The market participants seem to have turned cautious ahead of the FOMC meeting outcome and preferred to take profits off the table on December 12. Overall, the Nifty50 remained rangebound taking support at 20,850-20,800 levels and facing resistance at 21,000-21,100 levels, hence as long as the index holds this immediate support, the rangebound trade may continue and if it trades above 21,000 for a few days, then another leg of the rally can be possible, experts said.

On December 12, the BSE Sensex fell 378 points to 69,551, while the Nifty50 declined 91 points to 20,906 and formed a bearish candlestick pattern which somewhat resembles a Bearish Engulfing kind of pattern on the daily charts (not exactly one), the trend reversal pattern.

From a technical point of view, "there has been a mere alteration in the price chart for Nifty, but the recent candlestick formations certainly showcased the exhaustion of the bullish strength and might attract price-wise correction post the rally," Osho Krishan, senior analyst - technical & derivative research at Angel One said.

As far as levels are concerned, he feels 20,850-20,800 is likely to be seen as immediate support, followed by the bullish gap around 20,700. On the flip side, "21,000-21,040 withholds a significant hurdle, followed by the 21,100 zone," he said.

Jatin Gedia, technical research analyst at Sharekhan by BNP Paribas feels the Nifty is likely to consolidate over the next few trading sessions. Overall, "the trend is positive, and the current dip should be used as a buying opportunity," he said.

The market breadth was in favour of bears, but the broader markets had a mixed trend. About 1,371 equity shares declined against 758 advancing shares on the NSE.

The Nifty Midcap 100 index was up 0.4 percent and Smallcap 100 index gained 0.03 percent.

We have collated 15 data points to help you spot profitable trades:

Key support and resistance levels on the Nifty

The pivot point calculator indicates that the Nifty is likely to see immediate resistance at 21,002, followed by 21,043 and 21,108, while on the lower side, it can take support at 20,872, followed by 20,832 and 20,766 levels.

On December 12, the Bank Nifty was also under pressure, falling 217 points to 47,098 and forming a bearish candlestick pattern on the daily charts.

"The lower-end support for the index is positioned at 46,800, and a decisive break below this level could trigger additional downside movement towards the 46,400 levels," Kunal Shah, senior technical & derivative analyst at LKP Securities said.

With weekly expiry approaching, heightened volatility is anticipated, he feels. He advised traders to exercise caution and implement strict stop-loss measures on both sides of the market.

As per the pivot point calculator, the index is expected to see resistance at 47,357, followed by 47,463 and 47,635, while on the lower side, it may take support at 47,013, followed by 46,907 and 46,735.

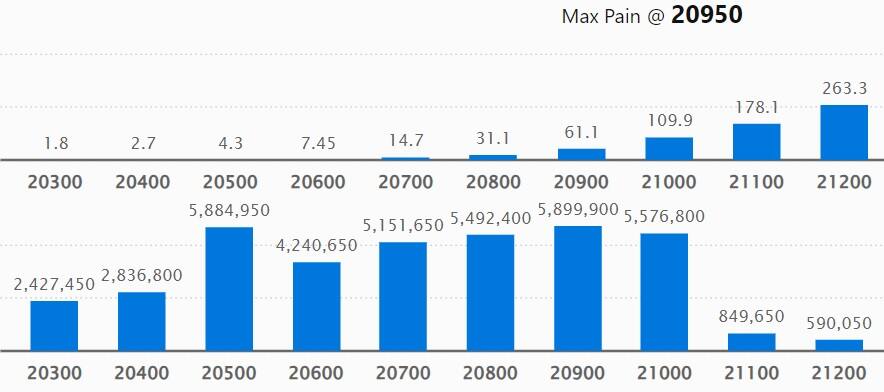

On the Call side, the 21,000 strike owned the maximum open interest (OI), with 1.48 crore contracts, which can act as a key resistance level for the Nifty. It was followed by the 21,500 strike, which had 80.75 lakh contracts, while the 21,200 strike had 68.18 lakh contracts.

Meaningful Call writing was seen at the 21,000 strike, which added 62.79 lakh contracts followed by 21,200 and 21,100 strikes, which added 21.41 lakh and 18.27 lakh contracts.

The maximum Call unwinding was at the 21,600 strike, which shed 12.23 lakh contracts followed by 20,600 and 21,700 strikes, which shed 1.59 lakh and 1.37 lakh contracts.

On the Put front, the 20,900 strike has the maximum open interest, which can act as a key support area for the Nifty, with 58.99 lakh contracts. It was followed by 20,500 strike comprising 58.84 lakh contracts and 20,000 strike with 56.34 lakh contracts.

Meaningful Put writing was at 20,500 strike, which added 9.93 lakh contracts followed by 20,600 strike and 20,100 strike, which added 3.64 lakh contracts and 1.8 lakh contracts.

Put unwinding was at 20,400 strike, which shed 12.8 lakh contracts followed by 20,900 strike, which shed 12.77 lakh contracts and 20,300 strike which shed 3.8 lakh contracts.

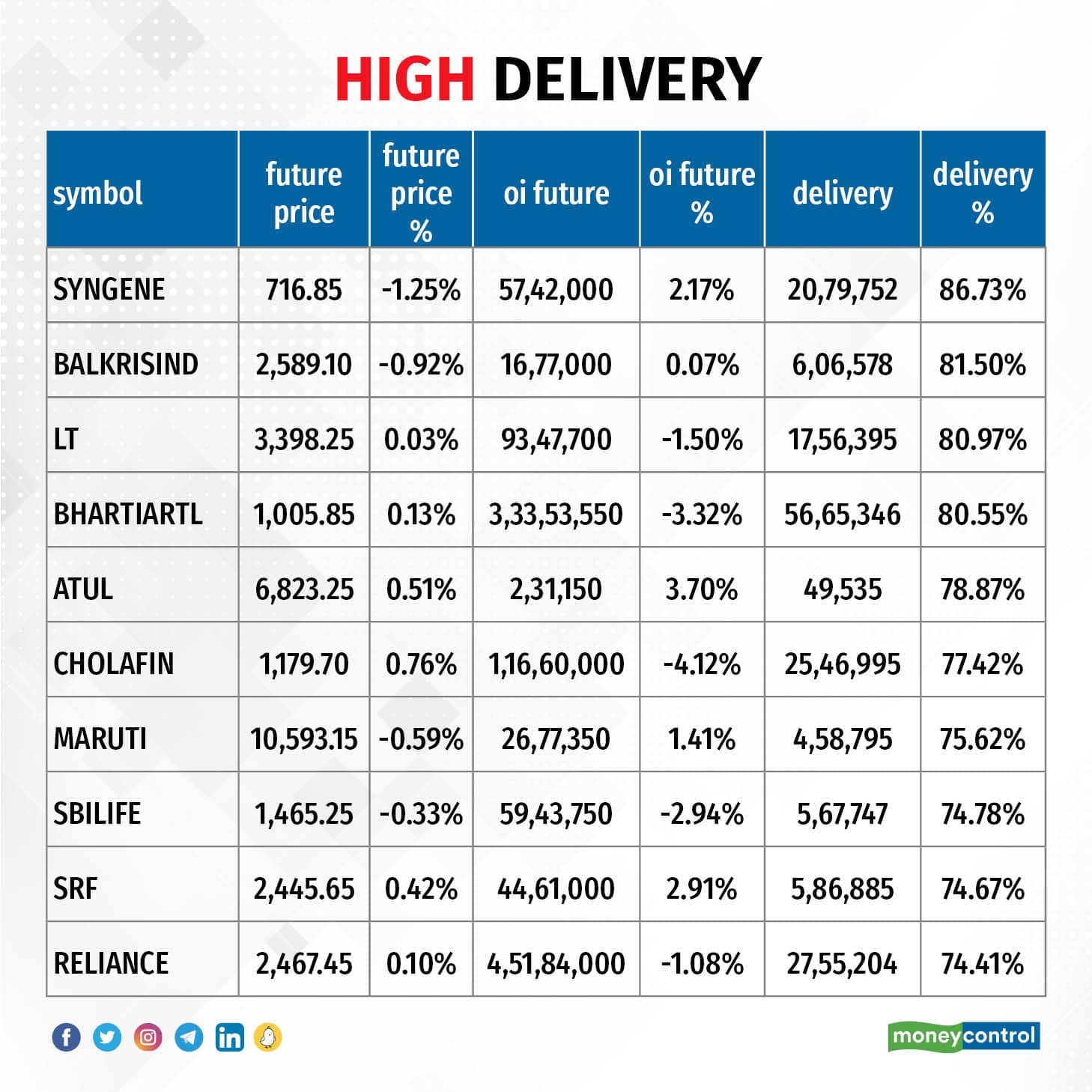

Stocks with high delivery percentage

A high delivery percentage suggests that investors are showing interest in the stock. Maruti Suzuki India, HCL Technologies, Larsen & Toubro, Hindustan Unilever, and Dabur India saw the highest delivery among the F&O stocks.

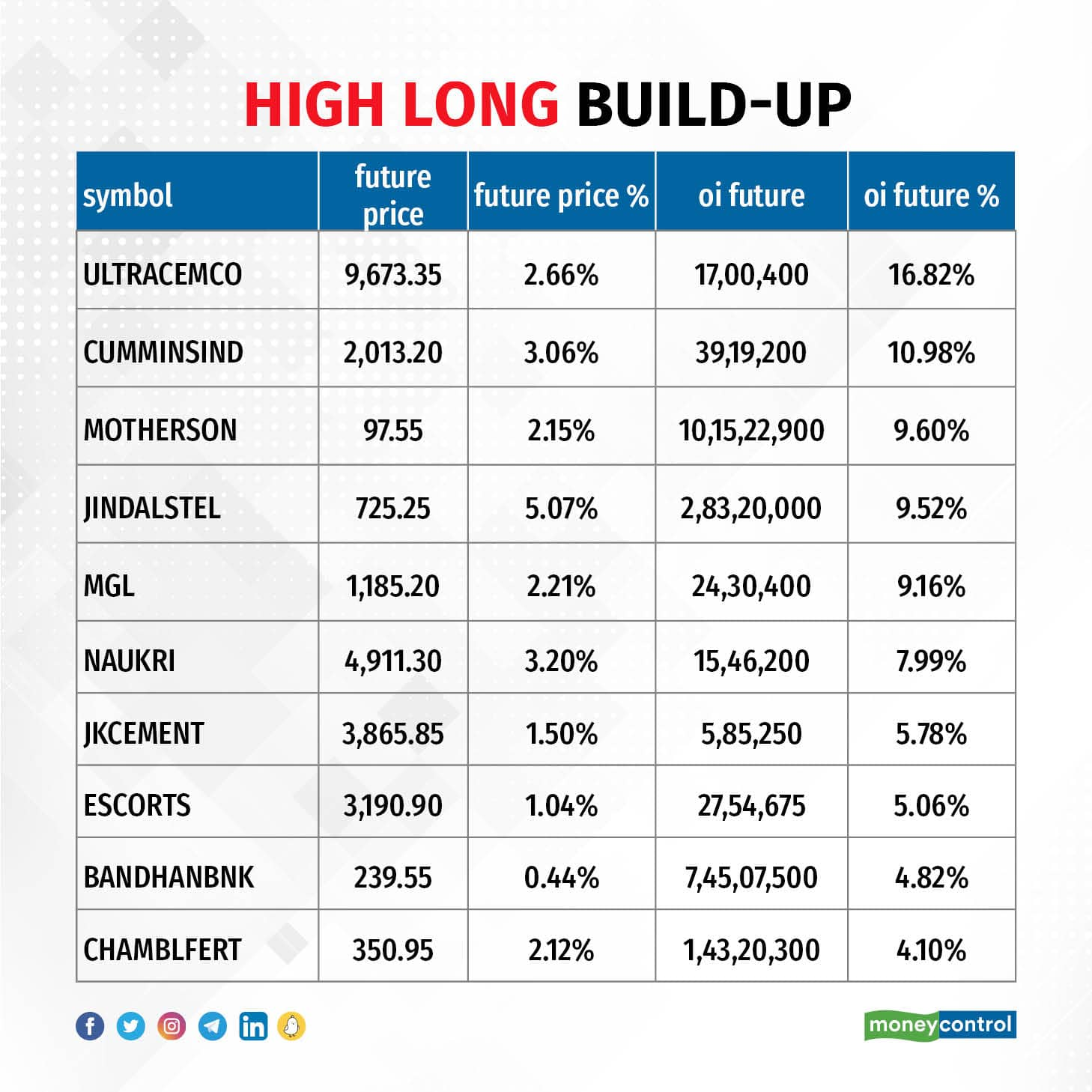

A long build-up was seen in 40 stocks, which included UltraTech Cement, Dixon Technologies, Granules India, HDFC Life Insurance Company, and Zee Entertainment Enterprises. An increase in open interest (OI) and price indicates a build-up of long positions.

Based on the OI percentage, 63 stocks saw long unwinding, including Coromandel International, SAIL, ONGC, Polycab India, and Sun TV Network. A decline in OI and price indicates long unwinding.

59 stocks see a short build-up

A short build-up was seen in 59 stocks, which were PI Industries, Bandhan Bank, Syngene International, Maruti Suzuki India, and Apollo Hospitals Enterprise. An increase in OI along with a fall in price points to a build-up of short positions.

Based on the OI percentage, 24 stocks were on the short-covering list. These include ICICI Bank, HCL Technologies, Persistent Systems, TCS, and L&T Technology Services. A decrease in OI along with a price increase is an indication of short-covering.

The Nifty Put Call ratio (PCR), which indicates the mood of the equity market, dropped below 1 for the first time in the last 11 consecutive sessions. It close at 0.94 on December 12, from 1.14 levels in the previous session. The below 1 PCR indicates that the traders are buying more Call options than Puts, which generally indicates an increase in bullish sentiment.

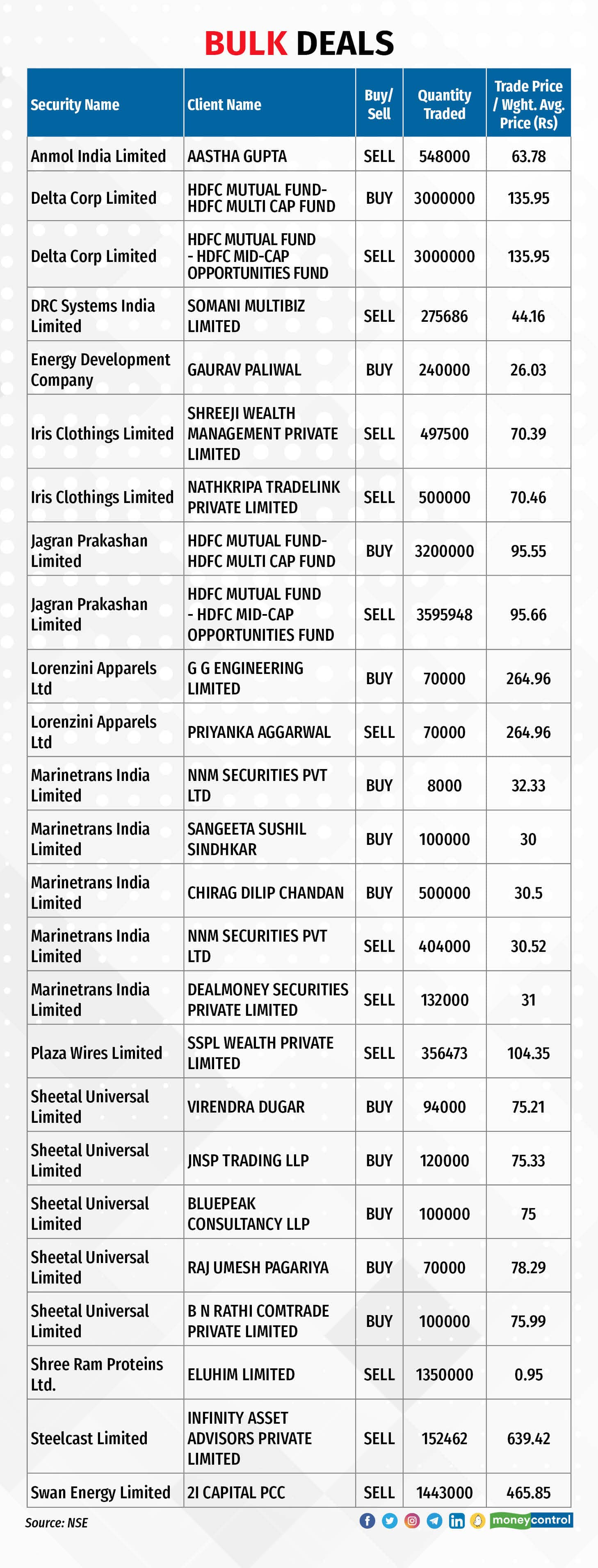

For more bulk deals, click here

Stocks in the news

Axis Bank: Private equity major Bain Capital is all set to sell a further stake in the private sector lender via a fresh block deal worth $444 million, multiple industry sources in the know told Moneycontrol. Entities associated with Bain Capital are looking to sell a 1.1 percent stake via a block deal in Axis Bank, and the offer floor price is Rs 1,109 per share.

Wipro: The technology services and consulting company has entered into a new agreement with RSA, one of the world’s leading general insurance companies.

Laurus Labs: The US Food and Drug Administration (US FDA) has issued five observations in Form 483 for the manufacturing facility in Visakhapatnam, Andhra Pradesh owned by Laurus Synthesis (LSPL), a wholly owned subsidiary of Laurus Labs. The inspection by the US FDA was conducted from December 4 to 12, 2023.

Indian Bank: The public sector lender launched its qualified institution placement (QIP) issue on December 12. The floor price has been fixed at Rs 414.44 per share.

Force Motors: The automobile company has received board approval to acquire 12.21 percent shares in TP Surya, a wholly-owned subsidiary of Tata Power Renewable Energy.

Shilpa Medicare: Shilpa Medicare's Unit VI, Bengaluru in Karnataka has received approval from TGA, Australia for the manufacture, labeling, packaging and testing of medicinal oral mouth dissolving films (wafers). This unit is engaged in the manufacture and testing of oral mouth-dissolving films and transdermal patches.

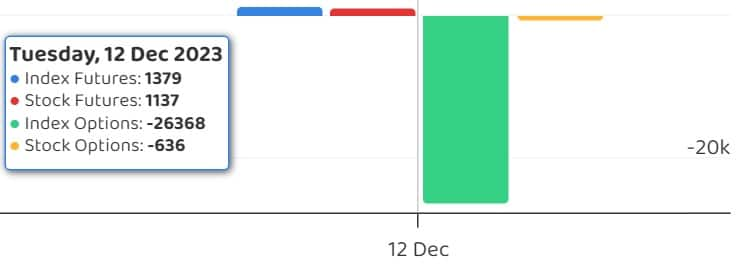

Funds Flow (Rs Crore)

Foreign institutional investors (FIIs) net bought shares worth Rs 76.86 crore, while domestic institutional investors (DIIs) purchased Rs 1,923.32 crore worth of stocks on December 12, provisional data from the National Stock Exchange (NSE) showed.

Stock under F&O ban on NSE

The NSE has added Zee Entertainment Enterprises to its F&O ban list for December 13, while retaining Balrampur Chini Mills, Delta Corp, Hindustan Copper, Indiabulls Housing Finance, India Cements, National Aluminium Company, and SAIL to the said list.

Securities banned under the F&O segment include companies where derivative contracts cross 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.Disclaimer: Moneycontrol is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.