IRCON International, IVRCL, Liberty Shoes, McNally Bharat Engineering, MEP Infrastructure Developers, Ortel Communications, Sadbhav Engineering, Sanwaria Consumer, Sequent Scientific, Simbhaoli Sugars, Simplex Infrastructures, SREI Infrastructure Finance, Ucal Fuel Systems, Vikas EcoTech, VIP Clothing, Zenith Exports, and Zodiac Clothing.

Burger King India: To meet Aditya Birla Sun Life MF, Dymon Asia Capital (Singapore), Franklin Resources Inc, Manulife Investment Management (US) LLC, Nippon Life Insurance Company, and Valiant Capital Management, L.P. on June 30.

Macrotech Developers: To meet investors/analysts at CLSA's India Real Estate Virtual Access Day on June 30.

Dixon Technologies (India): To meet GIC on June 30.

Hindalco Industries: To meet Kotak Mahindra Asset Management on June 30.

Indraprastha Gas: To meet analysts/institutional investors in an investor conference organized by UBS Securities India on June 30.

NBCC (India): To meet analysts/investors on June 30.

Punjab Chemicals & Crop Protection: To meet HDFC Securities, Anand Rathi, Alpha Invesco, Sharekhan, and UTI MF on June 30.

Sequent Scientific: To meet analysts/investors on July 1.

Mahindra Logistics: To meet Nikko Asset Management on July 1, and Ashmore Investments Management on July 2.

Mahindra Lifespace Developers: To meet investors/analysts at CLSA's 'India Real Estate Virtual Access Day' on July 1.

Stocks in News

Vindhya Telelinks: The company reported higher consolidated profit at Rs 116.04 crore in Q4FY21 against Rs 38.26 crore in Q4FY20, revenue jumped to Rs 556.56 crore from Rs 459.08 crore YoY.

Shriram EPC: The company reported consolidated loss at Rs 35.78 crore in Q4FY21 against loss Rs 91.08 crore in Q4FY20, revenue fell to Rs 177.51 crore from Rs 184 crore YoY.

Gujarat Sidhee Cement: The company reported higher consolidated profit at Rs 20.79 crore in Q4FY21 against Rs 16.27 crore in Q4FY20, revenue rose to Rs 194.41 crore from Rs 165.48 crore YoY.

HUDCO: The company reported higher consolidated profit at Rs 526.28 crore in Q4FY21 against Rs 440.91 crore in Q4FY20, revenue fell to Rs 1,759.38 crore from Rs 1,888.49 crore YoY.

Uflex: The company will double aspectic packaging capacity to 7 billion packs per annum by March 2022 and will invest Rs 120 crore for the proposed expansion.

Tata Coffee: ICRA has upgraded the long term rating to AA+/Stable from AA/Stable, and re-affirmed the short term rating at A1+.

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net bought shares worth Rs 116.63 crore, while domestic institutional investors (DIIs) net purchased shares worth Rs 1,810.05 crore in the Indian equity market on June 29, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

One stock - NALCO - is under the F&O ban for June 30. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!