The Indian market witnessed profit-booking on August 12 as the Nifty snapped its six-day winning streak while the Sensex closed with minor losses after four days of gains.

Investors booked profits in light of weak global cues as doubts grew about whether or not the US lawmakers would reach an agreement on the coronavirus fiscal package to support its struggling economy.

On the domestic front, muted macroeconomic data and persistently rising COVID-19 cases dented market sentiment.

The Sensex closed 37 points, or 0.1 percent, lower at 38,369.63 and the Nifty ended at 11,308.40, with a loss of 14 points, or 0.12 percent.

"Near-term momentum may continue in the market with in-between leaps and bounces, depending upon global cues. Going forward, investors would watch out for more economic data points, which are due this week, along with the adjusted gross revenue (AGR) case hearing on Friday (August 14) and an announcement of a US stimulus package," said Siddhartha Khemka, Head - Retail Research, Motilal Oswal Financial Services.

We have collated 15 data points to help you spot profitable trades:Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels for the Nifty

According to pivot charts, the key support level for the Nifty is placed at 11,260.07, followed by 11,211.73. If the index moves up, the key resistance levels to watch out for are 11,339.37 and 11,370.33.

Nifty Bank

The Bank Nifty closed 0.17 percent higher at 22,264. The important pivot level, which will act as crucial support for the index, is placed at 22,060.6, followed by 21,857.2. On the upside, key resistance levels are placed at 22,397 and 22,530.

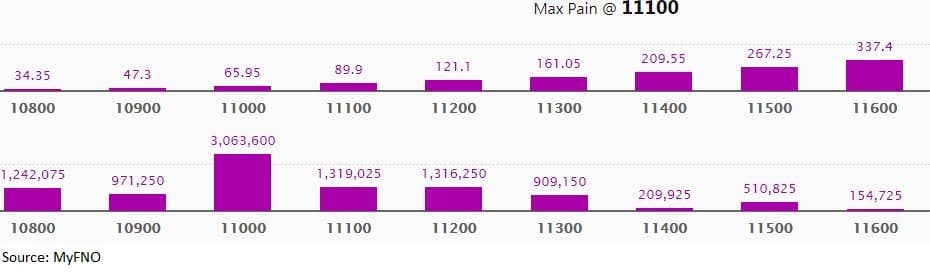

Call option data

Maximum call OI of nearly 20.78 lakh contracts was seen at 11,500 strikes, which will act as crucial resistance in the August series.

This is followed by 11,300, which holds 13.27 lakh contracts, and 11,800 strikes, which has accumulated 9.78 lakh contracts.

Call writing was seen at 11,400, which added 1.90 lakh contracts, followed by 11,300 strikes, which added 1.62 lakh contracts.

Call unwinding was seen at 11,500, which shed 42,975 contracts, followed by 11,100 strikes, which shed 38,850 contracts.

Put option data

Maximum put OI of 30.64 lakh contracts was seen at 11,000 strikes, which will act as crucial support in the August series.

This is followed by 11,100, which holds 13.19 lakh contracts, and 11,200 strikes, which has accumulated 13.16 lakh contracts.

Put writing was seen at 11,100, which added 71,850 contracts, followed by 11,300, which added 62,100 contracts and 11,400 strikes, which added 56,700 contracts.

Put unwinding was witnessed at 11,500, which shed 34,500 contracts, followed by 11,200, which shed 29,700 contracts, and 10,800 strikes, which shed 28,725 contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

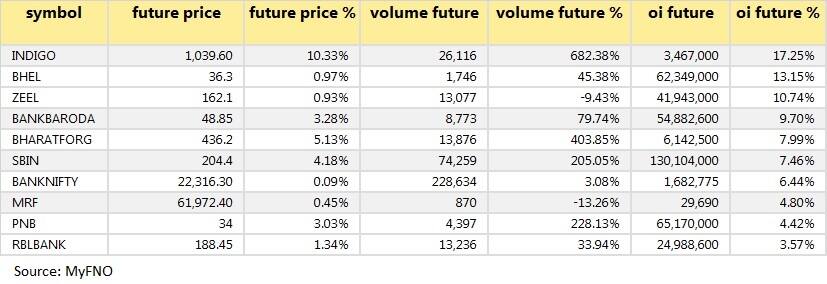

36 stocks saw long build-up

Based on the OI future percentage, here are the top 10 stocks in which long build-up was seen.

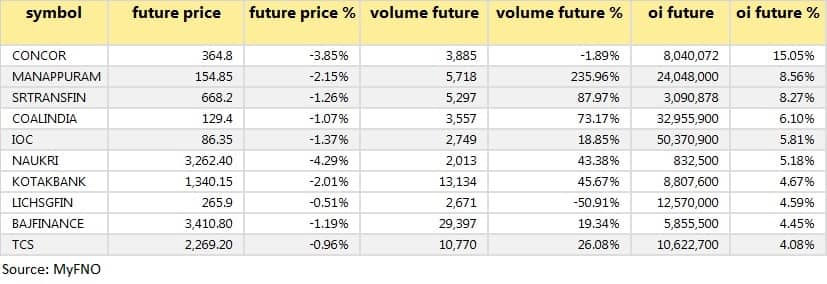

29 stocks saw long unwinding

Based on the OI future percentage, here are the top 10 stocks in which long unwinding was seen.

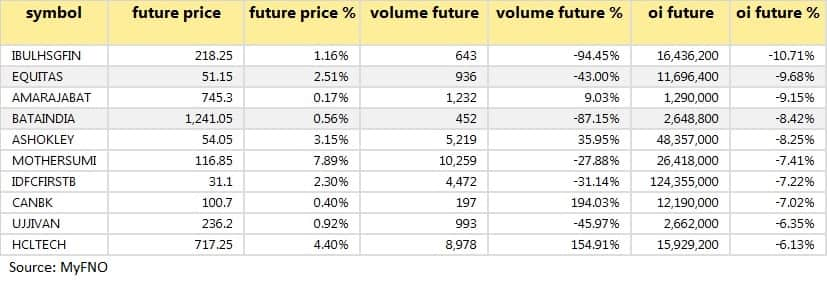

39 stocks saw short build-up

An increase in OI, along with a decrease in price, mostly indicates a build-up of short positions. Based on the OI future percentage, here are the top 10 stocks in which short build-up was seen.

37 stocks witnessed short-covering

A decrease in OI, along with an increase in price, mostly indicates a short-covering. Based on the OI future percentage, here are the top 10 stocks in which short-covering was seen.

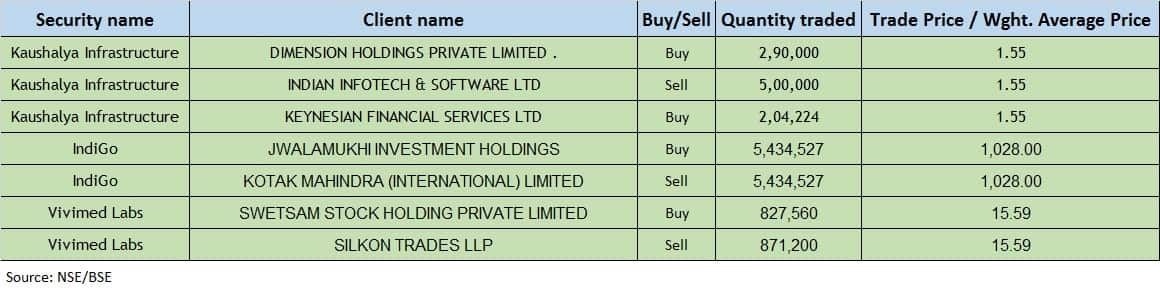

Bulk deals (For more bulk deals, click here)

(For more bulk deals, click here)

Results on August 13 Eicher Motors, Bharat Petroleum Corporation (BPCL), Hero MotoCorp, Tata Steel, GAIL India, Aditya Birla Fashion, APL Apollo Tubes, Balkrishna Industries, Bharat Bijlee, City Union Bank, DB Corp, Endurance Technologies, Engineers India, Godrej Industries, Grasim Industries, Greaves Cotton, Garden Reach Shipbuilders & Engineers, Kirloskar Industries, PFC, Prestige Estates Projects, Sandhar Technologies, Shankara Building Products, Shoppers Stop, Shriram Transport Finance, Trent, TTK Healthcare, etc.

Stocks in the news Tata Power: Q1 profit at Rs 268.1 crore versus Rs 243.08 crore, revenue at Rs 6,453 crore versus Rs 7,766.7 crore YoY.

Thermax:Q1 loss at Rs 15.3 crore versus a profit of Rs 62.8 crore, revenue at Rs 664.9 crore versus Rs 1,392.4 crore YoY. MS Unnikrishnan will retire and Ashish Bhandari will be its new MD and CEO.

NCC: Q1 profit at Rs 16.9 crore versus Rs 81.3 crore, revenue at Rs 1,178.8 crore versus Rs 2,187.7 crore YoY.

Indiabulls Housing Finance: Sameer Gehlaut relinquished the office of Executive Chairman with immediate effect. Gehlaut will be CEO at Indiabulls Ventures.

Aster DM Healthcare:Q1 loss at Rs 82.9 crore versus a profit of Rs 3.3 crore, revenue at Rs 1,760.6 crore versus Rs 2,028.6 crore YoY.

Fine Organic Industries: Q1 profit at Rs 28.7 crore versus Rs 37.6 crore, revenue at Rs 240 crore versus Rs 250.6 crore YoY.

Fund flow

FII and DII data

Foreign institutional investors (FIIs) bought shares worth Rs 351.15 crore while domestic institutional investors (DIIs) sold shares worth Rs 939.67 crore in the Indian equity market on August 12, as per provisional data available on the NSE.

Stock under F&O ban on NSE

10 stocks - Aurobindo Pharma, Bata India, Canara Bank, Century Textiles, Glenmark Pharmaceuticals, Indiabulls Housing Finance, Vodafone Idea, Muthoot Finance, Steel Authority of India (SAIL) and Vedanta - are under the F&O ban for August 13. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!